Cuny W2 Form

What is the CUNY W2 Form

The CUNY W2 form is a tax document issued by the City University of New York (CUNY) that reports an employee's annual wages and the taxes withheld from their paychecks. This form is essential for employees to accurately file their income taxes with the Internal Revenue Service (IRS). It provides a summary of earnings and tax deductions for the year, allowing individuals to determine their tax liability or refund eligibility.

How to obtain the CUNY W2 Form

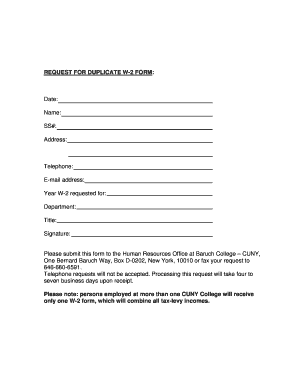

To obtain the CUNY W2 form, employees can access it through the CUNY payroll portal. Typically, the form is made available online by the end of January each year. Employees should log into their accounts, navigate to the tax documents section, and download the W2 form directly. In cases where employees cannot access the online portal, they may contact their human resources department for assistance in obtaining a physical copy.

Steps to complete the CUNY W2 Form

Completing the CUNY W2 form involves several straightforward steps:

- Review the personal information on the form to ensure accuracy, including your name, address, and Social Security number.

- Verify the reported wages and tax withholdings against your pay stubs for consistency.

- Use the information provided on the W2 form to fill out your federal and state tax returns accurately.

- Keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Legal use of the CUNY W2 Form

The CUNY W2 form is legally binding and must be completed accurately to comply with federal and state tax laws. It serves as an official record of income and taxes paid, which the IRS requires for tax filings. Failure to provide accurate information on the W2 form can result in penalties or audits. It is important to ensure that all details are correct and that the form is submitted by the appropriate deadlines to avoid any legal issues.

Key elements of the CUNY W2 Form

The CUNY W2 form includes several key elements that are crucial for tax reporting:

- Employee Information: This section contains the employee's name, address, and Social Security number.

- Employer Information: Details about CUNY, including the employer identification number (EIN).

- Wages and Tips: Total wages earned during the year, including tips and other compensation.

- Taxes Withheld: Amounts withheld for federal, state, and local taxes.

- Other Information: Any additional information relevant to the employee's tax situation, such as retirement plan contributions.

Filing Deadlines / Important Dates

Filing deadlines for the CUNY W2 form align with federal tax deadlines. Employees should receive their W2 forms by January 31 of the year following the tax year. The deadline for filing federal tax returns is typically April 15. It is essential to keep these dates in mind to ensure timely filing and avoid penalties.

Quick guide on how to complete cuny w2 form

Complete Cuny W2 Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Cuny W2 Form on any system with airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

The easiest method to modify and electronically sign Cuny W2 Form without stress

- Find Cuny W2 Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document hunting, or errors requiring new copies to be printed. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Modify and electronically sign Cuny W2 Form and ensure excellent communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cuny w2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CUNY W2 and why is it important?

A CUNY W2 is a tax form used by employees of the City University of New York (CUNY) to report their annual earnings and tax withholdings. It's important for filing your taxes correctly and ensuring compliance with federal regulations. Understanding your CUNY W2 helps you manage your finances effectively.

-

How can airSlate SignNow streamline the CUNY W2 signing process?

airSlate SignNow offers a user-friendly platform to electronically sign your CUNY W2 forms quickly and securely. With features like templates and bulk sending, you can efficiently manage and sign multiple documents, saving time and reducing the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for CUNY W2 forms?

Yes, airSlate SignNow provides several pricing plans that cater to different needs, starting with a free trial for new users. This allows you to explore the features for handling CUNY W2 forms before committing to a paid plan, ensuring you select the best option for your business.

-

What features does airSlate SignNow offer specifically for managing CUNY W2 forms?

airSlate SignNow offers features such as document templates, customizable workflows, and in-app collaboration, which signNowly enhance the management of CUNY W2 forms. These features make it easier to collect signatures and keep track of completion status in real-time.

-

Can airSlate SignNow integrate with other platforms for handling CUNY W2 documents?

Yes, airSlate SignNow integrates seamlessly with popular platforms such as Google Drive, Dropbox, and various CRM systems, making it easy to manage your CUNY W2 documents alongside other business operations. This integration capability ensures a smooth workflow across different applications.

-

What benefits can I expect when using airSlate SignNow for CUNY W2 forms?

By using airSlate SignNow for your CUNY W2 forms, you can expect increased efficiency and reduced turnaround times. The platform ensures secure handling of your documents while providing an easy way to track and manage signatures, enhancing overall productivity.

-

How secure is airSlate SignNow when handling CUNY W2s?

airSlate SignNow employs advanced security protocols, including encryption and secure document storage, ensuring that your CUNY W2 forms and sensitive information are protected. You can trust that your data remains confidential and complies with industry standards.

Get more for Cuny W2 Form

Find out other Cuny W2 Form

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe