Fillable W2 Form

What is the fillable W-2 form?

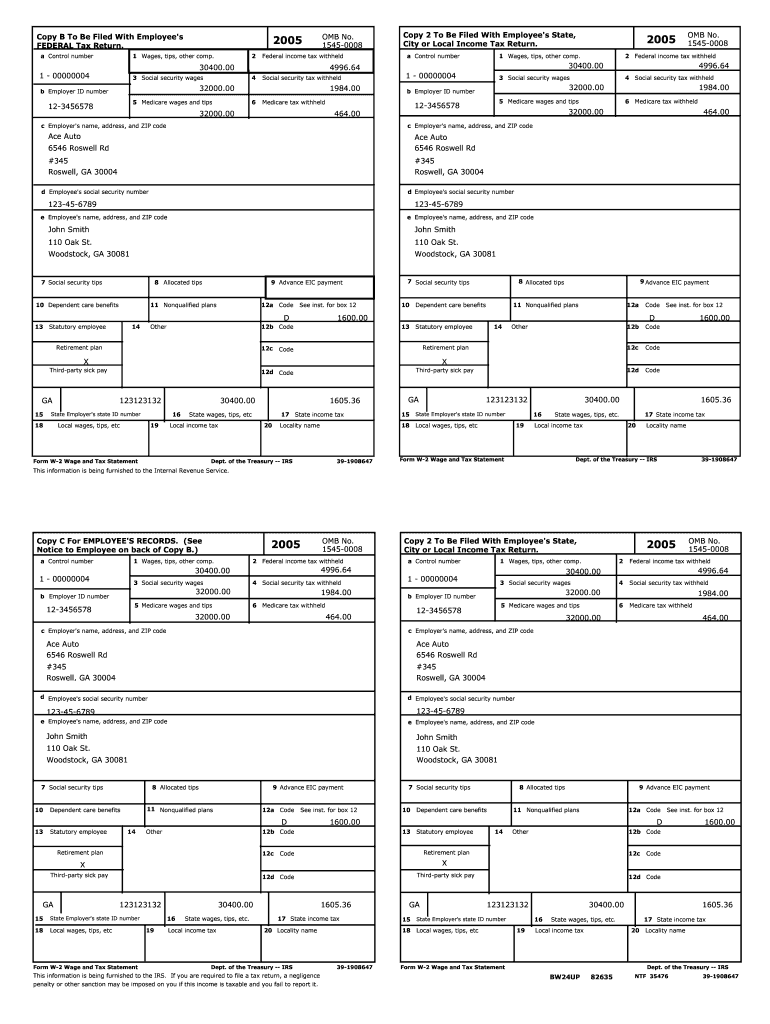

The fillable W-2 form is a crucial document used by employers in the United States to report an employee's annual wages and the taxes withheld from their paychecks. This form is essential for employees when filing their income tax returns, as it provides detailed information about their earnings and tax contributions for the year. The W-2 form includes various fields, such as the employee's Social Security number, employer identification number, and total earnings for the year. It is typically issued by employers by January 31 of each year, ensuring that employees have the necessary information to complete their tax filings accurately.

Steps to complete the fillable W-2 form

Completing the fillable W-2 form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you through the process:

- Gather necessary information: Collect the employee's personal details, including their full name, address, and Social Security number. Also, have the employer's information ready, including the company name, address, and Employer Identification Number (EIN).

- Fill in wage details: Enter the total wages paid to the employee during the tax year in the appropriate box. Include any bonuses or other compensation that may apply.

- Report tax withholdings: Input the federal income tax withheld, Social Security wages, and Medicare wages. Ensure that these figures are accurate to avoid discrepancies.

- Review the form: Double-check all entries for accuracy and completeness. Errors can lead to complications during tax filing.

- Distribute copies: Provide the employee with their copy of the W-2 form, and submit the required copies to the IRS and state tax agencies as necessary.

Legal use of the fillable W-2 form

The fillable W-2 form is legally binding when completed and submitted according to IRS guidelines. Employers are required by law to provide this form to their employees, ensuring that all wage and tax information is accurately reported. The electronic version of the W-2 is considered valid as long as it meets the necessary legal standards, including compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the digital signatures and submissions are recognized as legally valid, similar to traditional paper forms.

How to obtain the fillable W-2 form

Employers can obtain the fillable W-2 form from various sources. The most common method is through the IRS website, where the form is available for download in PDF format. This version can be filled out electronically or printed for manual completion. Additionally, many payroll software solutions offer integrated options for generating W-2 forms, simplifying the process for employers. It is essential to ensure that the most current version of the form is used to comply with the latest tax regulations.

Key elements of the fillable W-2 form

The fillable W-2 form contains several key elements that are crucial for accurate reporting. These include:

- Employee information: Full name, address, and Social Security number.

- Employer information: Company name, address, and Employer Identification Number (EIN).

- Wage details: Total wages, tips, and other compensation.

- Tax withholdings: Federal income tax withheld, Social Security tax, and Medicare tax.

- State and local tax information: Any applicable state or local taxes withheld, along with the corresponding amounts.

Filing deadlines / Important dates

Employers must adhere to specific deadlines when it comes to filing the fillable W-2 form. The key dates include:

- January 31: Deadline for employers to provide employees with their W-2 forms.

- February 28: Deadline for paper filing of W-2 forms with the IRS.

- March 31: Deadline for electronic filing of W-2 forms with the IRS.

Quick guide on how to complete fillable w2 form

Effortlessly Prepare Fillable W2 Form on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle Fillable W2 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Simplest Way to Modify and eSign Fillable W2 Form with Ease

- Find Fillable W2 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Fillable W2 Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable w2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2 fillable form?

A W2 fillable form is an interactive document that allows users to enter information directly into designated fields before printing or submitting electronically. This format streamlines the process of reporting tax information and ensures accuracy. With airSlate SignNow, you can easily create and manage your W2 fillable forms.

-

How much does it cost to use airSlate SignNow for W2 fillable forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial for basic features. For W2 fillable form functionalities, advanced plans are available that include features like secure eSigning and document management. Check the website for the latest pricing details.

-

Can I create and customize my W2 fillable form with airSlate SignNow?

Yes, airSlate SignNow allows users to create customized W2 fillable forms that can be tailored to specific requirements. You can add logos, adjust field placements, and include essential instructions for users. This flexibility makes it easier to fit your business's branding.

-

What are the benefits of using airSlate SignNow for W2 fillable forms?

Using airSlate SignNow for W2 fillable forms simplifies tax document management with user-friendly eSigning capabilities. This efficient solution reduces paper usage, saves time, and minimizes errors. Additionally, it enhances the security of sensitive tax information during the signing process.

-

Is it easy to share W2 fillable forms with others using airSlate SignNow?

Absolutely! Sharing W2 fillable forms with airSlate SignNow is straightforward. You can send forms via email or provide a link, ensuring recipients can easily access and complete the forms. The platform's collaboration features also allow multiple users to sign and submit important tax documents seamlessly.

-

What integrations does airSlate SignNow offer for managing W2 fillable forms?

airSlate SignNow integrates with various third-party applications that assist in managing W2 fillable forms effectively. Popular integrations include Google Workspace, Salesforce, and Microsoft Office. These connections streamline workflow and enhance productivity while handling sensitive tax documents.

-

How does airSlate SignNow ensure the security of W2 fillable forms?

airSlate SignNow prioritizes security with advanced encryption protocols to protect W2 fillable forms and sensitive information. The platform also includes authentication features, ensuring that only authorized users can access and sign documents. This commitment to security helps build trust around handling personal tax data.

Get more for Fillable W2 Form

- Minnesota complaint form

- Minnesota complaint 497312386 form

- Agreement for delayed or partial rent payments minnesota form

- Best custody interrogatories form

- Discovery interrogatories post dissolution ex spouse not remarried minnesota form

- Discovery interrogatories post dissolution ex spouse remarried minnesota form

- Suggested signature page for judgment and decree recommended by referee minnesota form

- Minnesota parentage 497312392 form

Find out other Fillable W2 Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later