How to Fill Out a Rollover Form from Icma

What is the rollover form from ICMA?

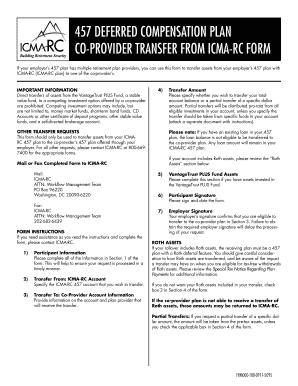

The rollover form from ICMA (International City/County Management Association) is a document used to facilitate the transfer of retirement funds from one account to another without incurring tax penalties. This form is essential for individuals who wish to move their retirement savings into a new account, such as an IRA or another qualified retirement plan. Understanding the purpose and function of this form is crucial for ensuring compliance with IRS regulations and for making informed financial decisions regarding retirement savings.

Key elements of the rollover form from ICMA

When filling out the rollover form from ICMA, several key elements must be included to ensure its validity. These elements typically include:

- Personal Information: Full name, address, Social Security number, and contact information.

- Account Details: Information about the current retirement account and the new account to which funds will be transferred.

- Amount to be Rolled Over: The specific dollar amount or percentage of funds being transferred.

- Signature: The form must be signed and dated by the account holder to authorize the rollover.

Providing accurate information in these sections is vital for the successful processing of the rollover.

Steps to complete the rollover form from ICMA

Completing the rollover form from ICMA involves several straightforward steps:

- Gather Required Information: Collect all necessary personal and account information before starting the form.

- Fill Out the Form: Carefully enter your personal information, account details, and the amount you wish to roll over.

- Review the Form: Double-check all entries for accuracy to avoid delays in processing.

- Sign and Date: Ensure that you sign and date the form, as this is a critical step for authorization.

- Submit the Form: Send the completed form to the appropriate institution, whether online, by mail, or in person, depending on the submission methods available.

Following these steps can help ensure a smooth rollover process.

Legal use of the rollover form from ICMA

The rollover form from ICMA must adhere to specific legal requirements to be considered valid. Compliance with IRS regulations is essential to avoid tax penalties. The form should be filled out accurately and submitted in a timely manner. Additionally, the use of electronic signatures is permissible under the ESIGN Act, provided that the electronic signature solution meets legal standards for authentication and security. This ensures that the rollover is legally binding and recognized by financial institutions.

Form submission methods for the rollover form from ICMA

There are various methods for submitting the rollover form from ICMA, which may include:

- Online Submission: Many financial institutions allow for electronic submission of the rollover form through their secure portals.

- Mail: You can print the completed form and send it via postal mail to the designated address provided by ICMA or your financial institution.

- In-Person: Some individuals may prefer to deliver the form in person at their financial institution's office for immediate processing.

Choosing the right submission method can facilitate a quicker and more efficient rollover process.

IRS guidelines for rollovers

The IRS has established specific guidelines regarding rollovers to ensure compliance and avoid penalties. Key points include:

- Funds must be rolled over within sixty days of withdrawal to avoid taxation.

- Only one rollover is allowed per twelve-month period for IRAs.

- Direct rollovers, where funds are transferred directly between accounts, are not subject to the sixty-day rule.

Understanding these guidelines is crucial for individuals looking to manage their retirement funds effectively.

Quick guide on how to complete how to fill out a rollover form from icma

Complete How To Fill Out A Rollover Form From Icma seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage How To Fill Out A Rollover Form From Icma on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and eSign How To Fill Out A Rollover Form From Icma effortlessly

- Obtain How To Fill Out A Rollover Form From Icma and then click Get Form to initiate the process.

- Use the tools we provide to finalize your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign How To Fill Out A Rollover Form From Icma to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out a rollover form from icma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to learn how to fill out a rollover form from icma using airSlate SignNow?

To learn how to fill out a rollover form from icma using airSlate SignNow, start by selecting the document template you need. Once selected, fill in the required fields with necessary information. Finally, utilize our eSigning features to complete your rollover form securely and efficiently.

-

Are there any costs associated with using airSlate SignNow to fill out a rollover form from icma?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While there is a basic cost for using the service, it is considered a cost-effective solution for businesses looking to fill out a rollover form from icma. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow provide for filling out a rollover form from icma?

When filling out a rollover form from icma with airSlate SignNow, you can access features like document templates, real-time collaboration, and electronic signatures. These tools streamline the process, making it easier for users to ensure their forms are completed accurately and promptly.

-

Can I save my progress when filling out a rollover form from icma on airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your progress while filling out a rollover form from icma. You can return to your document at any time, ensuring you can complete it at your convenience without worrying about losing your information.

-

Is it easy to integrate airSlate SignNow with other platforms for rollover forms?

Yes, airSlate SignNow offers seamless integrations with a variety of platforms. This makes it easy to incorporate the service into your existing workflows while filling out a rollover form from icma. Our integrations enhance efficiency and productivity across different applications.

-

What benefits can businesses expect when using airSlate SignNow for rollover forms?

By using airSlate SignNow, businesses can enjoy faster processing times and improved accuracy when filling out a rollover form from icma. Our user-friendly interface and eSigning capabilities also reduce the need for paper documents, ultimately saving time and resources.

-

Is customer support available for users learning how to fill out a rollover form from icma?

Yes, airSlate SignNow offers comprehensive customer support to assist users who are learning how to fill out a rollover form from icma. Our support team is available to answer any questions and provide guidance through the process to ensure a smooth experience.

Get more for How To Fill Out A Rollover Form From Icma

- Painting contractor package rhode island form

- Framing contractor package rhode island form

- Foundation contractor package rhode island form

- Plumbing contractor package rhode island form

- Brick mason contractor package rhode island form

- Roofing contractor package rhode island form

- Electrical contractor package rhode island form

- Sheetrock drywall contractor package rhode island form

Find out other How To Fill Out A Rollover Form From Icma

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF