St 121 1 Form

What is the St 121 1?

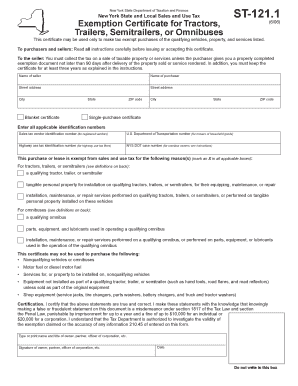

The St 121 1 is a tax form used in the United States, primarily for sales tax exemption purposes. This form allows eligible organizations to purchase goods and services without paying sales tax, provided they meet specific criteria established by state regulations. It is often utilized by non-profit organizations, government entities, and certain educational institutions. Understanding the St 121 1 is crucial for entities looking to maximize their financial resources by minimizing tax liabilities.

How to use the St 121 1

To effectively use the St 121 1, organizations must first determine their eligibility for sales tax exemption. This involves reviewing state-specific guidelines and ensuring that the organization qualifies under the appropriate categories. Once eligibility is confirmed, the organization should fill out the form accurately, providing all necessary information, including the name, address, and tax identification number. After completing the form, it should be presented to the vendor at the time of purchase to claim the exemption.

Steps to complete the St 121 1

Completing the St 121 1 involves several key steps:

- Gather necessary documentation to prove eligibility, such as tax-exempt status letters.

- Fill out the form with accurate organizational details, including the name and address.

- Provide the tax identification number, which is essential for verification.

- Review the completed form for accuracy and completeness.

- Submit the form to the vendor during the purchase transaction.

Legal use of the St 121 1

The legal use of the St 121 1 is governed by state tax laws. To ensure compliance, organizations must only use the form for qualifying purchases and must not misuse it for personal or non-qualifying items. Misrepresentation or fraudulent use of the St 121 1 can result in penalties, including fines and loss of tax-exempt status. Therefore, it is essential to maintain accurate records and ensure that the form is used in accordance with state regulations.

Key elements of the St 121 1

Several key elements are essential for the St 121 1 to be valid:

- Organization Information: Complete details about the organization, including name and address.

- Tax Identification Number: This number verifies the organization’s tax-exempt status.

- Signature: A signature from an authorized representative is often required to validate the form.

- Purpose of Purchase: Clearly stating the reason for the tax exemption helps in compliance with regulations.

Who Issues the Form

The St 121 1 is typically issued by state tax authorities. Each state has its own version of the form, and it is essential for organizations to obtain the correct form from their respective state’s department of revenue or taxation. This ensures that the form complies with local regulations and is recognized for sales tax exemption purposes.

Quick guide on how to complete st 121 1

Easily Prepare St 121 1 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hold-ups. Manage St 121 1 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Effortlessly Edit and eSign St 121 1

- Locate St 121 1 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools especially designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Carefully review the information and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign St 121 1 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 121 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st121 1 feature offered by airSlate SignNow?

The st121 1 feature in airSlate SignNow allows users to seamlessly manage electronic signatures and document workflows. This feature simplifies the process of signing and sending documents, ensuring that businesses can operate efficiently and securely.

-

How does pricing work for the st121 1 plan?

The pricing for the st121 1 plan varies based on the number of users and features selected. airSlate SignNow offers competitive rates designed to provide excellent value for small and large businesses. You can choose a plan that adequately meets your operational needs.

-

What are the key benefits of using the st121 1 solution?

Using the st121 1 solution by airSlate SignNow offers numerous benefits including time savings, enhanced security, and improved document management. Businesses can expect increased productivity through streamlined workflows and reduced reliance on paper documents.

-

Can st121 1 integrate with other software applications?

Yes, the st121 1 solution integrates smoothly with various software applications such as Google Workspace, Microsoft Office, and CRM systems. This versatility allows businesses to incorporate airSlate SignNow into their existing tech stack effortlessly.

-

How does st121 1 enhance collaboration in document management?

The st121 1 feature enhances collaboration by allowing multiple users to review, edit, and sign documents in real-time. This ensures that all stakeholders can participate in the signing process, thereby speeding up approvals and improving communication.

-

Is there customer support available for st121 1 users?

Absolutely! airSlate SignNow provides dedicated customer support for st121 1 users via chat, email, and phone. Our support team is available to assist you with any inquiries and ensure that you maximize your experience with our solution.

-

What security measures are in place for st121 1 users?

The st121 1 solution incorporates advanced security measures such as encryption and multi-factor authentication. This ensures that all documents remain secure throughout the signing process, protecting sensitive information from unauthorized access.

Get more for St 121 1

- Child care services package south carolina form

- Special or limited power of attorney for real estate sales transaction by seller south carolina form

- Sc closing real estate form

- Limited power of attorney where you specify powers with sample powers included south carolina form

- Limited power of attorney for stock transactions and corporate powers south carolina form

- Special durable power of attorney for bank account matters south carolina form

- South carolina small business startup package south carolina form

- South carolina property management form

Find out other St 121 1

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document