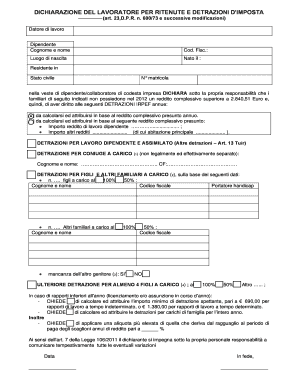

Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta Form

What is the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta

The Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta is a formal declaration that workers in the United States use to report their tax withholdings and deductions. This document is essential for ensuring that the correct amount of taxes is withheld from an employee's paycheck. It provides critical information to employers regarding the employee's tax situation, including any applicable deductions that may reduce their taxable income.

Steps to complete the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta

Completing the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta involves several key steps:

- Gather necessary personal information, including your Social Security number and employment details.

- Identify applicable deductions and credits that you qualify for, such as education or healthcare expenses.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form to your employer, either electronically or in paper format, depending on their requirements.

Legal use of the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta

The legal validity of the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta is established under various federal and state tax laws. For the form to be legally binding, it must be completed accurately and submitted on time. Employers are required to keep these forms on file for record-keeping and compliance purposes. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta. These guidelines outline how to report income, what deductions are allowable, and the process for submitting the form. It is crucial for employees to familiarize themselves with these guidelines to ensure compliance and maximize their potential tax benefits.

Form Submission Methods

Submitting the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta can be done through various methods:

- Online: Many employers offer electronic submission options, allowing for quick and efficient processing.

- Mail: Employees can print the completed form and send it to their employer via postal service.

- In-Person: Some employees may choose to deliver the form directly to their employer's HR department.

Penalties for Non-Compliance

Failure to submit the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta can result in various penalties. Employers may face fines for not withholding the correct amount of taxes, while employees may incur additional taxes owed if deductions are not claimed. It is essential to adhere to submission deadlines and ensure the accuracy of the information provided to avoid these consequences.

Quick guide on how to complete dichiarazione del lavoratore per ritenute e detrazioni damp39imposta

Complete Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the accurate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta with ease

- Locate Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets your document management needs in several clicks from your chosen device. Modify and eSign Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta and guarantee exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dichiarazione del lavoratore per ritenute e detrazioni damp39imposta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

The Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta is a declaration form that allows employees to specify their tax withholding and deductions. This form helps ensure that the correct amount of taxes is withheld from your paycheck, maximizing your take-home pay and optimizing your tax situation.

-

How can airSlate SignNow assist with the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

airSlate SignNow provides an efficient platform for preparing, sending, and electronically signing the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta. With our easy-to-use interface, you can streamline the entire process, ensuring compliance and reducing the time you spend on paperwork.

-

What features does airSlate SignNow offer for managing documents like the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures, making it simpler to manage essential documents like the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta. These tools enhance productivity and facilitate faster processing times.

-

Is there a cost associated with using airSlate SignNow for the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure you can efficiently handle the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta without breaking the bank, allowing you to choose a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for handling the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

Absolutely! airSlate SignNow integrates seamlessly with popular software like CRM and accounting tools, enhancing your workflow around the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta. This interoperability enables you to manage documents efficiently across platforms.

-

What are the benefits of using airSlate SignNow for the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

Using airSlate SignNow for the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta offers numerous benefits, including reduced paper usage, increased efficiency, and enhanced security for your sensitive data. This allows businesses to stay compliant while focusing on growth.

-

How secure is airSlate SignNow for processing the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance with international security standards to protect documents like the Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta, ensuring your data remains safe.

Get more for Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta

- Nh will template form

- Legal last will and testament form for married person with adult and minor children from prior marriage new hampshire

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage new hampshire

- Legal last will and testament form for married person with adult and minor children new hampshire

- Legal last will and testament form for civil union partner with adult and minor children new hampshire

- Mutual wills package with last wills and testaments for married couple with adult and minor children new hampshire form

- Legal last will and testament form for a widow or widower with adult children new hampshire

- Legal last will and testament form for widow or widower with minor children new hampshire

Find out other Dichiarazione Del Lavoratore Per Ritenute E Detrazioni D'imposta

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT