1099 S Form Site pdfFiller Com

Understanding the IRS 1099 S Form

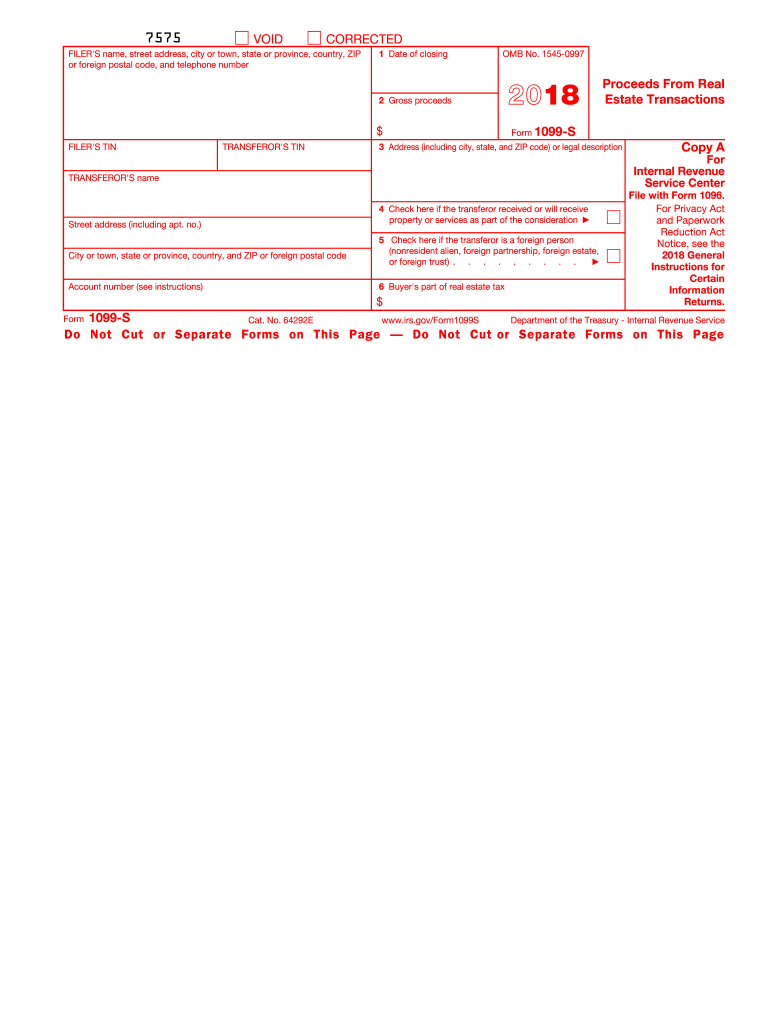

The IRS 1099 S form is used to report proceeds from real estate transactions. This form is essential for sellers who have sold real estate and need to report the sale to the Internal Revenue Service. The information provided on the form helps determine any capital gains tax owed on the sale. It is important for both the seller and the buyer to understand the implications of this form, as it affects tax obligations and compliance with federal regulations.

Steps to Complete the IRS 1099 S Form

Completing the IRS 1099 S form involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number (TIN).

- Collect details about the property sold, including the address and the date of sale.

- Determine the gross proceeds from the sale, which should be reported on the form.

- Complete the form accurately, ensuring all fields are filled in correctly.

- Provide copies of the completed form to the seller and the IRS by the required deadline.

IRS Guidelines for the 1099 S Form

The IRS provides specific guidelines for completing and submitting the 1099 S form. These guidelines include:

- Filing deadlines, which typically fall on January thirty-first of the year following the transaction.

- Requirements for electronic filing if there are more than two forms being submitted.

- Instructions for correcting any errors on the form after submission.

Who Issues the IRS 1099 S Form

The 1099 S form is typically issued by the settlement agent or the person responsible for closing the real estate transaction. This may include title companies, attorneys, or real estate brokers. It is their responsibility to ensure that the form is completed accurately and submitted to the IRS and the seller in a timely manner.

Penalties for Non-Compliance with the 1099 S Form

Failure to file the IRS 1099 S form or filing it inaccurately can result in penalties. The IRS imposes fines for late filings, which can increase based on how late the form is submitted. Additionally, if a taxpayer fails to report income from a real estate transaction, they may face further tax liabilities and interest on unpaid taxes. It is crucial to comply with all requirements to avoid these penalties.

Digital vs. Paper Version of the IRS 1099 S Form

Both digital and paper versions of the IRS 1099 S form are acceptable for submission. The digital version allows for easier completion and filing, often integrating with tax software for streamlined processing. However, some individuals may prefer the traditional paper form for record-keeping purposes. Regardless of the format chosen, it is essential to ensure that the information is accurate and submitted by the deadline.

Quick guide on how to complete 2018 form 1099 s proceeds from real estate transactions irs

Effortlessly Prepare 1099 S Form Site Pdffiller Com on Any Device

The management of documents online has gained traction among both organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 1099 S Form Site Pdffiller Com on any system with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Edit and eSign 1099 S Form Site Pdffiller Com with Ease

- Acquire 1099 S Form Site Pdffiller Com and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1099 S Form Site Pdffiller Com to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I report Form 1099-B (Proceeds from real estate transactions) in personal income tax return?

A2A.Proceeds from real estate transactions are typically reported on Form 1099-S. Form 1099-B is typically used to report sales made by a broker, normally stock sales. I'm not sure why you would be getting a 1099-B for a real estate transaction, so I assume you meant 1099-S. How you report it depends on the type of property you sold.If you sold a personal-use property, you use Part II of IRS Form 8949, Sales and Other Dispositions of Capital Assets to compute the gain or loss. If this is your personal home and you qualify for the capital gains exclusion, you incorporate that on Form 8949. You then carry the information to Schedule D (Form 1040), Capital Gains and Losses. You cannot deduct a loss on the sale of a personal-use property.If you sold a property other than a personal-use property, you use IRS Form 4797, Sales of Business Property to report the sale. If you did not use the property in a trade or business but were holding it for investment, the portion of the gain that represents recapture of depreciation is reported as ordinary income, and any remaining gain is carried to Form 8949 and Schedule D and reported as capital gain. If you used the property in a trade or business, you still report depreciation recapture as ordinary income, and any remaining gain from the sale is treated as section 1231 gain. See IRS Publication 544 (2015), Sales and Other Dispositions of Assets for a full description of how to treat section 1231 gain.

-

Why doesn’t a 1099-S need to be issued to corporations? How does the corporation report the proceeds of the real estate transaction and what check exists to ensure that the corporation actually reports such proceeds?

Due to the high level of administrative reporting for corporations, the IRS exempts corporations from needing to receive a Form 1099-MISC at the close of escrow. It is the responsibility of the corporation to disclose all their sells and purchases when they are filing their taxes with their CPA. There is really no cross reference and it would be really hard for the IRS to track down every sale that is done unless they did an audit of the corporation.

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 1099 s proceeds from real estate transactions irs

How to generate an electronic signature for the 2018 Form 1099 S Proceeds From Real Estate Transactions Irs online

How to make an eSignature for your 2018 Form 1099 S Proceeds From Real Estate Transactions Irs in Chrome

How to generate an electronic signature for putting it on the 2018 Form 1099 S Proceeds From Real Estate Transactions Irs in Gmail

How to create an eSignature for the 2018 Form 1099 S Proceeds From Real Estate Transactions Irs straight from your smart phone

How to generate an eSignature for the 2018 Form 1099 S Proceeds From Real Estate Transactions Irs on iOS

How to make an electronic signature for the 2018 Form 1099 S Proceeds From Real Estate Transactions Irs on Android OS

People also ask

-

What is the IRS 1099 S form 2018?

The IRS 1099 S form 2018 is a tax form used to report the sale or exchange of real estate. It is essential for individuals and businesses who need to report these transactions accurately to the IRS. Completing this form helps ensure you meet your tax obligations and avoid potential penalties.

-

How can airSlate SignNow simplify the submission of the IRS 1099 S form 2018?

airSlate SignNow offers an intuitive platform for businesses to easily prepare, send, and eSign the IRS 1099 S form 2018. With efficient document workflows, you can quickly collect signatures and finalize your financial documents, thereby reducing the chances of errors. This streamlined process helps you maintain compliance and stay organized.

-

What are the pricing options for airSlate SignNow's eSigning services for IRS forms?

airSlate SignNow provides flexible pricing plans that cater to various needs, including packages suitable for individuals and businesses needing to process the IRS 1099 S form 2018. You can choose a plan that fits your budget while benefiting from features such as unlimited eSigning and document storage. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing IRS 1099 S form 2018?

airSlate SignNow includes features like customizable templates, automated workflows, and secure storage, all of which enhance your ability to manage the IRS 1099 S form 2018. These tools allow you to personalize your documents, track their status, and ensure they are eSigned in a timely manner. Staying organized has never been easier.

-

Can I integrate airSlate SignNow with other software for my IRS reporting needs?

Yes, airSlate SignNow integrates with various software solutions such as accounting and financial management tools that can assist in preparing the IRS 1099 S form 2018. This seamless integration allows you to consolidate your operations and improve efficiency. Make sure to explore our integration options to maximize your workflow.

-

How does airSlate SignNow ensure the security of my IRS 1099 S form 2018 documents?

airSlate SignNow prioritizes the security of your documents, including the IRS 1099 S form 2018, by employing industry-standard encryption and compliance measures. Our platform is designed to protect sensitive information, ensuring your data remains confidential and secure. You can sign documents with peace of mind.

-

What benefits does eSigning the IRS 1099 S form 2018 with airSlate SignNow provide?

Using airSlate SignNow for eSigning the IRS 1099 S form 2018 offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced accuracy. By digitizing the process, you can eliminate the hassles of printing and mailing documents, which saves you time and resources. Improve your efficiency with our eSigning solutions.

Get more for 1099 S Form Site Pdffiller Com

- Kvittens form

- Corrective action report form

- Confidential youth emergency card san bernardino valley college form

- Humira enrollment form pdf

- Universal medication form you can help make your health care safer by keeping this list

- Fillable st 236 form

- Sepa lastschriftmandat finanzamt rheinland pfalz form

- The camille natale awards nomination doc template form

Find out other 1099 S Form Site Pdffiller Com

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free