St Louis County Personal Property Declaration Form

What is the St Louis County Personal Property Declaration?

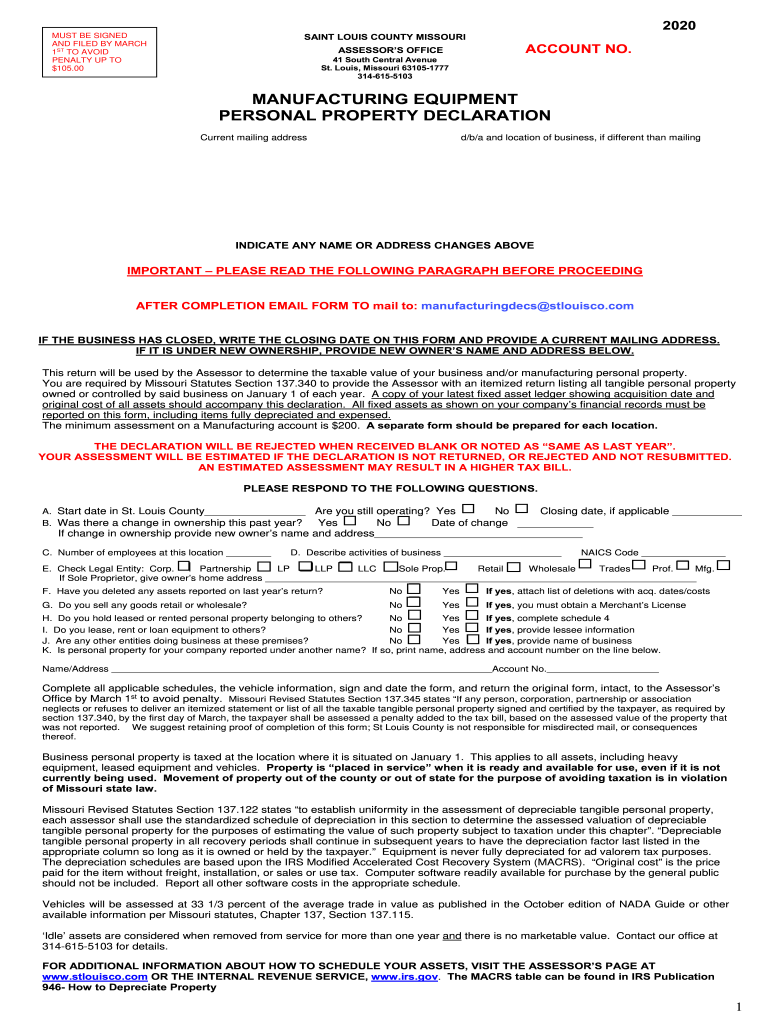

The St Louis County Personal Property Declaration is a formal document that residents must complete to report personal property owned within the county. This declaration is essential for assessing personal property taxes, which are levied on items such as vehicles, boats, and business equipment. By submitting this form, individuals ensure that their property is accurately accounted for in the county’s tax records, which ultimately affects the tax assessment and liability.

Steps to complete the St Louis County Personal Property Declaration

Completing the St Louis County Personal Property Declaration involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information about all personal property owned, including descriptions, values, and purchase dates.

- Access the declaration form, which can typically be found on the St Louis County website or obtained from local tax offices.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online, by mail, or in person.

Legal use of the St Louis County Personal Property Declaration

The legal use of the St Louis County Personal Property Declaration is crucial for maintaining compliance with local tax laws. This form must be filled out truthfully and submitted by the deadline to avoid penalties. The information provided on the declaration is used by the county to assess property taxes fairly. Failure to submit this declaration can result in fines or an estimated assessment based on incomplete information, which may lead to higher tax liabilities.

Required Documents

When completing the St Louis County Personal Property Declaration, certain documents may be required to support the information provided. These documents can include:

- Proof of ownership for each item declared, such as titles for vehicles or receipts for business equipment.

- Previous tax assessments, if available, to provide context for current valuations.

- Any relevant identification documents that may be requested by the county.

Filing Deadlines / Important Dates

Filing deadlines for the St Louis County Personal Property Declaration are critical to avoid penalties. Typically, the declaration must be submitted by a specific date each year, often in early April. It is important for residents to check the St Louis County tax office's announcements for any changes to deadlines or important dates related to the filing process.

Form Submission Methods (Online / Mail / In-Person)

The St Louis County Personal Property Declaration can be submitted through various methods to accommodate residents' preferences. Options include:

- Online submission through the St Louis County official website, which offers a convenient way to complete and send the form electronically.

- Mailing the completed form to the designated tax office address, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, where residents can receive assistance if needed.

Quick guide on how to complete st louis county personal property declaration

Effortlessly Prepare St Louis County Personal Property Declaration on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly without any holdups. Handle St Louis County Personal Property Declaration on any device with airSlate SignNow’s Android or iOS applications and enhance your document-centered workflows today.

How to Edit and eSign St Louis County Personal Property Declaration Effortlessly

- Find St Louis County Personal Property Declaration and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Verify all details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), sharing a link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require reprinting documents. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Edit and eSign St Louis County Personal Property Declaration to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st louis county personal property declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal property declaration form?

A personal property declaration form is a document used to declare ownership of personal assets for various purposes, including tax assessments and insurance claims. With airSlate SignNow, you can easily create, send, and eSign your personal property declaration form, ensuring a smooth and efficient process.

-

How does airSlate SignNow help with the personal property declaration form?

AirSlate SignNow provides a user-friendly platform for businesses to create and manage personal property declaration forms effortlessly. With intuitive features such as templates, eSignatures, and secure storage, you can streamline your document workflow and save valuable time.

-

What is the pricing structure for using airSlate SignNow for personal property declaration forms?

AirSlate SignNow offers flexible pricing plans to fit your business needs while processing personal property declaration forms. You can choose from monthly or yearly subscription options, which come with various features to help you manage documents efficiently at an affordable cost.

-

Can I integrate airSlate SignNow with other software for personal property declaration forms?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, enhancing your ability to manage personal property declaration forms. This connectivity allows for easy data transfer between systems, reducing manual entry and improving overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for personal property declaration forms?

Using airSlate SignNow for personal property declaration forms provides several benefits, including increased efficiency, better document security, and cost savings. With features like real-time tracking and automated reminders, you can ensure that all necessary signatures are obtained promptly.

-

Is the personal property declaration form customizable in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your personal property declaration form to meet your specific needs. You can add fields, change layouts, and include your branding, ensuring that the form aligns with your company's image and requirements.

-

How secure is airSlate SignNow when handling personal property declaration forms?

AirSlate SignNow prioritizes security for all documents, including personal property declaration forms. With encryption, secure cloud storage, and compliant eSignature standards, you can trust that your sensitive information is protected against unauthorized access.

Get more for St Louis County Personal Property Declaration

- Bill sale art form

- Bylaws template form

- Personal injury waiver release hold harmless and indemnity agreement for babysitting services offered by nonprofit organization 497328365 form

- Agreement personal injury form

- Boat agreement form

- Hauling contract form

- Sale purchase estate contract form

- Service agreement provider form

Find out other St Louis County Personal Property Declaration

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself