Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I

Understanding Form 1096

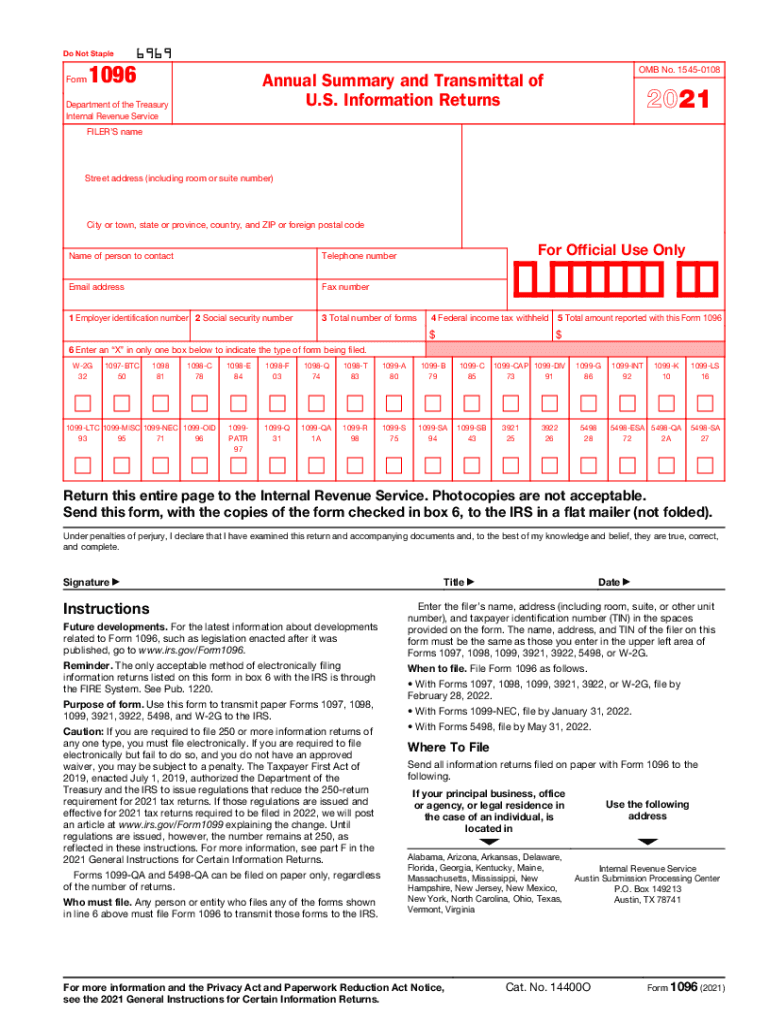

The 1096 form is an essential document for businesses that report certain types of income to the Internal Revenue Service (IRS). This form serves as a summary of various information returns, including forms such as the 1099 series. It is primarily used to transmit these information returns when filing by mail. Understanding the purpose and requirements of Form 1096 is crucial for compliance with IRS regulations.

Steps to Complete Form 1096

Completing Form 1096 involves several key steps to ensure accuracy and compliance. First, gather all necessary information returns that you are submitting, such as 1099 forms. Next, fill out the form by entering your business's name, address, and Employer Identification Number (EIN). You will also need to indicate the total number of forms being submitted and the total amount reported. After completing the form, review it for accuracy before submitting it to the IRS.

Legal Use of Form 1096

Form 1096 must be filed with the IRS to comply with federal tax regulations. It is legally binding when completed accurately and submitted within the required deadlines. This form must be accompanied by the appropriate information returns, such as the 1099 forms, to ensure that the IRS has a complete record of income reported. Failure to file Form 1096 correctly can result in penalties and complications with tax compliance.

Filing Deadlines for Form 1096

Timely filing of Form 1096 is crucial to avoid penalties. The deadline for submitting Form 1096 generally aligns with the deadlines for the information returns it summarizes. Typically, if you are filing by mail, the due date is the last day of February for the previous tax year. If filing electronically, the deadline is usually extended to March 31. Always check the IRS guidelines for any updates to these deadlines.

Form Submission Methods

Form 1096 can be submitted to the IRS through various methods. The most common method is by mailing a paper copy of the form along with the accompanying information returns. Additionally, if you are filing electronically, you may use IRS-approved e-filing software that supports Form 1096. This method can streamline the filing process and reduce the risk of errors.

Key Elements of Form 1096

When filling out Form 1096, certain key elements must be included to ensure it is complete. These elements include the filer’s name, address, and EIN, as well as the total number of information returns being submitted and the total amount reported. It is also important to include the type of forms being submitted, such as 1099-MISC or 1099-INT, to provide clarity to the IRS regarding the nature of the income reported.

Quick guide on how to complete form 1096 internal revenue service2020 form 1096 internal revenue service2020 form 1096 internal revenue service2019 form 1096

Effortlessly prepare Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the right form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I with ease

- Locate Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and bears the same legal validity as a conventional handwritten signature.

- Review all the information and hit the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1096 internal revenue service2020 form 1096 internal revenue service2020 form 1096 internal revenue service2019 form 1096

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 1096 IRS used for?

The form 1096 IRS is a summary form that accompanies various types of information returns submitted to the IRS. Businesses use this form to report payments made throughout the year, such as wages or dividends. Using airSlate SignNow, you can efficiently manage and eSign documents related to the form 1096 IRS.

-

How does airSlate SignNow streamline the filing of form 1096 IRS?

AirSlate SignNow simplifies the process of preparing and submitting the form 1096 IRS by providing an easy-to-use interface for document management and eSignature. You can collect necessary signatures digitally, reducing time and paperwork. Plus, our solution allows you to keep track of all submissions for compliance and auditing purposes.

-

What pricing options are available for using airSlate SignNow for form 1096 IRS filings?

AirSlate SignNow offers a variety of pricing plans tailored to different business needs. Whether you are a solo entrepreneur or part of a large organization, our pricing is designed to be cost-effective. This ensures that you can efficiently manage your form 1096 IRS filings without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for form 1096 IRS submissions?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software solutions. This allows for easy data transfer when preparing the form 1096 IRS, ensuring accuracy and compliance. Our integrations help streamline your workflow and keep everything organized.

-

What features does airSlate SignNow offer to assist with form 1096 IRS management?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and secure storage that enhance the management of the form 1096 IRS. These tools make it easy to create, send, and track your important documents. With our platform, you can ensure that all processes are efficient and comply with IRS requirements.

-

Is airSlate SignNow secure for handling sensitive information related to form 1096 IRS?

Absolutely, airSlate SignNow prioritizes the security of your sensitive data. We utilize advanced encryption and compliance with industry standards to ensure that all information related to the form 1096 IRS is safely processed and stored. You can trust our platform to handle your business documents with the utmost security.

-

How quickly can I complete my form 1096 IRS with airSlate SignNow?

With airSlate SignNow, you can complete your form 1096 IRS much faster than traditional methods. Our user-friendly platform allows for rapid document preparation, eSigning, and submission. Most users report signNow time savings compared to previous filing methods.

Get more for Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I

- Power of attorney for sale of motor vehicle new hampshire form

- Wedding planning or consultant package new hampshire form

- Hunting forms package new hampshire

- Identity theft recovery package new hampshire form

- Durable power of attorney for health care and living will statutory new hampshire form

- Durable power attorney nh form

- Aging parent package new hampshire form

- Sale of a business package new hampshire form

Find out other Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2020 Form 1096 Internal Revenue Service2019 Form 1096 I

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement