Abm W2 Form

What is the ABM W-2?

The ABM W-2 form is a crucial document used by employers to report wages paid to employees and the taxes withheld from those wages. This form is essential for employees when filing their income tax returns, as it provides a summary of their earnings and tax contributions for the year. The ABM W-2 is specifically associated with ABM Industries, a company that provides facility services across various sectors. Understanding the details of this form is vital for accurate tax reporting and compliance with IRS regulations.

How to Obtain the ABM W-2

To obtain your ABM W-2, you typically need to follow these steps:

- Check your email for any electronic versions sent by ABM Industries, as many employers now provide W-2 forms digitally.

- Log into the ABM Doculivery portal, where you can access your pay stubs and W-2 forms securely.

- If you do not have access to the online portal, contact your HR department or payroll administrator to request a physical copy of your W-2.

It is important to ensure that your contact information is up to date with your employer to receive your W-2 promptly.

Steps to Complete the ABM W-2

Completing the ABM W-2 involves several steps to ensure accuracy:

- Gather all necessary information, including your Social Security number, earnings, and tax withheld for the year.

- Fill in your personal details accurately in the designated fields on the form.

- Review the amounts reported for wages and taxes to ensure they match your pay stubs.

- Sign and date the form if required, or follow the electronic submission process if filing online.

Double-checking your entries can help prevent errors that may lead to complications with your tax filing.

Legal Use of the ABM W-2

The ABM W-2 is legally binding and must be completed accurately to comply with IRS regulations. Employers are required to issue W-2 forms to employees by January thirty-first of each year. This form serves as a record of income and taxes withheld, which is necessary for employees when filing their annual tax returns. Failure to provide accurate information on the W-2 can result in penalties for both the employer and the employee.

Filing Deadlines / Important Dates

Understanding the key deadlines related to the ABM W-2 is essential for timely tax filing:

- Employers must provide W-2 forms to employees by January thirty-first each year.

- Employees should file their tax returns by April fifteenth to avoid penalties.

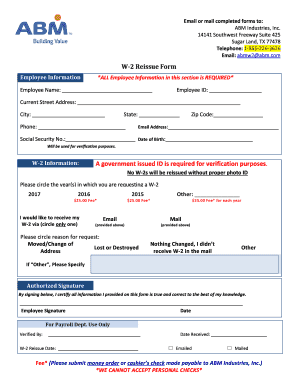

- If you need to request a reissue of your W-2, do so as soon as possible to ensure you meet the filing deadline.

Staying aware of these dates helps ensure compliance and avoids unnecessary complications during tax season.

Who Issues the Form

The ABM W-2 form is issued by ABM Industries, which is responsible for compiling and distributing these forms to its employees. The payroll department at ABM manages the preparation of W-2s, ensuring that all earnings and tax information are accurately reported. Employees should reach out to their HR or payroll department if they have questions about their W-2 or if they need assistance accessing it.

Quick guide on how to complete abm w2 101935670

Prepare Abm W2 effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Abm W2 on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Abm W2 with ease

- Find Abm W2 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Abm W2 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the abm w2 101935670

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ABM W2 form and how can airSlate SignNow help?

The ABM W2 form is a critical document used for reporting wages and taxes for employees. With airSlate SignNow, businesses can streamline the process of sending, signing, and managing ABM W2 forms electronically, making it faster and more secure.

-

How does airSlate SignNow ensure the security of my ABM W2 documents?

Security is paramount when handling sensitive documents like the ABM W2. airSlate SignNow employs bank-grade encryption, two-factor authentication, and secure data storage to ensure that your ABM W2 forms are safe from unauthorized access.

-

What pricing plans does airSlate SignNow offer for managing ABM W2 forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses, including those that frequently handle ABM W2 forms. You can choose from monthly or annual subscriptions, with options for small businesses and large enterprises alike.

-

Can I integrate airSlate SignNow with other software for handling ABM W2 forms?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools, such as CRM systems and HR platforms, to facilitate the processing of ABM W2 forms. This integration helps streamline workflows and enhances productivity across your organization.

-

What features does airSlate SignNow offer for processing ABM W2 documents?

airSlate SignNow provides essential features for processing ABM W2 documents, including customizable templates, automated workflows, and detailed tracking of document status. These features help ensure a smooth and efficient signing process for all parties involved.

-

How can airSlate SignNow improve the efficiency of sending ABM W2 forms?

By allowing businesses to send ABM W2 forms electronically, airSlate SignNow reduces the time and resources typically spent on printing and mailing documents. This efficiency translates into faster turnaround times for employees receiving their tax documents.

-

Is it easy to switch to airSlate SignNow for managing ABM W2 forms?

Absolutely! Transitioning to airSlate SignNow for managing your ABM W2 forms is simple and user-friendly. With step-by-step guidance, you can quickly set up your account and start using the platform with minimal disruption to your workflow.

Get more for Abm W2

- Power of attorney for sale of motor vehicle utah form

- Wedding planning or consultant package utah form

- Hunting forms package utah

- Identity theft recovery package utah form

- Statutory declaration for mental health treatment utah form

- Aging parent package utah form

- Utah declaration form

- Sale of a business package utah form

Find out other Abm W2

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile