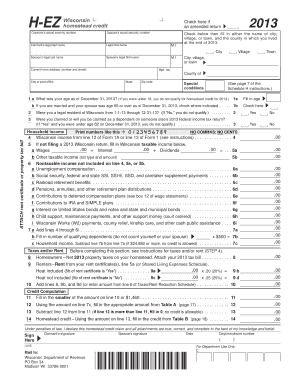

Homestead Credit Form

What is the Homestead Credit

The homestead credit is a property tax benefit designed to reduce the tax burden for homeowners. It is typically available to individuals who occupy their property as their primary residence. This credit can vary by state, but its primary aim is to provide financial relief to homeowners, making housing more affordable. The amount of the credit may depend on various factors, including the assessed value of the property and the homeowner's income level.

How to Use the Homestead Credit

To utilize the homestead credit, homeowners must first determine their eligibility based on state-specific guidelines. Once eligibility is confirmed, the next step involves completing the necessary application form, which may require documentation such as proof of residency and income verification. After filling out the form, it should be submitted to the appropriate local tax authority by the specified deadline to ensure the credit is applied to the upcoming tax year.

Eligibility Criteria

Eligibility for the homestead credit generally requires that the applicant be the owner of the property and use it as their primary residence. Additional criteria may include income limits, age restrictions, or disability status, depending on state regulations. Homeowners should review their state’s specific requirements to ensure they qualify for the credit.

Steps to Complete the Homestead Credit

Completing the homestead credit application involves several key steps:

- Check eligibility based on state-specific criteria.

- Gather necessary documentation, including proof of residency and income.

- Obtain the homestead credit application form from the local tax authority or online.

- Fill out the application accurately, ensuring all required information is included.

- Submit the completed form by the designated deadline, either online, by mail, or in person.

Required Documents

When applying for the homestead credit, homeowners typically need to provide several documents to support their application. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of property ownership, like a deed or mortgage statement.

- Evidence of residency, such as utility bills or lease agreements.

- Income verification, which may include recent tax returns or pay stubs.

Filing Deadlines / Important Dates

Filing deadlines for the homestead credit can vary significantly by state. Homeowners should be aware of these important dates to ensure their application is submitted on time. Typically, the deadline falls within a few months after the start of the tax year. It is advisable to check with the local tax authority for the exact dates and any potential extensions that may apply.

Quick guide on how to complete homestead credit

Easily Prepare Homestead Credit on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-conscious substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Homestead Credit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Edit and Electronically Sign Homestead Credit Effortlessly

- Locate Homestead Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Homestead Credit while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is homestead credit?

Homestead credit is a property tax benefit designed to reduce the tax burden on homeowners. By applying for homestead credit, eligible homeowners can receive a credit that lowers their taxable property value, which translates to lower property taxes. Understanding the requirements and benefits of homestead credit can help you save money on your taxes.

-

How can airSlate SignNow help with homestead credit applications?

AirSlate SignNow provides an efficient platform for eSigning and sending documents related to homestead credit applications. With our user-friendly features, you can easily create, sign, and submit necessary documents online, streamlining the process. This saves you time and ensures that your homestead credit application is submitted accurately and promptly.

-

What features does airSlate SignNow offer for managing homestead credit documentation?

AirSlate SignNow offers a host of features to manage your homestead credit documentation effectively. These include effortless document creation, templates that you can customize, and secure electronic signatures. Additionally, our document tracking feature allows you to monitor the status of your submissions, ensuring you never miss an important deadline.

-

Is airSlate SignNow cost-effective for small businesses seeking homestead credit?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to navigate homestead credit applications. Our pricing plans are flexible and designed to accommodate various business needs, ensuring that even small businesses can benefit from our services without breaking the bank. The savings from a successful homestead credit application can outweigh the cost of our services.

-

What are the benefits of using airSlate SignNow for homestead credit submissions?

Using airSlate SignNow for homestead credit submissions provides several benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform allows you to submit documents from anywhere, increasing convenience for busy homeowners. Moreover, our cloud-based solution ensures that your documents are securely stored and easily accessible whenever you need them.

-

Can I integrate airSlate SignNow with other tools for managing homestead credit?

Absolutely! AirSlate SignNow offers integrations with a variety of platforms that can enhance your workflow for managing homestead credit applications. Whether you're using CRM systems, invoicing software, or tax preparation tools, our integrations make it easy to streamline your processes. This can ultimately save you time and make the management of homestead credit applications much more efficient.

-

What security measures does airSlate SignNow take for homestead credit documentation?

AirSlate SignNow prioritizes the security of your documents, especially those related to homestead credit applications. We utilize advanced encryption protocols and secure data storage to protect your information. This means that your sensitive data remains confidential and is safe from unauthorized access while you manage your homestead credit documentation.

Get more for Homestead Credit

Find out other Homestead Credit

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form