M 941d Form

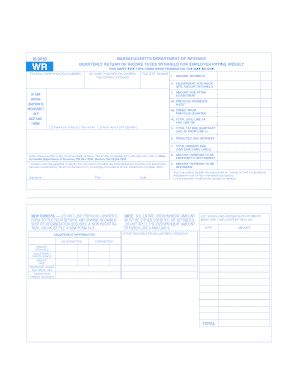

What is the M 941d Form

The M 941d Form is a specific tax form used by employers to report wages, tips, and other compensation paid to employees. This form is essential for ensuring compliance with federal tax regulations. It is typically filed quarterly and is a part of the employer's responsibility to report and remit payroll taxes to the IRS. Understanding the purpose of the M 941d Form is crucial for businesses to maintain accurate tax records and avoid penalties.

Steps to complete the M 941d Form

Completing the M 941d Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee wages, tips, and any withheld taxes. Next, fill out the form by entering the total wages paid, the amount of federal income tax withheld, and any adjustments for prior periods. It is important to double-check all entries for accuracy. Finally, sign and date the form before submission to the IRS.

Legal use of the M 941d Form

The M 941d Form must be completed in accordance with IRS guidelines to be considered legally valid. This includes ensuring that all information is accurate and submitted by the required deadlines. Employers are responsible for maintaining records that support the information reported on the form. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the M 941d Form are crucial for employers to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the due date for the first quarter is April 30, the second quarter is July 31, the third quarter is October 31, and the fourth quarter is January 31 of the following year. Employers should mark these dates on their calendars to ensure timely submission.

How to obtain the M 941d Form

The M 941d Form can be obtained directly from the IRS website or through authorized tax software. Employers can download and print the form for completion, or they may choose to fill it out electronically using compatible software. It is important to ensure that the most current version of the form is used to comply with any recent changes in tax regulations.

Key elements of the M 941d Form

Understanding the key elements of the M 941d Form is essential for accurate completion. Key sections include the employer's identification information, total wages paid, federal income tax withheld, and any adjustments. Additionally, the form requires the signature of an authorized representative of the business. Each of these elements plays a critical role in ensuring that the form is completed correctly and submitted to the IRS.

Form Submission Methods (Online / Mail / In-Person)

The M 941d Form can be submitted through various methods, providing flexibility for employers. It can be filed electronically using IRS-approved e-filing systems, which is often the fastest method. Alternatively, employers may choose to mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not an option for this form, as it is primarily designed for electronic or mail filing.

Quick guide on how to complete m 941d form

Prepare M 941d Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate forms and securely archive them online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage M 941d Form on any platform through the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign M 941d Form without hassle

- Obtain M 941d Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or mask sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign M 941d Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m 941d form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M 941d Form?

The M 941d Form is a tax form used to report certain income details to the IRS. It's crucial for businesses to understand how to complete the M 941d Form accurately to avoid penalties and ensure compliance. By using airSlate SignNow, you can easily eSign and manage your M 941d Form with efficiency.

-

How can airSlate SignNow help with the M 941d Form?

airSlate SignNow provides a streamlined solution for sending and eSigning the M 941d Form. With our user-friendly interface, you can quickly upload, sign, and send your forms, making tax reporting much simpler. This ensures that you focus more on your business operations instead of the paperwork.

-

Does airSlate SignNow offer pricing plans for businesses needing the M 941d Form?

Yes, airSlate SignNow offers flexible pricing plans suited for businesses of all sizes that need the M 941d Form. Whether you are a small business or a large enterprise, you can find a plan that fits your budget and requirements. Our pricing is competitive and often more affordable than traditional paper-based solutions.

-

What features does airSlate SignNow provide for the M 941d Form?

AirSlate SignNow includes features such as eSigning, document templates, and secure cloud storage for the M 941d Form. These features enhance efficiency by allowing you to manage your documents online and get them signed quickly. This leads to faster processing times for tax submissions.

-

Can I integrate airSlate SignNow with other software for the M 941d Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRMs and accounting software that can facilitate the management of your M 941d Form. This integration allows you to automate document workflows, reducing the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for the M 941d Form?

Using airSlate SignNow for the M 941d Form provides benefits like increased efficiency, reduced errors, and faster turnaround times. By embracing digital solutions, businesses can easily track their forms and ensure that they are always compliant with the latest tax regulations. Additionally, the convenience of eSigning reduces the need for physical document handling.

-

Is airSlate SignNow secure for handling the M 941d Form?

Yes, airSlate SignNow prioritizes security for all documents, including the M 941d Form. Our platform employs advanced encryption and compliance measures to protect your sensitive information. You can eSign and send your M 941d Form with peace of mind, knowing that your data is secure.

Get more for M 941d Form

- Subcontractors agreement maryland form

- Option to purchase addendum to residential lease lease or rent to own maryland form

- Maryland prenuptial premarital agreement with financial statements maryland form

- Maryland agreement form

- Md premarital form

- Financial statements only in connection with prenuptial premarital agreement maryland form

- Revocation of premarital or prenuptial agreement maryland form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children maryland form

Find out other M 941d Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document