FLS011 BApplicationb for PenCon Special STL Pag Ibig Fund Pagibigfund Gov Form

Understanding the pag ibig loan form

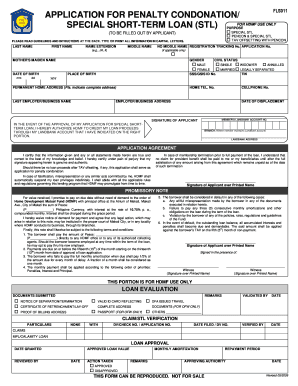

The pag ibig loan form is a crucial document for individuals seeking financial assistance through the Pag-IBIG Fund in the Philippines. This form serves as an application for various loan types, including housing and multipurpose loans. It requires detailed information about the applicant, such as personal identification, employment details, and financial status. Completing this form accurately is essential for the approval process, as it provides the Pag-IBIG Fund with the necessary information to assess eligibility and loan amounts.

Key elements of the pag ibig loan form

Several key elements must be included in the pag ibig loan form to ensure its completeness and accuracy. These elements typically include:

- Personal Information: Full name, address, contact details, and Pag-IBIG membership number.

- Loan Type: Specification of the loan type being applied for, such as housing or multipurpose loans.

- Income Details: Monthly income, sources of income, and employment status.

- Loan Amount: The amount being requested and the intended use of the funds.

- Supporting Documents: A list of required documents that must accompany the application, such as proof of income and identification.

Steps to complete the pag ibig loan form

Completing the pag ibig loan form involves several steps to ensure that all necessary information is accurately provided. Follow these steps for a smooth application process:

- Gather all required documents, including proof of income and identification.

- Fill out the personal information section, ensuring accuracy in your name and contact details.

- Select the type of loan you are applying for and specify the amount needed.

- Provide detailed income information, including monthly earnings and employment status.

- Review the form for any errors or missing information before submission.

Legal use of the pag ibig loan form

The pag ibig loan form is designed to comply with legal standards set by the Pag-IBIG Fund. This compliance ensures that the information provided is used appropriately in accordance with privacy laws and financial regulations. By submitting this form, applicants agree to the terms and conditions outlined by the Pag-IBIG Fund, which governs the loan process and repayment obligations.

Eligibility criteria for the pag ibig loan

To qualify for a loan through the Pag-IBIG Fund, applicants must meet specific eligibility criteria. These criteria generally include:

- Active membership in the Pag-IBIG Fund for a minimum period.

- Proof of stable income to demonstrate the ability to repay the loan.

- Age requirements, typically between eighteen and sixty-five years at the time of application.

- Good credit standing, with no outstanding loans or defaults.

Required documents for the pag ibig loan form

Submitting the pag ibig loan form requires several supporting documents to verify the information provided. Commonly required documents include:

- Valid identification (e.g., government-issued ID).

- Proof of income (e.g., payslips, income tax return).

- Certificate of employment or business registration, if applicable.

- Proof of membership in the Pag-IBIG Fund.

Quick guide on how to complete fls011 bapplicationb for pencon special stl pag ibig fund pagibigfund gov

Effortlessly Complete FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov with Ease

- Find FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize signNow sections of your documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Design your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then select the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fls011 bapplicationb for pencon special stl pag ibig fund pagibigfund gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pag ibig form loan and how can airSlate SignNow help?

The pag ibig form loan is a financing option offered by the Home Development Mutual Fund in the Philippines. With airSlate SignNow, you can easily prepare, send, and eSign necessary documents for your pag ibig form loan, streamlining the process to ensure that you get approved quickly and efficiently.

-

How much does it cost to use airSlate SignNow for pag ibig form loan documentation?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost of using our platform for pag ibig form loan documentation is competitive, ensuring that you can manage your paperwork without breaking the bank while enjoying a seamless eSigning experience.

-

What features does airSlate SignNow offer for pag ibig form loan processing?

airSlate SignNow provides a variety of features to facilitate the pag ibig form loan process, including customizable templates, secure eSignature capabilities, and automated reminders. These features not only enhance productivity but also ensure that your loan documentation is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for my pag ibig form loan?

Yes, airSlate SignNow offers various integrations with popular software and tools, making it easy to incorporate your pag ibig form loan process into existing workflows. Whether it's CRM systems or file storage platforms, our integrations help centralize your processes and data for better management.

-

How secure is my data when using airSlate SignNow for pag ibig form loan?

Data security is paramount at airSlate SignNow, particularly for sensitive documents like the pag ibig form loan. We use bank-level encryption and secure data storage practices to protect your information, ensuring that your loan application is safe from unauthorized access.

-

Is it easy to use airSlate SignNow for new users applying for a pag ibig form loan?

Absolutely! airSlate SignNow is designed with user-friendly features that make it easy for anyone to navigate. New users applying for a pag ibig form loan can quickly create and manage their documents without any technical expertise, thanks to our intuitive interface.

-

What benefits does airSlate SignNow provide for pag ibig form loan applicants?

Using airSlate SignNow for your pag ibig form loan applications provides many benefits, including reduced processing times, enhanced document accuracy, and the convenience of eSigning. These advantages not only expedite your loan approval process but also improve overall efficiency and reduce paperwork.

Get more for FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov

- West virginia tenant 497431774 form

- Notice of default on residential lease west virginia form

- Landlord tenant lease co signer agreement west virginia form

- Application for sublease west virginia form

- West virginia post 497431778 form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out west virginia form

- Property manager agreement west virginia form

- Agreement for delayed or partial rent payments west virginia form

Find out other FLS011 BApplicationb For PenCon Special STL Pag ibig Fund Pagibigfund Gov

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed