Central Bank Application Form

What is the Central Bank Application?

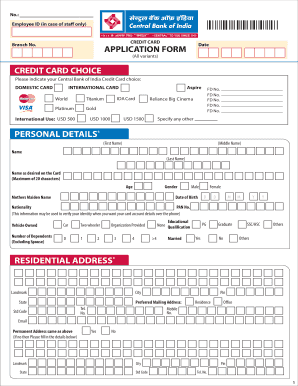

The central bank application form is a formal document used by individuals or entities to apply for services or products offered by a central bank. This form typically includes essential information such as the applicant's name, address, and the specific services requested. Understanding the purpose of this application is crucial, as it serves as the first step in establishing a relationship with the central bank, which may include opening an account, obtaining loans, or accessing other financial services.

Steps to Complete the Central Bank Application

Completing the central bank application form requires careful attention to detail. Here are the steps to ensure a smooth process:

- Gather necessary information, including personal identification, financial details, and any required documentation.

- Fill out the application form accurately, ensuring that all fields are completed as directed.

- Review the application for any errors or omissions, as inaccuracies can lead to delays.

- Submit the completed application through the designated method, whether online, by mail, or in person.

Legal Use of the Central Bank Application

The legal validity of the central bank application form is governed by various regulations. For the application to be considered legally binding, it must meet specific criteria, such as proper signatures and compliance with relevant laws. Using a reliable eSignature solution can enhance the legitimacy of the application, ensuring that it adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Required Documents

When completing the central bank application form, certain documents are typically required to verify identity and financial status. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of residence, like a utility bill or lease agreement.

- Financial statements or tax returns to demonstrate income and financial stability.

Form Submission Methods

The central bank application form can usually be submitted through various methods, providing flexibility for applicants. Common submission methods include:

- Online submission via the central bank's official website, often the most efficient option.

- Mailing a hard copy of the application to the designated address.

- In-person submission at a local branch or office of the central bank.

Eligibility Criteria

Eligibility for submitting the central bank application form may vary depending on the services requested. Generally, applicants must meet specific criteria, which may include:

- Age requirements, typically being at least eighteen years old.

- Residency status, often requiring applicants to be U.S. citizens or legal residents.

- Financial qualifications, such as creditworthiness or income level, depending on the service sought.

Application Process & Approval Time

The application process for the central bank application form can vary in duration based on several factors. After submission, the central bank typically reviews the application, which may include background checks and verification of provided information. Approval times can range from a few days to several weeks, depending on the complexity of the application and the bank's internal processes.

Quick guide on how to complete central bank application

Complete Central Bank Application effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Central Bank Application on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Central Bank Application with ease

- Find Central Bank Application and click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that reason.

- Generate your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click the Done button to save your updates.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Central Bank Application and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the central bank application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a central bank application form?

A central bank application form is an essential document used by financial entities to apply for banking privileges with the central bank. With airSlate SignNow, you can easily create, send, and eSign your central bank application form digitally, ensuring a streamlined process for your banking needs.

-

How can airSlate SignNow help with central bank application forms?

airSlate SignNow provides a user-friendly platform for managing your central bank application forms efficiently. You can automate the signing process, track document statuses in real-time, and securely store all your applications, making compliance simpler and more organized.

-

What are the key features of airSlate SignNow for central bank application forms?

Key features of airSlate SignNow include customizable templates for central bank application forms, secure eSignature capabilities, and real-time tracking of document interactions. These features empower users to manage their applications effectively and save time.

-

Is there a cost associated with using airSlate SignNow for central bank application forms?

Yes, airSlate SignNow offers various pricing plans based on your organizational needs. Each plan is designed to provide value for businesses looking to manage their central bank application forms efficiently while keeping costs low.

-

Can I integrate airSlate SignNow with other applications for central bank application forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as CRMs and document management systems, enhancing your workflow. This capability allows you to manage your central bank application forms alongside your existing tools, improving efficiency.

-

What benefits will I gain from using airSlate SignNow for my central bank application forms?

Using airSlate SignNow for your central bank application forms enhances efficiency, reduces processing time, and improves security. The platform not only simplifies document management but also ensures compliance and provides a better experience for your clients.

-

How secure is airSlate SignNow for managing central bank application forms?

airSlate SignNow prioritizes security by using advanced encryption protocols to protect your central bank application forms. We adhere to industry standards for data protection and privacy, ensuring that your sensitive information remains safe and confidential.

Get more for Central Bank Application

- Warranty deed from individual to individual oklahoma form

- Warranty deed from two individuals to an individual oklahoma form

- Warranty deed trust to trust oklahoma form

- Oklahoma order form

- Warranty deed to child reserving a life estate in the parents oklahoma form

- Mineral deed trust to three individuals oklahoma form

- Discovery interrogatories from plaintiff to defendant with production requests oklahoma form

- Ok discovery form

Find out other Central Bank Application

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free