Form 886

What is the Form 886

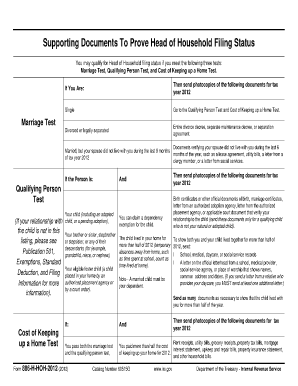

The Form 886 is a tax form used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for various tax-related purposes, including the reporting of income, deductions, and credits. Understanding the purpose of Form 886 can help taxpayers ensure compliance with federal tax laws and accurately report their financial activities.

How to use the Form 886

Using Form 886 involves several key steps. First, determine the specific requirements based on your tax situation. Next, gather all necessary financial documents, such as income statements and receipts for deductions. Carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on the IRS guidelines. It is important to retain a copy for your records.

Steps to complete the Form 886

Completing Form 886 requires attention to detail. Follow these steps to ensure accuracy:

- Review the instructions provided by the IRS for Form 886.

- Gather all relevant financial documents.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income and any deductions or credits applicable to your situation.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Form 886

The legal use of Form 886 is governed by IRS regulations. When filled out correctly, the form serves as a legally binding document that can be used in tax assessments and audits. It is crucial to comply with all applicable laws and regulations to avoid penalties. Utilizing a reliable electronic signature solution, like signNow, can further enhance the legal standing of the completed form.

Filing Deadlines / Important Dates

Filing deadlines for Form 886 may vary depending on individual tax circumstances. Generally, taxpayers must submit their forms by the annual tax deadline, which is typically April 15. However, it is advisable to check for any updates or changes to deadlines each tax year. Late submissions may incur penalties, so staying informed about important dates is essential for compliance.

Required Documents

To complete Form 886 accurately, several documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant documentation supporting credits claimed.

Having these documents on hand will streamline the completion process and ensure that all information reported is accurate.

Form Submission Methods (Online / Mail / In-Person)

Form 886 can be submitted through various methods. Taxpayers have the option to file online using IRS-approved software, which often provides step-by-step guidance. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location. In-person submissions are generally not available for Form 886, making online and mail submissions the most common methods.

Quick guide on how to complete form 886

Complete Form 886 effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without any holdups. Manage Form 886 on any device with airSlate SignNow's Android or iOS applications and simplify document-centric processes today.

How to modify and eSign Form 886 with ease

- Find Form 886 and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Highlight important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click the Done button to save your changes.

- Choose your preferred delivery method for your form: email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Edit and eSign Form 886 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 886

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 886 and why is it important?

Form 886 is an important tax form used for various tax credits and benefits in the United States. Understanding how to properly fill out Form 886 can help individuals and businesses maximize their tax returns. Utilizing airSlate SignNow simplifies the signing process for Form 886, ensuring accuracy and timeliness.

-

How can airSlate SignNow help me with Form 886?

airSlate SignNow provides a user-friendly platform for electronically signing and managing Form 886. With its intuitive interface, users can quickly fill out and eSign the document from any device. This streamlines the process, making it easier to meet tax submission deadlines.

-

Is airSlate SignNow secure for signing Form 886?

Yes, airSlate SignNow employs top-notch security measures to ensure your Form 886 is safely signed and stored. Our platform utilizes encryption and secure cloud storage, ensuring that your personal information remains confidential. Feel confident that your documents are protected when using our service.

-

What are the pricing options for airSlate SignNow when using Form 886?

airSlate SignNow offers competitive pricing plans designed to fit a variety of budgets for users needing to manage Form 886. Our flexible pricing allows you to choose a plan based on your specific needs, whether you're an individual or a business. Explore our pricing page for detailed information on available plans.

-

Can I integrate airSlate SignNow with other software for Form 886?

Absolutely! airSlate SignNow supports integrations with various software solutions to facilitate the management of Form 886. Whether you need to connect with accounting tools or other document management systems, our platform is designed to work seamlessly with your existing workflows.

-

What features does airSlate SignNow offer for managing Form 886?

airSlate SignNow provides essential features for managing Form 886, including electronic signatures, document tracking, and customizable templates. Our platform also allows users to collaborate in real-time, making the process of completing tax documents much smoother. Take advantage of these features to enhance your document management experience.

-

Is it easy to use airSlate SignNow for Form 886?

Yes, airSlate SignNow is designed with user experience in mind, making it easy to prepare and eSign Form 886. Our intuitive platform minimizes the learning curve, allowing users to navigate effortlessly. You'll be completing and signing your forms in no time!

Get more for Form 886

- Application for sublease district of columbia form

- Inventory and condition of leased premises for pre lease and post lease district of columbia form

- Move out form

- Property manager agreement district of columbia form

- Agreement for delayed or partial rent payments district of columbia form

- Tenants maintenance repair request form district of columbia

- Guaranty attachment to lease for guarantor or cosigner district of columbia form

- Amendment to lease or rental agreement district of columbia form

Find out other Form 886

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe