Form Ptax 1002 21

What is the Form Ptax 1002 21

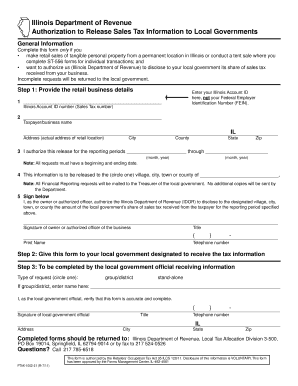

The Form Ptax 1002 21 is a specific document used primarily for tax purposes in the United States. It is essential for individuals and businesses to accurately report certain financial information to the relevant tax authorities. This form typically serves as a means to declare property taxes or other related financial obligations. Understanding its purpose is crucial for ensuring compliance with state and federal tax regulations.

How to use the Form Ptax 1002 21

Using the Form Ptax 1002 21 involves several key steps. First, gather all necessary financial documentation, including previous tax returns and property assessment information. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors. Finally, submit the form according to the guidelines provided by your local tax authority, whether online, by mail, or in person.

Steps to complete the Form Ptax 1002 21

Completing the Form Ptax 1002 21 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents related to your property or business.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide details about the property or financial situation being reported.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form through the appropriate channels as specified by your local tax authority.

Legal use of the Form Ptax 1002 21

The legal use of the Form Ptax 1002 21 is governed by various tax laws and regulations. When filled out correctly, it serves as a legally binding document that can impact your tax obligations. It is important to ensure that all information provided is truthful and accurate, as discrepancies may lead to penalties or legal issues. Additionally, the form must be submitted within the deadlines set by the tax authority to avoid any potential fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ptax 1002 21 can vary depending on your location and the specific tax year. Generally, it is advisable to check with your local tax authority for the most accurate and up-to-date information regarding submission dates. Missing these deadlines can result in penalties, so staying informed is crucial for compliance.

Who Issues the Form

The Form Ptax 1002 21 is typically issued by state or local tax authorities. These agencies are responsible for providing the necessary forms and guidelines for taxpayers to report their financial information accurately. It is essential to obtain the form directly from the official source to ensure that you are using the most current version and following the correct procedures.

Quick guide on how to complete form ptax 1002 21

Effortlessly Prepare Form Ptax 1002 21 on Any Device

Digital document management has gained traction amongst businesses and individuals. It offers an ideal sustainable substitute to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools required to formulate, revise, and electronically sign your documents promptly without delays. Manage Form Ptax 1002 21 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

Ways to modify and eSign Form Ptax 1002 21 effortlessly

- Obtain Form Ptax 1002 21 and click on Get Form to commence.

- Utilize the tools we provide to finish your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Modify and eSign Form Ptax 1002 21 and ensure excellent communication at any phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ptax 1002 21

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ptax 1002 21?

Form ptax 1002 21 is a property tax exemption application used in certain jurisdictions. Businesses often need to submit this form to secure tax benefits. airSlate SignNow helps streamline this process by providing a secure and efficient way to eSign and submit your form ptax 1002 21.

-

How does airSlate SignNow simplify the process of handling form ptax 1002 21?

With airSlate SignNow, you can easily upload, modify, and eSign form ptax 1002 21 digitally. This eliminates the need for printing, scanning, or mailing, thus saving time and reducing errors. The platform also keeps your documents organized for easy access and reference.

-

What are the pricing options for using airSlate SignNow for form ptax 1002 21?

airSlate SignNow offers flexible pricing plans tailored to different needs, making it affordable for businesses of all sizes. Whether you are an individual or part of a larger organization, you'll find a plan that suits your budget while helping you manage form ptax 1002 21 efficiently.

-

Can I integrate airSlate SignNow with other software to manage form ptax 1002 21?

Yes, airSlate SignNow integrates with a variety of third-party applications to enhance workflow management for form ptax 1002 21. Popular integrations include CRM systems, cloud storage services, and project management tools. This allows you to keep your processes seamless and efficient.

-

What features does airSlate SignNow offer for managing form ptax 1002 21?

airSlate SignNow provides a range of features such as eSigning, document templates, and secure storage specifically for form ptax 1002 21. You can also track the status of your documents in real-time, ensuring you never lose sight of an important submission. These tools enhance accuracy and efficiency.

-

Is airSlate SignNow secure for submitting form ptax 1002 21?

Absolutely! airSlate SignNow uses bank-level encryption to protect your documents, including form ptax 1002 21. You can trust that your sensitive information is safe and secure throughout the signing and submission process.

-

What benefits can I expect by using airSlate SignNow for form ptax 1002 21?

Using airSlate SignNow for form ptax 1002 21 offers numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. You can focus more on your core business activities while ensuring that your tax exemption documents are handled smoothly.

Get more for Form Ptax 1002 21

- Paternity father form

- Consent child form

- With license form

- Liability injuries form

- Sale condominium unit form

- Instruction to jury regarding effect of conversion of part of chattel form

- Covenant agreement form

- Instruction to jury that refusal to deliver goods after demand and tender of freight and storage charges can constitute form

Find out other Form Ptax 1002 21

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile