Profit and Loss Statement Centrelink Form

What is the Profit and Loss Statement Centrelink

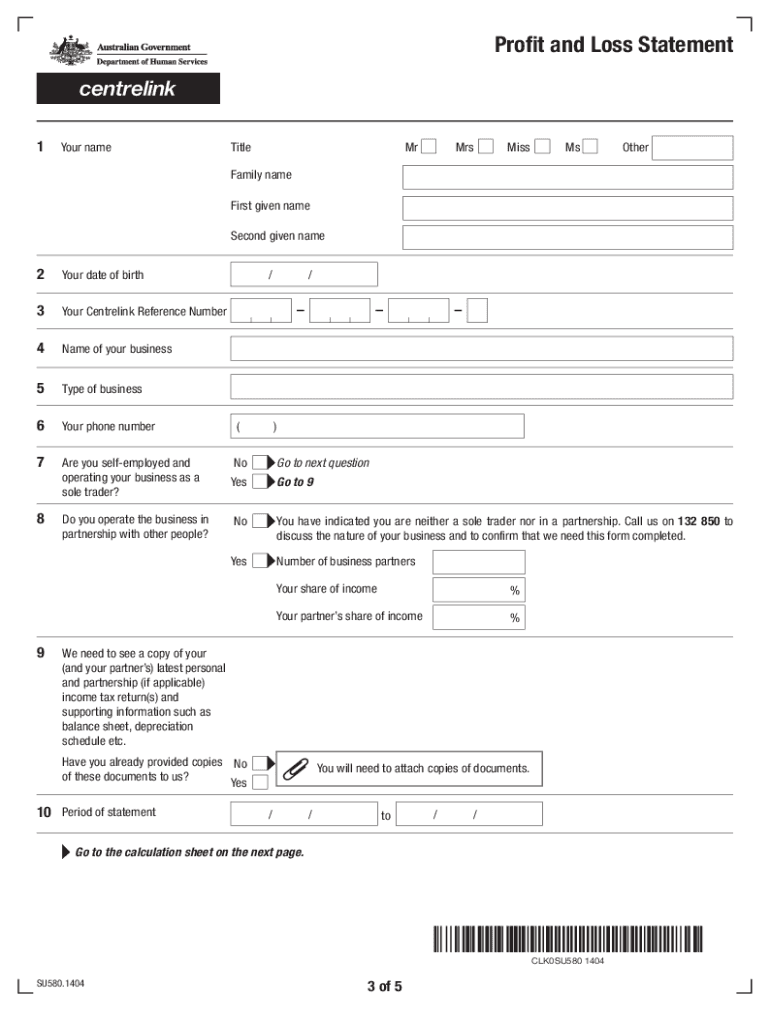

The profit and loss statement for sole traders, often referred to as the Centrelink profit and loss statement, is a financial document that summarizes the income and expenses of a sole trader over a specific period. This statement is essential for assessing the financial performance of the business, providing a clear view of profitability. It typically includes various income sources, operational costs, and any other relevant expenses, allowing sole traders to understand their financial standing and make informed decisions.

Key elements of the Profit and Loss Statement Centrelink

A comprehensive profit and loss statement for sole traders should include several key elements:

- Revenue: Total income generated from sales or services provided.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold or services rendered.

- Gross Profit: Revenue minus COGS, indicating the profit before operational expenses.

- Operating Expenses: Costs incurred in the normal course of business, such as rent, utilities, and salaries.

- Net Profit: The final profit after deducting all expenses from total revenue, representing the sole trader's earnings.

Steps to complete the Profit and Loss Statement Centrelink

Completing the profit and loss statement for Centrelink involves several steps:

- Gather all financial records, including invoices, receipts, and bank statements.

- Calculate total revenue from all sources of income.

- Determine the cost of goods sold by summing up all direct costs related to the production of goods or services.

- Subtract COGS from total revenue to find the gross profit.

- List all operating expenses and calculate the total.

- Subtract total operating expenses from gross profit to arrive at the net profit.

- Review the statement for accuracy before submission.

Legal use of the Profit and Loss Statement Centrelink

The profit and loss statement for sole traders is a legally recognized document that can be used for various purposes, including tax filings, loan applications, and financial assessments. To ensure its legal validity, it is essential to maintain accurate records and comply with relevant regulations. This includes adhering to the guidelines set forth by the IRS and ensuring that the statement is prepared honestly and transparently.

How to obtain the Profit and Loss Statement Centrelink

Sole traders can obtain the profit and loss statement for Centrelink by preparing it based on their financial records. Many accounting software programs can assist in generating this statement automatically. Additionally, templates are available online that can guide sole traders in creating their profit and loss statements. It is crucial to ensure that the format meets any specific requirements set by Centrelink for submission.

Form Submission Methods (Online / Mail / In-Person)

The profit and loss statement can typically be submitted to Centrelink through various methods, depending on the requirements. These methods include:

- Online: Submitting the statement through the Centrelink online portal, which is often the fastest method.

- Mail: Sending a printed copy of the statement via postal service.

- In-Person: Delivering the statement directly to a Centrelink office, which may be necessary for certain cases.

Quick guide on how to complete profit and loss statement centrelink

Accomplish Profit And Loss Statement Centrelink seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and eSign your files swiftly without holdups. Manage Profit And Loss Statement Centrelink on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Profit And Loss Statement Centrelink effortlessly

- Obtain Profit And Loss Statement Centrelink and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to share your form, be it via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Profit And Loss Statement Centrelink and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the profit and loss statement centrelink

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the su580 feature in airSlate SignNow?

The su580 feature in airSlate SignNow allows users to efficiently manage their document signing process. It provides a user-friendly interface for sending, signing, and tracking documents, making it ideal for businesses of all sizes. With su580, you can enhance productivity by reducing the time it takes to complete agreements.

-

How does pricing for the su580 package work?

The pricing for the su580 package in airSlate SignNow is designed to be cost-effective for businesses. It offers various subscription plans based on the number of users and features needed, ensuring that every organization can find a suitable option. You can check our website for the latest pricing details and choose the plan that best fits your needs.

-

What are the key benefits of using the su580 feature?

The su580 feature provides numerous benefits, including enhanced efficiency, reduced paper usage, and improved document security. Businesses can streamline their signing processes, leading to quicker turnaround times and increased customer satisfaction. Additionally, su580 supports compliance with legal standards, making it a reliable choice for organizations.

-

Can I integrate su580 with other software tools?

Yes, airSlate SignNow’s su580 feature seamlessly integrates with various software tools such as CRMs, document management systems, and productivity applications. This integration enables users to create a more cohesive workflow and eliminates the need for manual data entry. Look into our integration options to enhance your business processes further.

-

Is there a mobile app for the su580 feature?

Yes, airSlate SignNow provides a mobile app that includes the su580 feature, allowing you to manage document signing on-the-go. The app is available for both iOS and Android devices, ensuring that you can send and eSign documents anytime and anywhere. This flexibility is essential for businesses that require mobility in their operations.

-

What types of documents can I send using su580?

With the su580 feature in airSlate SignNow, you can send various types of documents for signing, including contracts, agreements, and legal forms. The platform supports multiple file formats like PDFs and Word documents, making it versatile for different business needs. This capability helps streamline your document management effectively.

-

How secure is the su580 feature for document signing?

The su580 feature in airSlate SignNow employs advanced security measures, including encryption and user authentication, to protect your documents. It complies with industry standards and regulations to ensure your data remains confidential and secure. By using su580, you can have peace of mind that your documents are protected throughout the signing process.

Get more for Profit And Loss Statement Centrelink

Find out other Profit And Loss Statement Centrelink

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later