Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi Form

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR?

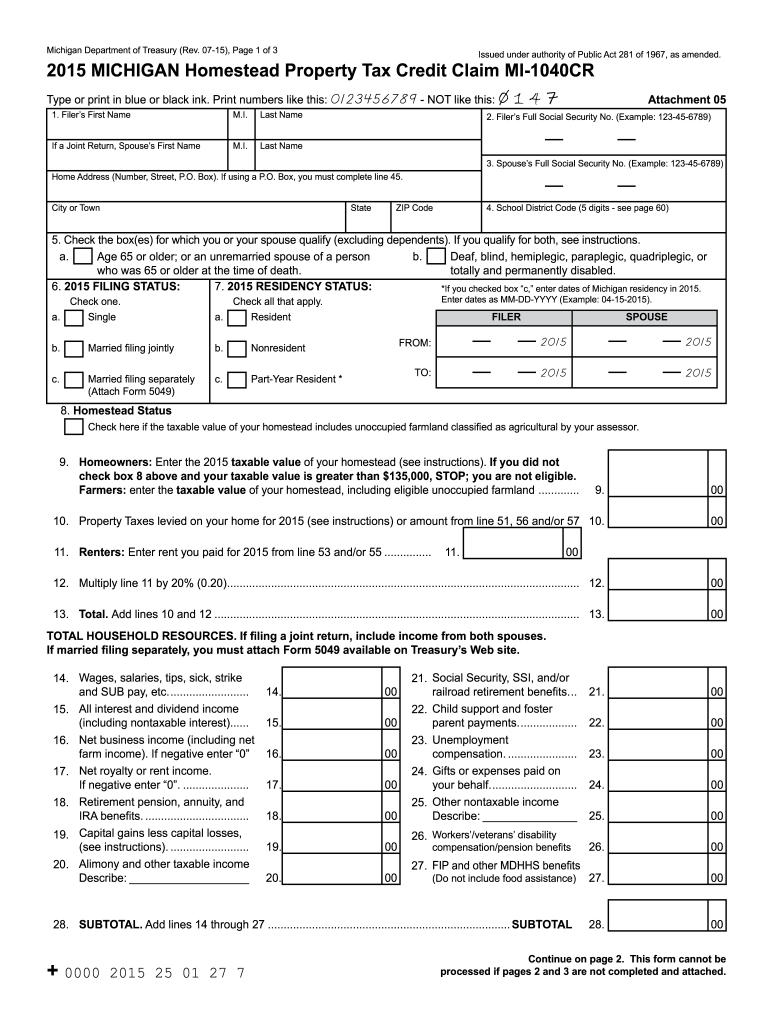

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a form that allows eligible homeowners in Michigan to claim a credit on their property taxes. This credit is designed to assist individuals with lower incomes or those who are elderly or disabled, helping to alleviate the financial burden of property taxes. The form requires detailed information about the homeowner's income, property, and residency status to determine eligibility and the amount of credit that can be claimed.

Steps to Complete the Michigan Homestead Property Tax Credit Claim MI 1040CR

Completing the MI 1040CR involves several key steps:

- Gather necessary documentation, including proof of income, property tax statements, and identification.

- Fill out the personal information section, ensuring that all details are accurate and up-to-date.

- Provide information regarding your property, including its address and the amount of property taxes paid.

- Calculate your total household income and determine if it falls within the eligibility limits for the credit.

- Complete the credit calculation section to determine the amount you can claim.

- Sign and date the form before submission.

Eligibility Criteria for the Michigan Homestead Property Tax Credit Claim MI 1040CR

To qualify for the Michigan Homestead Property Tax Credit, applicants must meet specific eligibility criteria, including:

- Being a resident of Michigan and occupying the property as your principal residence.

- Meeting income limits set by the state, which may vary based on household size.

- Having paid property taxes on the home for the year in which you are filing the claim.

