Tx Form 50 a 6 PDF

What is the Tx Form 50 A 6 Pdf

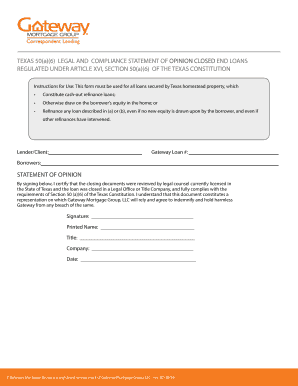

The Tx Form 50 A 6, commonly referred to as the Texas 50(a)(6) form, is a document used in Texas for cash-out refinancing on homestead properties. This form is essential for homeowners looking to access the equity in their homes while complying with state regulations. The Texas 50(a)(6) rules dictate that homeowners can borrow against the equity of their primary residence, provided they meet specific legal requirements. Understanding this form is crucial for anyone considering a cash-out refinance in Texas.

How to use the Tx Form 50 A 6 Pdf

Using the Tx Form 50 A 6 PDF involves several steps to ensure that the document is completed accurately and legally. First, download the form from a reliable source. Next, fill in the required information, including personal details, loan amounts, and property information. It is important to review the form for completeness and accuracy before submission. Once completed, the form must be signed by all parties involved to validate the transaction. Utilizing a digital signature solution can streamline this process, ensuring that the document is executed in compliance with eSignature laws.

Steps to complete the Tx Form 50 A 6 Pdf

Completing the Tx Form 50 A 6 PDF involves a systematic approach:

- Download the form from a trusted source.

- Enter your personal information, including your name, address, and Social Security number.

- Provide details about the property, such as its address and current market value.

- Specify the loan amount you wish to access through the cash-out refinance.

- Ensure that all required signatures are included, which may involve notarization.

- Review the completed form for accuracy and compliance with Texas regulations.

Legal use of the Tx Form 50 A 6 Pdf

The legal use of the Tx Form 50 A 6 PDF is governed by Texas law, specifically the Texas Constitution and the Texas Finance Code. These regulations outline the conditions under which homeowners can access their home equity. It is important to ensure that the form is used in accordance with these laws to avoid potential legal issues. The form must be executed properly, with all necessary disclosures provided to the borrower, ensuring transparency and compliance with state requirements.

Eligibility Criteria

To qualify for using the Tx Form 50 A 6, homeowners must meet certain eligibility criteria. These criteria typically include:

- The property must be the homeowner's primary residence.

- The homeowner must have sufficient equity in the property, generally at least twenty percent.

- The homeowner must not have any existing liens that could complicate the refinancing process.

- The borrower must be able to demonstrate the ability to repay the new loan.

Form Submission Methods (Online / Mail / In-Person)

The Tx Form 50 A 6 can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online: Many lenders offer an online submission process, allowing homeowners to upload the completed form directly through their website.

- Mail: Homeowners can also print the form and send it via postal mail to their lender.

- In-Person: Some homeowners may choose to deliver the form in person, especially if they require immediate assistance or clarification.

Quick guide on how to complete tx form 50 a 6 pdf

Set Up Tx Form 50 A 6 Pdf Effortlessly on Any Device

Web-based document management has become increasingly popular among both companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Tx Form 50 A 6 Pdf on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Alter and Electronically Sign Tx Form 50 A 6 Pdf Without Difficulty

- Locate Tx Form 50 A 6 Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tiresome document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Tx Form 50 A 6 Pdf to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tx form 50 a 6 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the texas 50a6 cash out rules?

The texas 50a6 cash out rules allow homeowners to refinance and access their home equity while ensuring they meet specific legal requirements. It's important for borrowers to understand these rules to avoid potential pitfalls during the cash-out refinance process. Familiarizing yourself with these regulations can help streamline your refinancing experience.

-

How do texas 50a6 cash out rules affect my refinancing options?

The texas 50a6 cash out rules signNowly impact refinancing by limiting the amount of equity that can be accessed. Homeowners can cash out up to 80% of their home’s appraised value, but they must ensure compliance with the guidelines to avoid legal issues. Understanding these limitations is crucial for effective financial planning.

-

Are there any fees associated with texas 50a6 cash out loans?

Yes, there may be various fees associated with texas 50a6 cash out loans, including appraisal fees, closing costs, and title insurance. It's essential to review these costs carefully, as they can affect your overall cash-out amount. Budgeting for these fees can help you maximize your benefits under the texas 50a6 cash out rules.

-

What are the benefits of understanding texas 50a6 cash out rules?

Understanding the texas 50a6 cash out rules can empower homeowners to make informed decisions about their refinancing options. Knowledge of these rules can lead to financial savings and a smoother refinancing process. Additionally, awareness helps in complying with legal requirements, minimizing the risk of complications.

-

How does airSlate SignNow help with refinancing under texas 50a6 cash out rules?

airSlate SignNow streamlines the document signing process required for refinancing under the texas 50a6 cash out rules. Our platform offers an easy-to-use solution for eSigning and sending essential documents, making the refinancing process faster and more efficient. This ensures you can focus more on navigating the cash-out process while we handle the logistics.

-

Can I use airSlate SignNow for multiple types of cash-out refinancing?

Absolutely! airSlate SignNow is versatile and supports various types of cash-out refinancing, including those under the texas 50a6 cash out rules. Our platform’s flexibility allows you to manage different transactions seamlessly, making it easier to handle your financing needs in one place.

-

What integrations does airSlate SignNow offer to assist with cash-out refinances?

airSlate SignNow integrates with several popular platforms to improve the cash-out refinance process, especially in compliance with texas 50a6 cash out rules. By connecting with tools like CRM systems and document management solutions, users can manage their refinancing documents more efficiently. These integrations streamline workflows and ensure you stay on top of your refinancing transactions.

Get more for Tx Form 50 A 6 Pdf

- Case fee form

- Oregon petition custody form

- Parte motion order form

- Respondent affidavit form

- Petitioners affidavit in support of motion for order of default oregon form

- General judgment of custody parenting timesupport order oregon form

- Petitioners respondents certificate of mailing of judgment and decree oregon form

- Oregon parte form

Find out other Tx Form 50 A 6 Pdf

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form