Restaurant Gross Receipts Restaurant Gross Receipts Stlouis Mo Form

Understanding Restaurant Gross Receipts

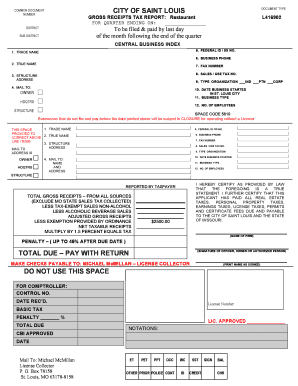

Restaurant gross receipts refer to the total income generated by a restaurant from all sales, including food, beverages, and any additional services provided. This figure is crucial for tax reporting and financial analysis. It encompasses all revenue streams, whether cash or credit, and is a key indicator of a restaurant's financial health. Understanding what constitutes gross receipts helps restaurant owners accurately report their earnings and comply with tax regulations.

Steps to Complete the Restaurant Gross Receipts Form

Completing the restaurant gross receipts form involves several important steps. First, gather all relevant financial documents, including sales records, receipts, and bank statements. Next, calculate the total gross receipts by summing all income from sales during the reporting period. Ensure that you account for any discounts, returns, or allowances that may affect the total. Once you have the accurate figure, fill out the form with the calculated gross receipts, ensuring all entries are clear and accurate to avoid discrepancies.

Legal Use of the Restaurant Gross Receipts

The legal use of restaurant gross receipts is primarily for tax purposes. Businesses must report their gross receipts to the Internal Revenue Service (IRS) to determine their tax liability. Accurate reporting is essential to comply with federal and state tax laws. Additionally, gross receipts may be used to assess eligibility for certain business loans or grants. Maintaining thorough records of gross receipts is vital for legal compliance and financial management.

IRS Guidelines for Reporting Gross Receipts

The IRS provides specific guidelines for reporting gross receipts, which vary depending on the business structure. Sole proprietors, partnerships, and corporations must adhere to distinct regulations. Generally, businesses are required to report gross receipts on their tax returns, typically using Schedule C for sole proprietors or Form 1120 for corporations. Understanding these guidelines ensures that restaurant owners fulfill their tax obligations accurately and on time.

Filing Deadlines and Important Dates

Filing deadlines for reporting restaurant gross receipts are critical for compliance. Typically, businesses must submit their tax returns by April 15 for individual filers or March 15 for corporations. However, extensions may be available. It is essential to stay informed about any changes in deadlines or requirements to avoid penalties. Marking these dates on a calendar can help ensure timely submissions.

Required Documents for Reporting Gross Receipts

When reporting restaurant gross receipts, several documents are necessary. These include sales records, bank statements, and any additional financial statements that reflect income. Keeping organized records of all transactions throughout the year simplifies the reporting process. Accurate documentation not only aids in filing taxes but also provides a clear overview of the restaurant's financial performance.

Penalties for Non-Compliance

Failure to accurately report restaurant gross receipts can result in significant penalties. The IRS may impose fines for underreporting income, which can include interest on unpaid taxes and additional penalties for late filings. In severe cases, businesses may face audits or legal action. Understanding the importance of compliance helps restaurant owners avoid these risks and maintain their business's integrity.

Quick guide on how to complete restaurant gross receipts restaurant gross receipts stlouis mo

Complete Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo effortlessly on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo with ease

- Locate Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo and ensure exceptional communication throughout every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the restaurant gross receipts restaurant gross receipts stlouis mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are gross receipts, and how do they affect my business?

Gross receipts refer to the total amount of money received by a business before any deductions or expenses are taken into account. Understanding your gross receipts is crucial as it impacts your tax obligations, financial reporting, and overall business strategy. Properly tracking gross receipts can help businesses make informed financial decisions.

-

How can airSlate SignNow help me manage my gross receipts documentation?

airSlate SignNow provides a seamless solution to eSign and manage documents related to your gross receipts. With our easy-to-use platform, you can quickly send, sign, and store receipts while maintaining compliance and organization. This not only streamlines your operations but also ensures that all important documentation is securely managed.

-

Does airSlate SignNow offer pricing plans that fit small businesses with limited gross receipts?

Yes, airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, including small businesses with limited gross receipts. Our cost-effective solutions ensure that even companies with modest gross receipts can access essential eSignature features without breaking the bank. Explore our pricing options to find the best fit for your business needs.

-

What features does airSlate SignNow provide for tracking gross receipts?

With airSlate SignNow, you can easily create and manage documents that record your gross receipts, including invoices and receipts. Our platform offers customizable templates and automated workflows to simplify the process of documenting and organizing financial transactions. This allows you to maintain an accurate and efficient record of your gross receipts.

-

Can airSlate SignNow integrate with accounting software to manage gross receipts?

Yes, airSlate SignNow integrates seamlessly with various accounting software systems, allowing you to manage and track your gross receipts more effectively. This integration ensures that all financial documentation is synchronized across platforms, giving you a comprehensive view of your business's financial health. It helps eliminate manual entry and reduces the risk of errors.

-

What benefits does using airSlate SignNow provide for managing gross receipts?

Using airSlate SignNow to manage your gross receipts offers numerous benefits, including increased efficiency, improved organization, and enhanced security. Our platform simplifies the documentation process, allowing you to focus on your core business activities while ensuring that your financial records are accurate and up-to-date. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow for storing sensitive gross receipts information?

airSlate SignNow prioritizes data security and employs advanced encryption technologies to protect your sensitive gross receipts information. Our platform complies with industry standards and regulations, ensuring that your documents remain confidential and secure. You can trust airSlate SignNow to safeguard your business's important financial data.

Get more for Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo

- New hampshire legal 497318855 form

- Essential legal life documents for new parents new hampshire form

- New hampshire power attorney form

- Nh small business form

- Company employment policies and procedures package new hampshire form

- New hampshire attorney form

- Newly divorced individuals package new hampshire form

- Contractors forms package new hampshire

Find out other Restaurant Gross Receipts Restaurant Gross Receipts Stlouis mo

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT