Tc 20r Form

What is the TC 20R?

The TC 20R is a specific form used in Utah for property tax purposes. It is primarily utilized to report and claim a property tax exemption for certain qualifying properties. This form is essential for property owners who wish to benefit from tax relief associated with specific exemptions provided by state law. Understanding the TC 20R's purpose can help property owners navigate the tax exemption process more effectively.

How to Use the TC 20R

Using the TC 20R involves several steps to ensure that property owners can successfully claim their tax exemptions. First, gather all necessary information about the property, including ownership details and the specific exemption being claimed. Next, fill out the TC 20R form accurately, ensuring that all required fields are completed. Finally, submit the form to the appropriate local tax authority before the designated deadline to ensure the exemption is applied to your property taxes.

Steps to Complete the TC 20R

Completing the TC 20R involves a series of straightforward steps:

- Gather required documentation, such as proof of ownership and any relevant exemption criteria.

- Download the TC 20R form from the state’s tax website or obtain a physical copy from your local tax office.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed TC 20R to your local tax authority, either online or by mail, before the deadline.

Legal Use of the TC 20R

The legal use of the TC 20R is governed by Utah state laws regarding property tax exemptions. To be considered valid, the form must be completed accurately and submitted within the established deadlines. Failure to comply with these legal requirements may result in the denial of the exemption. It is important for property owners to understand the specific legal stipulations associated with the TC 20R to ensure compliance and to protect their rights to claim the exemption.

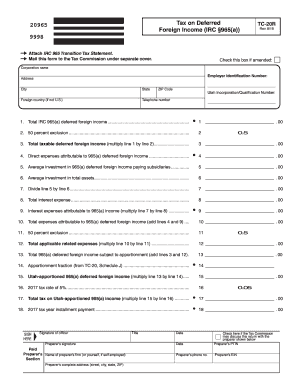

Key Elements of the TC 20R

Several key elements are essential when completing the TC 20R:

- Property Information: This includes the address, parcel number, and type of property.

- Owner Information: The name and contact details of the property owner must be provided.

- Exemption Type: Clearly indicate the specific exemption being claimed.

- Signature: The form must be signed by the property owner or an authorized representative.

Form Submission Methods

The TC 20R can be submitted through various methods, depending on local tax authority guidelines. Property owners may have the option to submit the form online via the local tax authority's website, by mailing a physical copy to the designated office, or delivering it in person. It is important to check with the local tax authority for specific submission methods and any associated requirements.

Quick guide on how to complete tc 20r

Effortlessly prepare Tc 20r on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tc 20r on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and eSign Tc 20r with ease

- Find Tc 20r and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Tc 20r and ensure top-notch communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 20r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tc 20r and how does it work?

The tc 20r is a powerful tool designed for businesses to streamline document signing processes. It allows users to easily send, receive, and eSign documents, improving efficiency and reducing turnaround time. By leveraging the tc 20r, businesses can ensure secure and legally binding agreements with minimal effort.

-

What are the key features of the tc 20r?

The tc 20r offers a range of features including customizable templates, real-time status tracking, and integrations with various applications. It also supports multiple file formats for easy document uploading. These features enhance the user experience and make it an ideal solution for businesses looking to simplify their eSigning workflows.

-

How does the pricing for the tc 20r compare to competitors?

The tc 20r is a cost-effective solution that provides great value compared to its competitors. Pricing is structured to accommodate businesses of all sizes, with flexible plans that cater to various needs. This affordability makes the tc 20r an attractive option for companies looking to optimize their document signing processes without breaking the bank.

-

What are the benefits of using the tc 20r for my business?

Using the tc 20r streamlines document handling, saving time and resources while enhancing operational efficiency. It provides a secure platform for document signing, which can help reduce the risk of fraud. Additionally, the convenience of eSigning helps improve customer satisfaction and accelerates the agreement process.

-

Can I integrate the tc 20r with my existing software tools?

Yes, the tc 20r is designed to easily integrate with a variety of software applications. This allows for seamless document workflows, enabling your team to work with tools they're already familiar with. Such integrations enhance productivity by minimizing disruptions in your existing processes.

-

Is the tc 20r suitable for small businesses?

Absolutely! The tc 20r is an ideal solution for small businesses looking to adopt a reliable eSigning platform. Its user-friendly interface and cost-effective pricing make it accessible for small teams, allowing them to manage document signing without the complexity typically associated with larger solutions.

-

What security measures does the tc 20r implement?

The tc 20r prioritizes document security through advanced encryption and authentication protocols. It ensures that all signed documents remain confidential and protected from unauthorized access. This commitment to security makes the tc 20r a trustworthy solution for businesses handling sensitive information.

Get more for Tc 20r

- Plumbing contract for contractor maryland form

- Brick mason contract for contractor maryland form

- Roofing contract for contractor maryland form

- Electrical contract for contractor maryland form

- Sheetrock drywall contract for contractor maryland form

- Flooring contract for contractor maryland form

- Maryland new home construction contract maryland form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract maryland form

Find out other Tc 20r

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template