Rmft 11 a Form

What is the Rmft 11 A Form

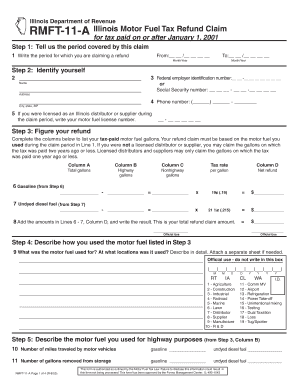

The Rmft 11 A form is a specific document used in various administrative and legal contexts within the United States. It serves as a formal request or declaration that may be required by governmental agencies or organizations. Understanding the purpose and requirements of this form is essential for compliance and effective communication with the relevant authorities.

How to use the Rmft 11 A Form

Using the Rmft 11 A form involves several key steps to ensure that it is completed accurately and submitted correctly. Begin by gathering all necessary information that pertains to the form's requirements. Carefully fill out each section, ensuring clarity and accuracy. Once completed, review the form for any errors before submission. Depending on the specific requirements, the form may need to be submitted online, via mail, or in person.

Steps to complete the Rmft 11 A Form

Completing the Rmft 11 A form requires careful attention to detail. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documents and information needed to fill out the form.

- Fill in the form clearly, ensuring that all fields are completed as required.

- Double-check the information for accuracy and completeness.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Rmft 11 A Form

The legal use of the Rmft 11 A form is governed by specific regulations and guidelines. It is crucial to ensure that the form is filled out in compliance with applicable laws to avoid any legal repercussions. This includes understanding the context in which the form is used and ensuring that all information provided is truthful and accurate.

Required Documents

When completing the Rmft 11 A form, certain documents may be required to support the information provided. Commonly required documents include identification, proof of residency, and any relevant financial records. It is important to check the specific requirements associated with the form to ensure that all necessary documentation is included with the submission.

Form Submission Methods

The Rmft 11 A form can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate agency.

- In-person delivery at specified locations.

Who Issues the Form

The Rmft 11 A form is issued by specific governmental agencies or organizations that require this documentation for their processes. Identifying the issuing authority is crucial, as it ensures that the form is used correctly and that all guidelines are followed. This information can usually be found on the form itself or through official agency websites.

Quick guide on how to complete rmft 11 a form

Effortlessly Prepare Rmft 11 A Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage Rmft 11 A Form on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-oriented process today.

The Easiest Way to Edit and Electronically Sign Rmft 11 A Form

- Find Rmft 11 A Form and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to apply your changes.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Rmft 11 A Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rmft 11 a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rmft 11 a and how does it relate to airSlate SignNow?

rmft 11 a refers to specific requirements for electronic signatures and document management in certain jurisdictions. airSlate SignNow provides functionalities that comply with rmft 11 a, ensuring that your electronic documents are legally binding and secure.

-

How much does airSlate SignNow cost in relation to rmft 11 a compliance?

Pricing for airSlate SignNow is competitive and varies depending on the features you need. Even with rmft 11 a compliance, our plans remain cost-effective, allowing businesses to benefit from seamless eSigning while staying within budget.

-

What features does airSlate SignNow offer to meet rmft 11 a standards?

airSlate SignNow includes features such as customizable templates, audit trails, and secure storage, all designed with rmft 11 a compliance in mind. These features help streamline the eSigning process while ensuring legality and integrity of your documentation.

-

How can airSlate SignNow benefit my business in terms of rmft 11 a compliance?

By utilizing airSlate SignNow, businesses can meet rmft 11 a compliance requirements seamlessly, thereby enhancing legal security. This not only boosts client trust but also expedites the document management process, leading to improved overall efficiency.

-

Is airSlate SignNow easy to integrate with existing software for rmft 11 a?

Yes, airSlate SignNow offers easy integrations with popular software applications, making it convenient to incorporate eSigning within your existing workflow. This flexibility ensures that you can meet rmft 11 a requirements without disrupting your current systems.

-

Can I use airSlate SignNow for international transactions under rmft 11 a?

Absolutely! airSlate SignNow is designed to support international transactions while adhering to rmft 11 a compliance, ensuring your documents are valid across borders. This capability provides global businesses with a reliable solution for their eSigning needs.

-

What type of customer support does airSlate SignNow provide concerning rmft 11 a?

airSlate SignNow offers extensive customer support to assist with any rmft 11 a-related queries. Our dedicated team is available via chat, email, or phone, ensuring you have the guidance needed to navigate compliance issues with confidence.

Get more for Rmft 11 A Form

Find out other Rmft 11 A Form

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now