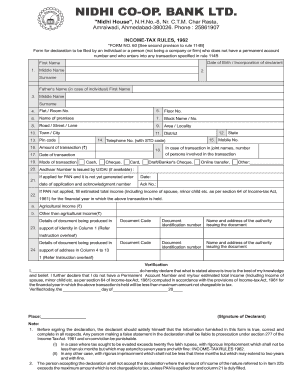

Income Tax Rules, 1962 FORM NO 60 Income Tax Department

What is Form No 60 under the Income Tax Rules, 1962?

Form No 60 is a declaration form used in India under the Income Tax Rules, 1962. It is primarily utilized by individuals who do not have a Permanent Account Number (PAN) but wish to engage in financial transactions that require PAN disclosure. This form serves as an alternative means for taxpayers to provide their identity and income details to the Income Tax Department. It is essential for ensuring compliance with tax regulations, especially for transactions involving significant sums of money.

Steps to Complete Form No 60

Completing Form No 60 involves several straightforward steps:

- Personal Information: Fill in your name, address, and contact details accurately.

- Transaction Details: Specify the nature of the transaction that necessitates the use of Form No 60.

- Declaration: Sign the form to declare that the information provided is true and correct.

- Submission: Submit the completed form to the relevant financial institution or entity requiring it.

Ensuring that all details are filled out correctly is crucial for compliance and to avoid any potential issues with the Income Tax Department.

Legal Use of Form No 60

Form No 60 is legally recognized by the Income Tax Department as a valid declaration for individuals without a PAN. It is important to understand that this form must be used in accordance with the Income Tax Act, 1961, and related regulations. When utilized correctly, it provides a legal framework for conducting transactions that would otherwise require a PAN, ensuring that individuals remain compliant with tax laws. Misuse of this form can lead to penalties or legal repercussions.

Required Documents for Form No 60

To successfully complete Form No 60, individuals must provide certain documents to support their identity and transaction details. Typically required documents include:

- Proof of identity (such as a passport, voter ID, or driver's license).

- Proof of address (such as utility bills or bank statements).

- Details of the financial transaction or investment.

Having these documents ready can facilitate a smoother completion and submission process.

Examples of Using Form No 60

Form No 60 is commonly used in various scenarios, including:

- Opening a bank account without a PAN.

- Investing in fixed deposits or mutual funds.

- Purchasing high-value items like property or vehicles.

These examples illustrate the form's utility in enabling individuals to engage in significant financial transactions while remaining compliant with tax regulations.

How to Obtain Form No 60

Form No 60 can be easily obtained through several channels:

- Download from the official Income Tax Department website.

- Request a physical copy from banks or financial institutions.

- Access through tax consultants or financial advisors.

Having access to this form is essential for individuals needing to declare their financial transactions without a PAN.

Quick guide on how to complete income tax rules 1962 form no 60 income tax department

Complete Income tax Rules, 1962 FORM NO 60 Income Tax Department effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Income tax Rules, 1962 FORM NO 60 Income Tax Department on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Income tax Rules, 1962 FORM NO 60 Income Tax Department with ease

- Obtain Income tax Rules, 1962 FORM NO 60 Income Tax Department and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it onto your PC.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Alter and eSign Income tax Rules, 1962 FORM NO 60 Income Tax Department and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax rules 1962 form no 60 income tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 60 and why is it important?

Form 60 is a declaration required by the Indian Income Tax Department for individuals who do not have a Permanent Account Number (PAN). It is essential for facilitating financial transactions and ensuring compliance with tax regulations, allowing businesses to operate smoothly in accordance with tax laws.

-

How can airSlate SignNow help with filling out Form 60?

airSlate SignNow streamlines the process of filling out Form 60 by providing an easy-to-use interface and templates for efficient document creation. Users can quickly input their information, ensuring accuracy and compliance, while also minimizing errors commonly associated with manual entry.

-

Is there a cost associated with using airSlate SignNow for Form 60?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing Form 60 submissions. Users can select a plan that fits their usage requirements and budget, providing flexibility as they scale their operations.

-

What features does airSlate SignNow provide for managing Form 60?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and real-time tracking for Form 60 submissions. These functionalities enhance the efficiency of document management and ensure that all parties can complete the process seamlessly.

-

Can I integrate airSlate SignNow with other software for Form 60 management?

Absolutely! airSlate SignNow offers integrations with popular SaaS applications, allowing users to connect their workflows and manage Form 60 alongside other business processes. This ensures a seamless flow of information and maximizes productivity across teams.

-

What are the benefits of using airSlate SignNow for Form 60?

Using airSlate SignNow for Form 60 provides numerous benefits, including saving time with automations, reducing paperwork, and enhancing security with eSignatures. This empowers businesses to focus on their core operations while ensuring compliance and efficient document handling.

-

Is airSlate SignNow secure for processing Form 60?

Yes, airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication measures to protect sensitive data in Form 60. Users can trust that their information is safeguarded throughout the entire document management process.

Get more for Income tax Rules, 1962 FORM NO 60 Income Tax Department

- Texas lease guarantor form

- Amendment rental agreement form

- Warning notice due to complaint from neighbors texas form

- Lease subordination agreement texas form

- Apartment rules and regulations texas form

- Tx cancellation form

- Texas original petition divorce form

- Amendment of residential lease texas form

Find out other Income tax Rules, 1962 FORM NO 60 Income Tax Department

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document