- Being at least 65 years old, or being permanently disabled, if applicable.

Required Documents for the Michigan Homestead Property Tax Credit Claim MI 1040CR

When filing the MI 1040CR, certain documents are essential to support your claim:

- Proof of income, such as tax returns or W-2 forms.

- Property tax statements or receipts showing the amount paid.

- Identification documents, such as a driver's license or state ID.

- Any additional documentation that may support your claim, such as proof of disability if applicable.

Form Submission Methods for the Michigan Homestead Property Tax Credit Claim MI 1040CR

The MI 1040CR can be submitted through various methods:

- Online submission through the Michigan Department of Treasury's website, if available.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state or local offices.

Legal Use of the Michigan Homestead Property Tax Credit Claim MI 1040CR

The MI 1040CR is legally recognized as a valid claim for property tax credits in Michigan. It must be completed accurately and submitted within the specified deadlines to ensure compliance with state tax laws. Failure to adhere to these regulations may result in denial of the credit or potential penalties. It is crucial to maintain records of all submitted documentation for future reference and verification.

Quick guide on how to complete 2015 michigan homestead property tax credit claim mi 1040cr 2015 michigan homestead property tax credit claim mi 1040cr michigan

Effortlessly Prepare Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, adjust, and electronically sign your documents quickly and without any hold-ups. Manage Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-focused procedure today.

How to Modify and Electronically Sign Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi with Ease

- Locate Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Decide how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, the hassle of searching for forms, or having to reprint due to errors. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 michigan homestead property tax credit claim mi 1040cr 2015 michigan homestead property tax credit claim mi 1040cr michigan

How to generate an electronic signature for your 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan online

How to make an electronic signature for your 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan in Chrome

How to make an eSignature for putting it on the 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan in Gmail

How to generate an electronic signature for the 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan straight from your smartphone

How to generate an electronic signature for the 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan on iOS

How to make an eSignature for the 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Michigan on Android

People also ask

-

What is the MI 1040CR form?

The MI 1040CR form is a Michigan tax credit form that allows eligible residents to claim a credit for certain property taxes. It helps reduce the overall tax burden and is essential for those looking to maximize their returns on their MI 1040CR filings.

-

How can airSlate SignNow assist with MI 1040CR submissions?

AirSlate SignNow provides a seamless way to eSign and submit your MI 1040CR documents securely. With its easy-to-use interface, you can quickly gather digital signatures required for your tax documents without the hassle of printing and mailing paperwork.

-

What features does airSlate SignNow offer for MI 1040CR processing?

AirSlate SignNow offers features like custom templates, document tracking, and secure cloud storage for your MI 1040CR forms. These functionalities streamline your document management, making it efficient to prepare and submit your tax filings.

-

Is there any pricing information for using airSlate SignNow for MI 1040CR forms?

AirSlate SignNow offers competitive pricing plans designed to fit various business needs. Whether you're a solo tax preparer or part of a larger organization, you'll find a pricing structure that accommodates your frequency of MI 1040CR submissions.

-

What are the benefits of using airSlate SignNow for eSigning MI 1040CR documents?

Using airSlate SignNow for your MI 1040CR documents enhances efficiency, saves time, and increases the overall security of your sensitive information. You can sign documents from anywhere, ensuring you meet deadlines without unnecessary delays.

-

Can I integrate airSlate SignNow with other tax software for MI 1040CR filings?

Yes, airSlate SignNow offers integrations with various tax software, allowing for a streamlined process when handling your MI 1040CR filings. This connectivity helps you maintain organized records and simplifies collaboration with your tax team.

-

How does airSlate SignNow ensure the security of my MI 1040CR documents?

AirSlate SignNow takes document security seriously, employing encryption and robust authentication measures to protect your MI 1040CR forms. Your data is stored securely in the cloud, ensuring it remains confidential and accessible only to authorized users.

Get more for Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi

Find out other Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Michi

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile