Form 941

What is the Form 941

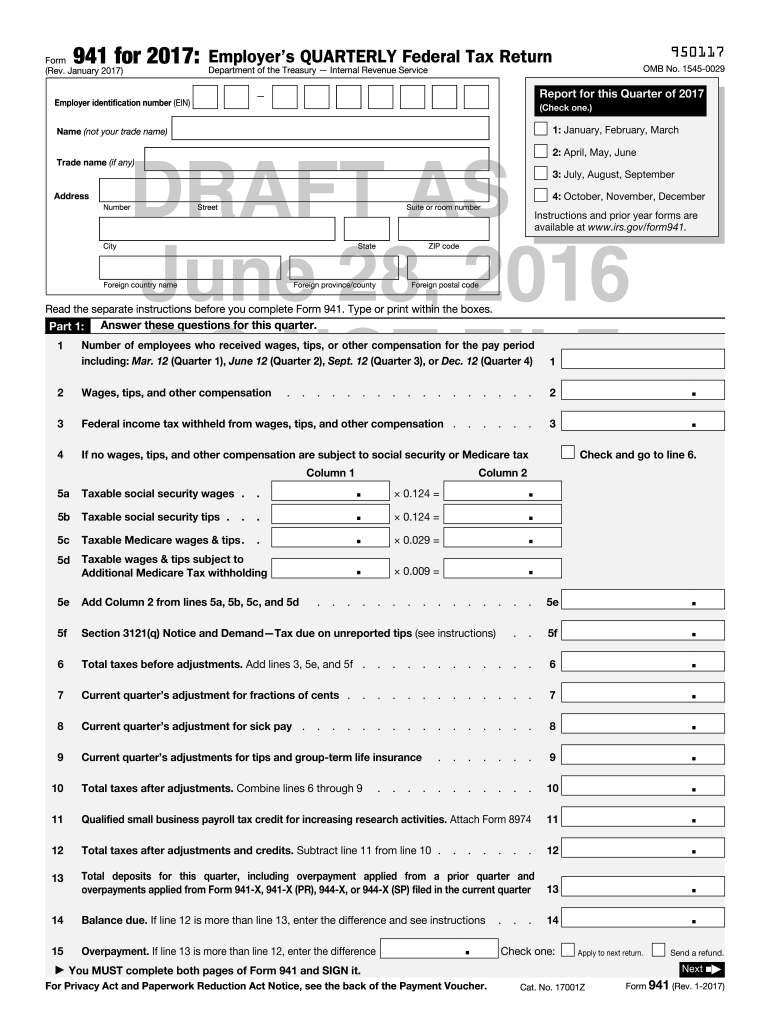

The federal tax form 941, also known as the Employers Quarterly Federal Tax Return, is a crucial document for businesses in the United States. It is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers must file this form quarterly to ensure compliance with federal tax regulations. The 941 form provides the IRS with essential information about payroll taxes and helps in tracking the amounts owed and paid by employers.

How to use the Form 941

Using the federal tax form 941 involves several key steps. First, employers must gather all necessary payroll information for the quarter, including total wages paid, tips reported, and the amount of taxes withheld. Next, employers fill out the form accurately, ensuring that all sections are completed, including the employer's identification information and the total tax liability. After completing the form, employers can file it electronically or by mail, depending on their preference and compliance requirements.

Steps to complete the Form 941

Completing the federal tax form 941 requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the quarter, including employee wages and withheld taxes.

- Fill in the employer identification information at the top of the form.

- Report total wages, tips, and other compensation in the appropriate sections.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Complete the signature section, certifying the accuracy of the information provided.

- Submit the form by the due date, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the federal tax form 941 are critical for compliance. Employers must submit the form for each quarter by the following deadlines:

- First quarter (January to March): Due by April 30.

- Second quarter (April to June): Due by July 31.

- Third quarter (July to September): Due by October 31.

- Fourth quarter (October to December): Due by January 31 of the following year.

Penalties for Non-Compliance

Failure to file the federal tax form 941 on time can result in significant penalties. The IRS imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if the form is not filed at all, the penalties can increase. Employers should ensure timely filing to avoid these financial repercussions and maintain compliance with federal tax laws.

Digital vs. Paper Version

Employers have the option to file the federal tax form 941 either digitally or using a paper version. Filing electronically offers several advantages, including faster processing times and immediate confirmation of submission. The digital version also reduces the risk of errors associated with manual entry. Conversely, some employers may prefer the paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete form 941 rev january 2016 employers quarterly federal tax return irs

Complete Form 941 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Form 941 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 941 without effort

- Locate Form 941 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and select the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and eSign Form 941 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How much would an accountant charge me for filling out a Quarterly Federal Tax Return (941) in Texas?

For full service payroll I charge $100 per month for up to 5 employees. That includes filing the federal and state quarterly returns and year end W2's.If you just need the 941 completed and you have all of your payroll records in order, then the fee would be $50 to prepare the form for you. Note that you also need to file a quarterly return with TWC if you have Texas employees.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev january 2016 employers quarterly federal tax return irs

How to create an eSignature for the Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs in the online mode

How to generate an electronic signature for your Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs in Chrome

How to create an electronic signature for putting it on the Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs in Gmail

How to make an eSignature for the Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs right from your mobile device

How to generate an eSignature for the Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs on iOS

How to generate an eSignature for the Form 941 Rev January 2016 Employers Quarterly Federal Tax Return Irs on Android devices

People also ask

-

What is the federal tax form 941?

The federal tax form 941 is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It helps businesses stay compliant with tax responsibilities. Understanding this form is crucial for accurate payroll processing and tax planning.

-

How can airSlate SignNow help with filing the federal tax form 941?

AirSlate SignNow simplifies the process of completing and signing the federal tax form 941. With our platform, users can easily fill out the form electronically, ensuring that all necessary fields are completed accurately. Plus, our eSigning feature allows for quick approval, speeding up your filing process.

-

Is there a cost associated with using airSlate SignNow for the federal tax form 941?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when managing federal tax form 941 and other documents. Our pricing is competitive, making it a cost-effective solution for businesses looking to streamline their document management. You can choose a plan that suits your volume of eSigning and document handling.

-

What features does airSlate SignNow offer for managing the federal tax form 941?

AirSlate SignNow provides an array of features for managing the federal tax form 941, including customizable templates, automatic reminders, and secure cloud storage. These features ensure that your forms are easily accessible and can be filled out efficiently. Additionally, you can track the progress of your submissions in real-time.

-

Can I integrate airSlate SignNow with accounting software for federal tax form 941?

Yes, airSlate SignNow seamlessly integrates with various accounting software to streamline your processes when dealing with the federal tax form 941. This integration simplifies data transfer and reduces the risk of errors, ensuring accurate tax reporting. It enhances productivity by allowing you to manage everything in one place.

-

Is airSlate SignNow secure for handling sensitive federal tax form 941 documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the federal tax form 941. Our platform employs advanced encryption and security protocols to protect sensitive data. You can confidently manage your tax documents knowing they are safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the federal tax form 941 over traditional methods?

Using airSlate SignNow for the federal tax form 941 offers numerous benefits over traditional methods, such as reduced paper usage, faster processing times, and enhanced collaboration. Our digital solution minimizes the risk of lost or misplaced documents and allows for easy sharing and signature collection. This efficiency leads to better compliance and reduced stress during tax season.

Get more for Form 941

- Florida family law financial affidavit long form

- Seasonal influenza vaccine consent form thehealthline ca

- Sf401adm form

- Ira403b beneficiary distribution form putnam investments

- Cobb county school district speech language program form

- Providence request record set form

- Widexpro form

- Child support letter from father sample form

Find out other Form 941

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors