Michigan Tax Tribunal Small Claims Division Petition Form

What is the Michigan Tax Tribunal Small Claims Division Petition Form

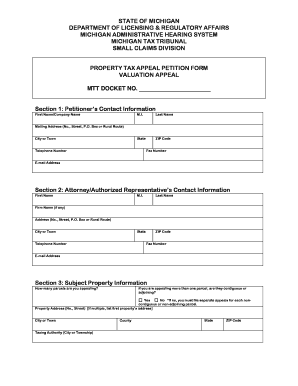

The Michigan property tax appeal petition form is a legal document used by property owners to contest their property tax assessments. This form is specifically designed for cases handled by the Michigan Tax Tribunal's Small Claims Division, which provides a simplified process for resolving disputes regarding property tax valuations. By submitting this petition, property owners can formally request a review of their property tax assessment, aiming to achieve a fair evaluation based on market conditions and property characteristics.

Steps to complete the Michigan Tax Tribunal Small Claims Division Petition Form

Completing the Michigan property tax appeal petition form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary documents, including your property tax assessment notice and any supporting evidence that substantiates your claim. Next, carefully fill out the petition form, providing detailed information about your property, the assessment in question, and the reasons for your appeal. It is essential to include any relevant data, such as comparable property sales, to strengthen your case. Once completed, review the form for any errors or omissions before signing it. Finally, submit the petition form to the Michigan Tax Tribunal by the designated deadline, ensuring that you retain a copy for your records.

Legal use of the Michigan Tax Tribunal Small Claims Division Petition Form

The Michigan property tax appeal petition form is legally binding once properly executed and submitted. To ensure its validity, it must comply with the legal standards set forth by the Michigan Tax Tribunal. This includes providing accurate information, adhering to submission deadlines, and including all required documentation. The form serves as a formal request for a hearing, allowing property owners to present their case and seek a reduction in their property tax assessment. Understanding the legal implications of this form is crucial for property owners looking to navigate the appeal process effectively.

Required Documents

When filing the Michigan property tax appeal petition form, several documents are required to support your appeal. These typically include:

- Your most recent property tax assessment notice.

- Evidence of property value, such as recent sales data for comparable properties.

- Photographs of the property, if applicable.

- Any previous correspondence with the local assessing office regarding your assessment.

Providing comprehensive documentation enhances the credibility of your appeal and aids the tribunal in making an informed decision.

Form Submission Methods

The Michigan property tax appeal petition form can be submitted through various methods to accommodate different preferences. Property owners have the option to file the petition online, which is often the most efficient method, allowing for immediate confirmation of receipt. Alternatively, the form can be mailed directly to the Michigan Tax Tribunal or submitted in person at the tribunal's office. Regardless of the method chosen, it is advisable to keep a copy of the submitted form and any accompanying documents for your records.

Eligibility Criteria

To file the Michigan property tax appeal petition form, property owners must meet specific eligibility criteria. Primarily, the applicant must be the owner of the property in question or an authorized representative. Additionally, the appeal must be based on the assessment for the current tax year, and it must be submitted within the designated filing period, typically within 35 days of the assessment notice date. Understanding these criteria is essential to ensure that your appeal is valid and can be considered by the tribunal.

Quick guide on how to complete michigan tax tribunal small claims division petition form

Complete Michigan Tax Tribunal Small Claims Division Petition Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Handle Michigan Tax Tribunal Small Claims Division Petition Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Michigan Tax Tribunal Small Claims Division Petition Form without any hassle

- Find Michigan Tax Tribunal Small Claims Division Petition Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which requires seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Michigan Tax Tribunal Small Claims Division Petition Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan tax tribunal small claims division petition form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Michigan property tax appeal petition?

A Michigan property tax appeal petition is a formal request submitted to contest the assessed value of your property. This petition allows you to present evidence as to why you believe your property's assessed value is inaccurate. Understanding how to properly file a Michigan property tax appeal petition can signNowly lower your tax burden.

-

How can airSlate SignNow help with my Michigan property tax appeal petition?

airSlate SignNow simplifies the process of preparing and sending your Michigan property tax appeal petition. With its intuitive eSigning features, you can ensure that your petitions are signed and submitted promptly. This streamlined process can help you effectively contest your property tax assessment.

-

What features does airSlate SignNow offer for property tax appeals?

airSlate SignNow provides features like document templates, automated workflows, and eSignature capabilities tailored for Michigan property tax appeal petitions. These tools allow you to create, customize, and send your appeal documents efficiently. Moreover, you can track the status of your petitions, ensuring you never miss a deadline.

-

Is there a cost associated with using airSlate SignNow for my property tax appeal?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when filing a Michigan property tax appeal petition. The costs vary based on features and the number of users, making it a flexible and cost-effective solution for anyone looking to manage their property tax appeal process.

-

Can I integrate airSlate SignNow with other tools for my property tax processes?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when handling Michigan property tax appeal petitions. These integrations allow you to connect with tools you already use, making the filing and management of your appeals even more efficient.

-

What are the benefits of using airSlate SignNow for filing a property tax appeal?

Using airSlate SignNow for your Michigan property tax appeal petition offers numerous benefits, including time efficiency and increased accuracy. The platform allows you to manage your documents in one place, minimizing the stress associated with filing appeals. Additionally, the ability to use eSignatures speeds up the process, so you can resolve your tax issues quickly.

-

How do I start a Michigan property tax appeal petition using airSlate SignNow?

To start a Michigan property tax appeal petition with airSlate SignNow, simply sign up for an account and follow the user-friendly interface. You can create your petition using templates specifically designed for property tax appeals and complete it with ease using intuitive tools. Once your document is ready, you can share it with the necessary parties for eSigning.

Get more for Michigan Tax Tribunal Small Claims Division Petition Form

Find out other Michigan Tax Tribunal Small Claims Division Petition Form

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA