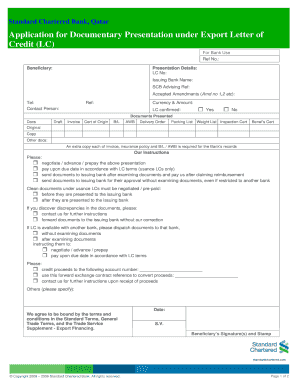

Application for Documentary Presentation under Export Letter of Credit Form

Understanding the Application for Documentary Presentation Under Export Letter of Credit

The application for documentary presentation under export letter of credit is a crucial document in international trade. It serves as a request for payment to the bank, contingent upon the presentation of specified documents that verify the shipment of goods. This application ensures that sellers receive payment while buyers are assured that their goods will be shipped as agreed. Understanding its structure and purpose is essential for businesses engaged in global commerce.

Steps to Complete the Application for Documentary Presentation Under Export Letter of Credit

Completing the application requires attention to detail to ensure all necessary information is accurately provided. Here are the key steps:

- Gather required documents, including the commercial invoice, bill of lading, and packing list.

- Fill out the application form with accurate details about the transaction, including buyer and seller information.

- Ensure that all documents align with the terms outlined in the letter of credit.

- Submit the completed application and accompanying documents to the bank for processing.

Legal Use of the Application for Documentary Presentation Under Export Letter of Credit

The application must comply with various legal standards to be considered valid. It is governed by the Uniform Customs and Practice for Documentary Credits (UCP) and must adhere to the specific terms set forth in the letter of credit. Ensuring compliance with these regulations protects all parties involved and facilitates smoother transactions.

Key Elements of the Application for Documentary Presentation Under Export Letter of Credit

Several critical components must be included in the application to ensure its effectiveness:

- Applicant Information: Details of the buyer and seller, including names and addresses.

- Letter of Credit Number: Reference to the specific letter of credit being utilized.

- Document Requirements: A clear list of documents that must be presented for payment.

- Shipping Details: Information regarding the shipment, including dates and methods.

How to Use the Application for Documentary Presentation Under Export Letter of Credit

Using the application effectively involves understanding the process and ensuring that all documents are in order. Once the application is completed, it should be submitted to the bank that issued the letter of credit. The bank will review the documents against the terms of the letter of credit and facilitate payment if everything is in compliance.

Examples of Using the Application for Documentary Presentation Under Export Letter of Credit

In practice, businesses often use this application in various scenarios. For instance, a manufacturer exporting goods to a foreign buyer may submit the application along with shipping documents to receive payment. Another example includes an importer who requires proof of shipment before releasing payment to the exporter. Each scenario highlights the importance of accurate documentation and adherence to the terms of the letter of credit.

Quick guide on how to complete application for documentary presentation under export letter of credit

Effortlessly Prepare Application For Documentary Presentation Under Export Letter Of Credit on Any Device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Application For Documentary Presentation Under Export Letter Of Credit on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Application For Documentary Presentation Under Export Letter Of Credit with Ease

- Obtain Application For Documentary Presentation Under Export Letter Of Credit and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For Documentary Presentation Under Export Letter Of Credit and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for documentary presentation under export letter of credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a standard letter of credit?

A standard letter of credit is a financial document that provides a guarantee of payment to a seller from a buyer's bank, ensuring that funds will be available once certain conditions are met. It is commonly used in international trade to mitigate risks associated with payment. By utilizing a standard letter of credit, businesses can transact with confidence, knowing that their financial interests are protected.

-

How does airSlate SignNow facilitate the use of standard letters of credit?

airSlate SignNow simplifies the process of creating, sending, and signing standard letters of credit with its easy-to-use interface. You can quickly upload your documents, customize fields for eSigning, and send them securely to relevant parties. This streamlines the traditionally lengthy processes involved in issuing and managing letters of credit.

-

What are the benefits of using a standard letter of credit in business transactions?

Using a standard letter of credit provides numerous benefits, including increased trust between buyers and sellers and reduced risk of non-payment. It also facilitates smoother international transactions, as it adheres to specific agreements which help overcome payment barriers. Overall, it bolsters your business's credibility and can lead to stronger relationships with suppliers.

-

Are there any costs associated with acquiring a standard letter of credit?

Yes, there are costs associated with obtaining a standard letter of credit, including bank fees for issuing and processing the letter. Additionally, charges may vary based on the bank's policies and the complexity of the transaction. It is advisable to discuss these costs upfront with your bank to ensure transparency.

-

Can I integrate airSlate SignNow with other financial software for managing standard letters of credit?

Absolutely! airSlate SignNow offers robust integrations with various financial software platforms. This allows businesses to seamlessly manage standard letters of credit and other financial documentation in one place, leading to increased efficiency and streamlined workflows.

-

What features does airSlate SignNow provide for standard letters of credit?

airSlate SignNow provides features such as customizable templates, advanced security options, and an intuitive eSignature process that enhances the management of standard letters of credit. Additionally, users can track the status of documents in real time, ensuring that all parties remain informed throughout the process.

-

How secure are the standard letters of credit processed through airSlate SignNow?

Security is a priority at airSlate SignNow. We utilize top-notch encryption and authentication measures to protect all standard letters of credit processed through our platform. This ensures that sensitive information remains confidential and secure, allowing businesses to focus on their transactions without worry.

Get more for Application For Documentary Presentation Under Export Letter Of Credit

- Assignment of lease package idaho form

- Lease purchase agreements package idaho form

- Satisfaction cancellation or release of mortgage package idaho form

- Premarital agreements package idaho form

- Painting contractor package idaho form

- Framing contractor package idaho form

- Foundation contractor package idaho form

- Plumbing contractor package idaho form

Find out other Application For Documentary Presentation Under Export Letter Of Credit

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple