Where Do I Send Form 500 Nol

What is the Where Do I Send Form 500 Nol

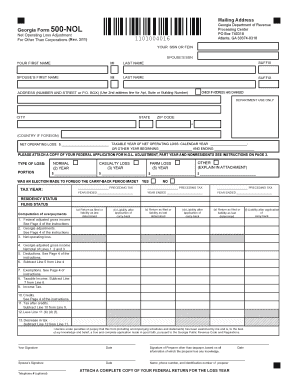

The Where Do I Send Form 500 Nol is a specific tax form used in the United States, primarily for reporting net operating losses (NOLs) to the Internal Revenue Service (IRS). This form allows taxpayers to carry forward or carry back their NOLs to offset taxable income in other years, potentially resulting in tax refunds or reduced tax liabilities. Understanding the purpose and function of this form is crucial for individuals and businesses looking to optimize their tax situations.

How to use the Where Do I Send Form 500 Nol

Using the Where Do I Send Form 500 Nol involves several steps. First, you need to accurately calculate your net operating loss for the tax year in question. Once you have determined the amount, complete the form with the required information, including your personal details and the specifics of the loss. After filling out the form, you can submit it to the IRS, ensuring that you follow the correct submission method for your situation, whether online or via mail.

Steps to complete the Where Do I Send Form 500 Nol

Completing the Where Do I Send Form 500 Nol requires attention to detail. Here are the essential steps:

- Gather necessary financial documents to calculate your net operating loss.

- Fill out the form, including your name, Social Security number, and the amount of the NOL.

- Review the form for accuracy to avoid delays in processing.

- Choose your submission method, whether online or by mail.

- Submit the form by the appropriate deadline to ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the filing and use of the Where Do I Send Form 500 Nol. It is essential to refer to the latest IRS publications and instructions to ensure compliance. These guidelines outline eligibility criteria, necessary documentation, and deadlines for submission. Familiarizing yourself with these regulations helps avoid penalties and ensures that your submission is processed efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Where Do I Send Form 500 Nol are crucial for compliance. Typically, the form must be submitted by the due date of your tax return for the year in which the NOL occurred. If you are carrying back the loss, you may have additional deadlines to consider. Keeping track of these important dates helps ensure that you do not miss your opportunity to claim your NOL benefits.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Where Do I Send Form 500 Nol. Taxpayers can file online using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address, depending on your state of residence. In-person submission is generally not available for this form, but understanding the available options helps streamline the filing process.

Quick guide on how to complete where do i send form 500 nol

Finish Where Do I Send Form 500 Nol effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents swiftly without any holdups. Handle Where Do I Send Form 500 Nol on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and electronically sign Where Do I Send Form 500 Nol without any hassle

- Obtain Where Do I Send Form 500 Nol and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Where Do I Send Form 500 Nol and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where do i send form 500 nol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where Do I Send Form 500 Nol for tax submission?

You should send Form 500 Nol to the tax authority indicated on the form. Typically, this includes submitting it to your state's Department of Revenue or other designated agency. It's important to check your specific state's guidelines to ensure compliance.

-

What is the purpose of Form 500 Nol?

Form 500 Nol is used to report net operating losses to potentially offset taxable income in future years. Correctly filling out and sending this form can provide signNow tax benefits. It is important for businesses to understand how to complete it accurately.

-

How much does airSlate SignNow cost for sending Form 500 Nol?

airSlate SignNow offers various pricing plans that are tailored to fit different business needs. You can choose from monthly or annual subscriptions, providing a cost-effective solution for managing and sending your documents, including Form 500 Nol.

-

Can I use airSlate SignNow to eSign Form 500 Nol?

Yes, you can use airSlate SignNow to easily eSign Form 500 Nol. Our platform allows for secure electronic signatures, ensuring that your documents are legally binding and compliant. Enjoy a streamlined process for signing and sending your tax forms.

-

What features does airSlate SignNow offer for sending documents?

airSlate SignNow provides a variety of features to enhance your document workflow, including templates, automated workflows, and real-time tracking. These tools make it simple to send and manage Form 500 Nol efficiently. You'll also benefit from integration with popular business applications.

-

Is airSlate SignNow suitable for small businesses that need to send Form 500 Nol?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our platform is user-friendly and affordable, providing an ideal solution for sending Form 500 Nol and other important documents without needing extensive technical knowledge.

-

How can I ensure the security of my Form 500 Nol when using airSlate SignNow?

airSlate SignNow employs advanced security measures, including end-to-end encryption and secure storage, to protect your documents. By using our platform to send Form 500 Nol, you can have peace of mind knowing that your sensitive information is safeguarded.

Get more for Where Do I Send Form 500 Nol

- Quitclaim deed from corporation to corporation new mexico form

- Warranty deed from corporation to corporation new mexico form

- Quitclaim deed from corporation to two individuals new mexico form

- Warranty deed from corporation to two individuals new mexico form

- Objection notice form

- Warranty deed from individual to a trust new mexico form

- Warranty deed from husband and wife to a trust new mexico form

- Health form request change

Find out other Where Do I Send Form 500 Nol

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy