Form Tax020

What is the Form Tax020

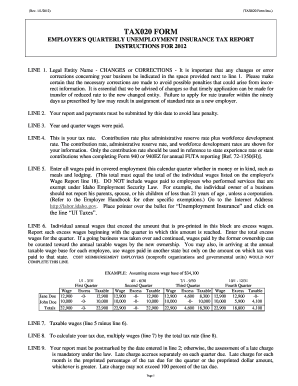

The Form Tax020 is a specific tax form utilized in the United States for various tax-related purposes. It is designed to collect essential information from taxpayers, enabling them to report income, claim deductions, or fulfill other tax obligations. Understanding the purpose and requirements of the Form Tax020 is crucial for ensuring compliance with federal tax regulations.

How to use the Form Tax020

Using the Form Tax020 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all required fields are completed accurately. Once the form is filled out, review it for any errors before submitting it to the appropriate tax authority, either electronically or via mail.

Steps to complete the Form Tax020

Completing the Form Tax020 requires a systematic approach:

- Gather necessary documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand each section.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring to include all sources of income.

- Claim any eligible deductions or credits by following the guidelines provided.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the designated deadline.

Legal use of the Form Tax020

The Form Tax020 has legal significance in the U.S. tax system. When filled out correctly and submitted on time, it serves as an official record of your tax obligations and compliance. It is essential to understand that any inaccuracies or omissions can lead to penalties or legal issues. Therefore, using the form in accordance with IRS guidelines is crucial for maintaining legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Form Tax020 may vary depending on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, the deadline for submitting the form is April 15 of each year, unless it falls on a weekend or holiday. It is important to stay informed about any changes to deadlines and to plan accordingly to avoid late fees or penalties.

Required Documents

To complete the Form Tax020 accurately, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year's tax return for reference

- Any relevant financial statements

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is included.

Quick guide on how to complete form tax020

Complete Form Tax020 effortlessly on any device

The management of documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, amend, and electronically sign your documents promptly without difficulties. Handle Form Tax020 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The optimal method to adjust and electronically sign Form Tax020 without strain

- Obtain Form Tax020 and click on Get Form to begin.

- Utilize the features we provide to finish your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign Form Tax020 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tax020

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form tax020 used for?

The form tax020 is a crucial document for businesses that need to report specific tax-related information. It helps streamline tax compliance processes, ensuring that your submissions are accurate and timely. By utilizing the form tax020, you can minimize errors and maintain compliance with relevant tax regulations.

-

How can airSlate SignNow assist with filling out form tax020?

airSlate SignNow simplifies the process of completing form tax020 by providing intuitive features that allow users to fill out and eSign documents easily. With customizable templates, you can pre-fill recurring information, saving time and reducing the potential for errors. This ensures that your form tax020 is completed accurately and efficiently.

-

Is airSlate SignNow a cost-effective solution for managing form tax020?

Absolutely! airSlate SignNow offers competitive pricing plans designed to fit various business needs, making it a cost-effective solution for managing form tax020. With our platform, you can save on printing and mailing costs while ensuring that your documents are signed and submitted securely.

-

Can I integrate airSlate SignNow with other software for managing form tax020?

Yes, airSlate SignNow provides seamless integration with various business applications, enhancing your workflow while handling form tax020. By connecting with tools like CRM systems or accounting software, you can automate processes, share data effortlessly, and improve overall efficiency.

-

What features does airSlate SignNow offer to facilitate eSigning of form tax020?

AirSlate SignNow comes equipped with features tailored for the eSigning of form tax020, including reusable templates, real-time tracking, and notifications. These features ensure a smooth signing experience, allowing multiple parties to sign the document from anywhere. This flexibility speeds up the process and keeps you on track with your submission deadlines.

-

How secure is the eSigning process for form tax020 with airSlate SignNow?

The security of your documents, including form tax020, is our top priority at airSlate SignNow. We employ state-of-the-art encryption and adhere to compliance standards, ensuring that your data remains protected throughout the eSigning process. You can trust that your sensitive information is safe while using our platform.

-

Can mobile devices be used to complete form tax020 through airSlate SignNow?

Yes! airSlate SignNow is fully optimized for mobile use, allowing you to complete form tax020 on the go. Whether you are using a smartphone or tablet, you can access and sign documents seamlessly, making it easier to manage your tasks from anywhere at any time.

Get more for Form Tax020

- Warranty deed two individuals to two individuals florida form

- Limited liability company 497302845 form

- Warranty timeshare form

- Quitclaim deed one individual to three individuals florida form

- Fl warranty form

- Limited liability company 497302849 form

- Trust two individual trustees to an individual florida form

- Husband wife two form

Find out other Form Tax020

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors