Form 16a 194c Sample

What is the Form 16a 194c Sample

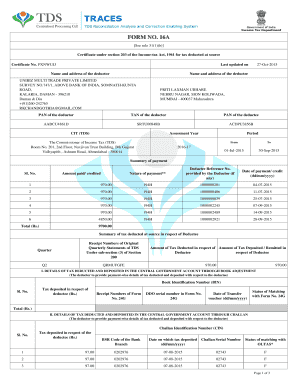

The Form 16a 194c sample is a tax document used in the United States to report income paid to contractors and service providers. This form is essential for businesses that need to comply with IRS regulations regarding tax withholding and reporting. It serves as a statement of the amount paid and any taxes withheld, ensuring that all parties fulfill their tax obligations. Understanding this form is crucial for both payers and payees to ensure accurate reporting and compliance with tax laws.

How to use the Form 16a 194c Sample

Using the Form 16a 194c sample involves several steps to ensure compliance with IRS requirements. First, businesses must gather all relevant payment information for the contractors or service providers. Next, the form should be filled out accurately, including details such as the payer's and payee's information, the total amount paid, and any taxes withheld. After completing the form, it should be provided to the payee and submitted to the IRS as required. This process helps maintain transparency and accountability in financial transactions.

Steps to complete the Form 16a 194c Sample

Completing the Form 16a 194c sample requires careful attention to detail. Follow these steps:

- Gather necessary information, including payer and payee details.

- Fill in the total amount paid to the contractor or service provider.

- Indicate any taxes withheld from the payments.

- Review the form for accuracy to avoid errors.

- Provide a copy to the payee and retain a copy for your records.

- Submit the form to the IRS by the specified deadline.

Legal use of the Form 16a 194c Sample

The legal use of the Form 16a 194c sample is governed by IRS regulations. It is essential for businesses to understand that this form must be completed accurately and submitted on time to avoid penalties. The form serves as a legal document that verifies income paid and taxes withheld, providing both the payer and payee with protection during audits. Compliance with these regulations ensures that all parties adhere to tax laws, minimizing the risk of legal issues.

Key elements of the Form 16a 194c Sample

Key elements of the Form 16a 194c sample include:

- Payer's name, address, and taxpayer identification number (TIN).

- Payee's name, address, and TIN.

- Total amount paid to the payee.

- Amount of tax withheld, if applicable.

- Signature of the payer or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 16a 194c sample are critical for compliance. Typically, the form must be submitted to the IRS by January 31 of the year following the tax year in which payments were made. Additionally, copies of the form should be provided to the payees by the same deadline. Staying aware of these dates helps avoid penalties and ensures that all parties meet their tax obligations in a timely manner.

Quick guide on how to complete form 16a 194c sample

Effortlessly Prepare Form 16a 194c Sample on Any Device

Digital document management has increasingly gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without hold-ups. Manage Form 16a 194c Sample on any device through airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Form 16a 194c Sample with Ease

- Locate Form 16a 194c Sample and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with features specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require reprinting documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 16a 194c Sample and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 16a 194c sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 16 sample?

A form 16 sample is a certificate issued by an employer that summarizes the salary and tax deductions of an employee for a financial year. It acts as proof of income and is crucial for filing income tax returns. This sample provides insight into the structure and content of the actual form.

-

How can airSlate SignNow help me with form 16 samples?

airSlate SignNow enables you to easily create, send, and eSign documents like form 16 samples. Our platform simplifies the process, ensuring that you can manage and share these samples securely and efficiently. With our intuitive interface, you can customize documents to suit your needs.

-

Is there a cost associated with using airSlate SignNow for form 16 samples?

Yes, airSlate SignNow offers several pricing plans based on the features you need for handling form 16 samples. We provide cost-effective solutions suitable for individuals and businesses of all sizes. You can choose a plan that fits your budget and document management requirements.

-

What features does airSlate SignNow offer for managing form 16 samples?

Our platform includes features like document templates, eSigning, and secure sharing that are perfect for managing form 16 samples. You can easily automate workflows and track document statuses in real-time, ensuring a seamless experience. Additionally, our integrations with popular tools enhance productivity further.

-

Can I customize my form 16 samples using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your form 16 samples according to your specific needs. You can modify text, add logos, and adjust the layout to create a professional-looking document that meets your requirements. This customization ensures that the samples reflect your brand accurately.

-

How do I eSign a form 16 sample using airSlate SignNow?

To eSign a form 16 sample with airSlate SignNow, simply upload the document, add the required signing fields, and send it to recipients for their signatures. The process is straightforward, and all parties can sign electronically from any device. This not only speeds up the process but also ensures easy tracking and compliance.

-

What benefits do I gain from using airSlate SignNow for form 16 samples?

Using airSlate SignNow for form 16 samples helps streamline your document management process, save time, and reduce costs. You can easily track, manage, and secure sensitive information while minimizing the risk of errors. Our solution enhances collaboration among teams and can signNowly improve your workflow.

Get more for Form 16a 194c Sample

- Ap chemistry multiple choice pdf 463214641 form

- Kiln log template form

- Explore learning answer key form

- Dole bwc ohsd ip 5 form

- Aditya admission test model papers form

- Life orientation grade 12 textbook download pdf form

- Aba intake packet form

- Inspection proforma shaheed benazir bhutto university sheringal

Find out other Form 16a 194c Sample

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online