Ghana Revenue Authority Form

What is the Ghana Revenue Authority Form

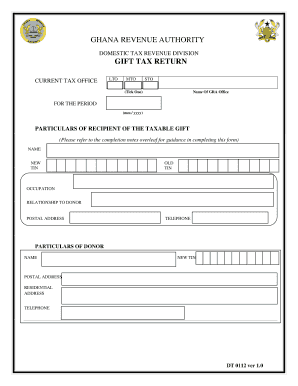

The Ghana Revenue Authority form is a crucial document used for various tax-related purposes within Ghana. It serves as an official means for individuals and businesses to report income, claim deductions, and fulfill their tax obligations. This form is essential for ensuring compliance with local tax laws and regulations. Understanding its purpose and requirements is vital for anyone engaging in financial activities that fall under the jurisdiction of the Ghana Revenue Authority.

How to use the Ghana Revenue Authority Form

Using the Ghana Revenue Authority form involves several steps to ensure accurate completion and submission. First, identify the specific form required based on your tax situation. Next, gather all necessary documentation, such as income statements and receipts for deductions. Complete the form by providing accurate information, ensuring that all fields are filled out correctly. After completing the form, review it for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the guidelines provided by the Ghana Revenue Authority.

Steps to complete the Ghana Revenue Authority Form

Completing the Ghana Revenue Authority form effectively requires careful attention to detail. Follow these steps:

- Identify the correct form type based on your tax needs.

- Collect all necessary documents, including proof of income and any applicable deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your entries for accuracy and completeness.

- Submit the form through the designated method, ensuring you meet any deadlines.

Legal use of the Ghana Revenue Authority Form

The legal use of the Ghana Revenue Authority form is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed accurately and submitted according to the established guidelines. Additionally, electronic submissions may require compliance with eSignature laws to ensure authenticity. It is essential to maintain records of submitted forms and any correspondence with the Ghana Revenue Authority to safeguard against potential disputes.

Required Documents

To complete the Ghana Revenue Authority form, several documents may be required. These typically include:

- Income statements, such as pay stubs or tax returns.

- Receipts for any deductions or credits being claimed.

- Identification documents to verify your identity.

- Any additional forms that may be relevant to your specific tax situation.

Form Submission Methods

The Ghana Revenue Authority form can be submitted through various methods, accommodating different preferences and needs. Common submission methods include:

- Online submission through the Ghana Revenue Authority's official website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices or authorized centers.

Quick guide on how to complete ghana revenue authority form

Complete Ghana Revenue Authority Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, edit, and electronically sign your documents promptly without interruptions. Manage Ghana Revenue Authority Form on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The most efficient method to edit and electronically sign Ghana Revenue Authority Form with ease

- Obtain Ghana Revenue Authority Form and select Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device you choose. Edit and electronically sign Ghana Revenue Authority Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ghana revenue authority form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ghana Revenue Authority form used for?

The Ghana Revenue Authority form is utilized for various tax-related submissions and documentation in compliance with Ghanaian tax regulations. Businesses often need to fill out these forms to report income, apply for tax relief, or fulfill other tax obligations.

-

How can airSlate SignNow help with the Ghana Revenue Authority form?

airSlate SignNow streamlines the process of completing the Ghana Revenue Authority form by enabling users to fill, sign, and send documents electronically. This saves time and reduces the risk of errors commonly associated with paper-based forms.

-

Is there a cost associated with using airSlate SignNow for the Ghana Revenue Authority form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, ensuring cost-effectiveness while utilizing the platform for the Ghana Revenue Authority form. Users can choose a plan that fits their usage and budget.

-

What features does airSlate SignNow provide for the Ghana Revenue Authority form?

airSlate SignNow offers a range of features for the Ghana Revenue Authority form, including customizable templates, eSignature options, and real-time document tracking. These features enhance efficiency and simplify the signing process.

-

Can I integrate airSlate SignNow with other software for handling the Ghana Revenue Authority form?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, making it easy to manage the Ghana Revenue Authority form alongside other business tools. This integration ensures a smooth workflow across your systems.

-

What are the benefits of using airSlate SignNow for the Ghana Revenue Authority form?

Using airSlate SignNow for the Ghana Revenue Authority form brings numerous benefits, such as improved efficiency, better accuracy, and enhanced compliance with tax regulations. Additionally, eSigning documents speeds up the process, allowing businesses to meet deadlines more easily.

-

Is airSlate SignNow secure for handling the Ghana Revenue Authority form?

Yes, airSlate SignNow takes security seriously and employs robust encryption measures to protect sensitive information within the Ghana Revenue Authority form. Users can trust that their data is safe and secure.

Get more for Ghana Revenue Authority Form

- Renunciation and disclaimer of real property interest north dakota form

- United states v south carolina recycling and disposal form

- Quitclaim deed by two individuals to corporation north dakota form

- North dakota corporation form

- Nd tod form

- Self inspection form

- Freedom school tax matters page form

- North dakota lien 497317483 form

Find out other Ghana Revenue Authority Form

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later