Form 1099s PDF

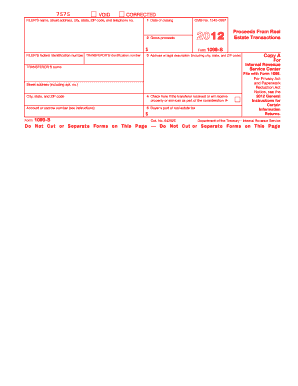

What is the Form 1099s Pdf

The Form 1099s Pdf is a crucial document used in the United States for reporting various types of income other than wages, salaries, and tips. This form is typically issued by businesses to report payments made to independent contractors, freelancers, and other non-employees. It serves to inform the Internal Revenue Service (IRS) about the income received by individuals or entities, ensuring accurate tax reporting and compliance. The 1099 form is part of a series of 1099 forms, each designated for different types of income, but the 1099s specifically focuses on non-employee compensation.

How to use the Form 1099s Pdf

Using the Form 1099s Pdf involves several steps to ensure accurate reporting of income. First, businesses must gather all relevant information about the payee, including their name, address, and taxpayer identification number (TIN). Once this information is collected, it can be entered into the form. After completing the form, it should be submitted to the IRS and provided to the payee by the required deadlines. It is essential to ensure that all information is accurate to avoid penalties or issues with tax filings.

Steps to complete the Form 1099s Pdf

Completing the Form 1099s Pdf requires attention to detail. Follow these steps for proper completion:

- Gather necessary information about the payee, including their name, address, and TIN.

- Fill out the form, ensuring that all fields are accurately completed.

- Double-check the entries for any errors or omissions.

- Sign and date the form where required.

- Submit the completed form to the IRS and provide a copy to the payee.

Legal use of the Form 1099s Pdf

The legal use of the Form 1099s Pdf is governed by IRS regulations. It is essential for businesses to issue this form to comply with tax laws and accurately report payments made to non-employees. Failure to issue a 1099s when required can result in penalties for the business. Additionally, the payee must report the income received on their tax return, making the accurate completion and submission of this form vital for both parties.

Filing Deadlines / Important Dates

Timely filing of the Form 1099s Pdf is crucial to avoid penalties. The IRS requires that the form be submitted by January thirty-first of the year following the tax year in which the payments were made. If the form is filed electronically, the deadline may extend to March thirty-first. It is important to keep track of these dates to ensure compliance and avoid potential fines.

Penalties for Non-Compliance

Failure to comply with the requirements for issuing the Form 1099s Pdf can lead to significant penalties. The IRS imposes fines for late filing, failure to file, and incorrect information on the form. These penalties can vary based on how late the form is filed and the size of the business. It is essential for businesses to understand these consequences and ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete form 1099s pdf

Easily prepare Form 1099s Pdf on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Form 1099s Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The most efficient way to edit and eSign Form 1099s Pdf effortlessly

- Find Form 1099s Pdf and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details carefully and hit the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1099s Pdf and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099s pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 1099s Pdf?

A Form 1099s Pdf is a tax document used to report income received from various sources besides your regular employment. It's essential for freelancers and contractors as it helps both the payer and receiver to file their taxes accurately. Using airSlate SignNow, you can easily manage and eSign your Form 1099s Pdf electronically, ensuring a seamless process.

-

How can airSlate SignNow help me with Form 1099s Pdf?

airSlate SignNow allows you to create, send, and eSign Form 1099s Pdfs efficiently. With our user-friendly interface, you can quickly prepare and share your tax forms while ensuring compliance and security. This makes tax season less stressful and more organized for your business.

-

What features does airSlate SignNow offer for handling Form 1099s Pdf?

Our platform offers features specifically designed for handling Form 1099s Pdf, including easy template creation, automated workflows, and secure digital signatures. Additionally, you can track the status of your documents in real time and receive notifications when they are signed. This streamlines the entire process and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for Form 1099s Pdf?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing Form 1099s Pdf effectively, including eSigning, document storage, and team collaboration tools. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099s Pdf?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software and platforms to facilitate the handling of Form 1099s Pdf. This integration helps you manage your documents more efficiently by directly syncing your tax forms and ensuring all your financial data is in one place.

-

What are the benefits of using airSlate SignNow for Form 1099s Pdf?

Using airSlate SignNow for Form 1099s Pdf offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. You can easily track document statuses, store forms securely, and reduce the risks associated with paper handling. This makes it an ideal solution for businesses looking to optimize their tax processes.

-

How secure is my data with airSlate SignNow when handling Form 1099s Pdf?

Security is a top priority for airSlate SignNow. We implement industry-standard encryption protocols and provide secure access controls to protect your data when handling Form 1099s Pdf. You can trust that your sensitive tax information is safe with us as we comply with privacy regulations and best practices.

Get more for Form 1099s Pdf

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out oklahoma form

- Property manager agreement oklahoma form

- Agreement for delayed or partial rent payments oklahoma form

- Tenants maintenance repair request form oklahoma

- Guaranty attachment to lease for guarantor or cosigner oklahoma form

- Amendment to lease or rental agreement oklahoma form

- Warning notice due to complaint from neighbors oklahoma form

- Lease subordination agreement oklahoma form

Find out other Form 1099s Pdf

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe