Canada Mortgage Loan Agreement Form

What is the Canada Mortgage Loan Agreement

The Canada mortgage loan agreement is a legal document that outlines the terms and conditions under which a lender provides funds to a borrower for the purchase of real estate. This agreement details the loan amount, interest rate, repayment schedule, and any other obligations the borrower must fulfill. It serves as a binding contract that protects both parties involved in the transaction, ensuring that the lender's investment is secured by the property itself.

Key Elements of the Canada Mortgage Loan Agreement

Understanding the key elements of the Canada mortgage loan agreement is crucial for both borrowers and lenders. Essential components include:

- Loan Amount: The total amount borrowed to purchase the property.

- Interest Rate: The cost of borrowing expressed as a percentage of the loan amount.

- Repayment Terms: The schedule detailing how and when the borrower will repay the loan.

- Property Description: A detailed description of the property being financed.

- Default Terms: Conditions under which the lender can claim the property if the borrower fails to meet obligations.

Steps to Complete the Canada Mortgage Loan Agreement

Completing the Canada mortgage loan agreement involves several steps to ensure accuracy and compliance. These steps typically include:

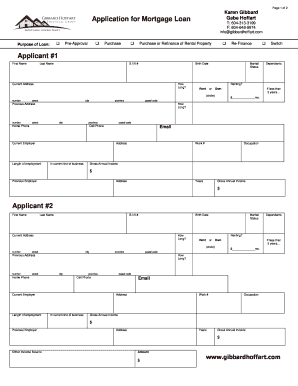

- Gather Required Information: Collect personal and financial information, including income, credit history, and property details.

- Review Loan Terms: Carefully read through the terms of the loan, including interest rates and repayment schedules.

- Fill Out the Agreement: Accurately complete the mortgage loan agreement form, ensuring all fields are filled in correctly.

- Sign the Document: Both parties must sign the agreement, often in the presence of a notary or witness.

- Submit the Agreement: Provide the signed document to the lender for processing and record-keeping.

Legal Use of the Canada Mortgage Loan Agreement

The legal use of the Canada mortgage loan agreement is governed by various regulations that ensure its enforceability. To be legally binding, the agreement must include essential elements such as the signatures of both parties, a clear description of the loan terms, and compliance with applicable state and federal laws. Additionally, the document should be stored securely to protect the rights of both the borrower and lender in case of disputes.

How to Obtain the Canada Mortgage Loan Agreement

Obtaining the Canada mortgage loan agreement typically involves contacting a lender or financial institution that offers mortgage products. Borrowers can request a copy of the agreement during the loan application process. Many lenders provide a digital version of the agreement, allowing for easier access and completion. It's important to review the terms carefully before signing to ensure understanding and acceptance of the conditions outlined.

Eligibility Criteria for the Canada Mortgage Loan Agreement

Eligibility for a Canada mortgage loan agreement varies by lender but generally includes several common criteria. Borrowers typically need to demonstrate:

- Stable Income: Proof of consistent income to support loan repayment.

- Creditworthiness: A satisfactory credit score that meets the lender's requirements.

- Debt-to-Income Ratio: A ratio that indicates the borrower's ability to manage monthly payments.

- Property Appraisal: An evaluation of the property's value to ensure it meets the loan amount.

Quick guide on how to complete canada mortgage loan agreement

Complete Canada Mortgage Loan Agreement effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Canada Mortgage Loan Agreement across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Canada Mortgage Loan Agreement effortlessly

- Locate Canada Mortgage Loan Agreement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Alter and electronically sign Canada Mortgage Loan Agreement to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada mortgage loan agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canada financial mortgage loan?

A Canada financial mortgage loan is a type of loan specifically designed to help individuals purchase real estate in Canada. It allows borrowers to finance their home purchases by borrowing money from lenders, securing the loan against the property itself. Understanding the specifics of a Canada financial mortgage loan can help you make informed decisions about your home purchase.

-

What are the typical interest rates for a Canada financial mortgage loan?

Interest rates for a Canada financial mortgage loan can vary signNowly based on the lender, the type of mortgage, and the borrower's creditworthiness. Generally, fixed and variable rates are available, with competitive options in the market. It's essential to shop around and consider current rates to find the best fit for your financial situation.

-

What documents are required to apply for a Canada financial mortgage loan?

To apply for a Canada financial mortgage loan, you typically need to provide documents such as proof of income, credit history, and details of your current debts. Additional documentation may include identification, employment verification, and property details. Having these documents prepared will streamline your loan application process.

-

How long does it take to process a Canada financial mortgage loan?

The processing time for a Canada financial mortgage loan can vary, but it typically takes from a few weeks to a month. Factors affecting this timeline include the lender’s workload and the completeness of your application. Timely submission of required documents can expedite the approval process.

-

What are the benefits of a Canada financial mortgage loan?

A Canada financial mortgage loan offers several benefits, including the ability to purchase a home without paying the full price upfront. It can also help build equity over time, providing a stable financial investment. Additionally, Canadian tax benefits on mortgage interest can make homeownership more affordable.

-

Can I use a Canada financial mortgage loan for investment properties?

Yes, a Canada financial mortgage loan can be used for investment properties, allowing investors to purchase rental homes or commercial real estate. It is vital to understand the terms and conditions associated with investment mortgages, as they may differ from those for primary residences. Lenders may have specific criteria for approving investment property loans.

-

What features do different Canada financial mortgage loans offer?

Different Canada financial mortgage loans may offer various features such as adjustable or fixed interest rates, loan terms ranging from a few years to several decades, and options for prepayment. It's crucial to review these features to select a mortgage that aligns with your financial goals and lifestyle. Comparing options can ensure you make an informed choice.

Get more for Canada Mortgage Loan Agreement

- Lease subordination agreement hawaii form

- Apartment rules and regulations hawaii form

- Agreed cancellation of lease hawaii form

- Amendment of residential lease hawaii form

- Agreement for payment of unpaid rent hawaii form

- Commercial lease assignment from tenant to new tenant hawaii form

- Tenant consent to background and reference check hawaii form

- Residential lease or rental agreement for month to month hawaii form

Find out other Canada Mortgage Loan Agreement

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself