Virginia Form R 7 Authority Tax Services

What is the Virginia Form R 7 Authority Tax Services

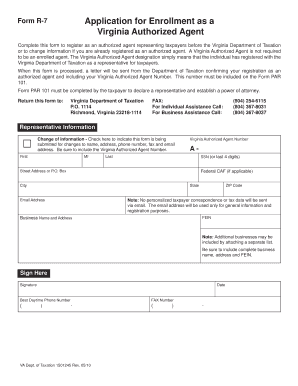

The Virginia Form R 7 Authority Tax Services is a crucial document used for tax purposes within the state of Virginia. This form allows businesses and individuals to authorize tax services to act on their behalf in matters related to state tax obligations. It is essential for ensuring that the designated tax professional can legally represent the taxpayer in communications and filings with the Virginia Department of Taxation. Understanding this form's purpose is vital for anyone seeking assistance with their tax affairs in Virginia.

How to use the Virginia Form R 7 Authority Tax Services

To utilize the Virginia Form R 7 Authority Tax Services effectively, taxpayers must complete the form accurately and submit it to the appropriate tax authority. The form requires specific information, including the taxpayer's details, the tax professional's information, and the scope of authority granted. Once submitted, the authorized tax professional can manage tax-related matters, including filing returns and responding to inquiries on behalf of the taxpayer. It is important to ensure that the form is filled out completely to avoid any delays or issues in representation.

Steps to complete the Virginia Form R 7 Authority Tax Services

Completing the Virginia Form R 7 Authority Tax Services involves several key steps:

- Gather necessary information, such as your Social Security number or Employer Identification Number (EIN).

- Provide details about the tax professional you are authorizing, including their name, address, and contact information.

- Specify the type of tax matters the authority covers, ensuring clarity on the scope of representation.

- Review the completed form for accuracy and ensure all required fields are filled in.

- Sign and date the form to validate your authorization.

Once completed, the form should be submitted to the Virginia Department of Taxation or the relevant tax authority for processing.

Legal use of the Virginia Form R 7 Authority Tax Services

The legal use of the Virginia Form R 7 Authority Tax Services is governed by state tax laws. This form must be filled out correctly to ensure that the authorization is valid and recognized by the Virginia Department of Taxation. It is essential to comply with all legal requirements when completing and submitting the form, as any inaccuracies or omissions could render the authorization ineffective. Additionally, the form must be signed by the taxpayer to confirm their consent for the tax professional to act on their behalf.

Required Documents

When completing the Virginia Form R 7 Authority Tax Services, certain documents may be necessary to support the process. These documents typically include:

- Proof of identity, such as a driver's license or Social Security card.

- Taxpayer identification number, which may be a Social Security number or Employer Identification Number (EIN).

- Any previous correspondence with the Virginia Department of Taxation that may be relevant.

Having these documents ready can streamline the completion and submission of the form.

Form Submission Methods

The Virginia Form R 7 Authority Tax Services can be submitted through various methods to accommodate different preferences. Taxpayers can choose to:

- Submit the form online through the Virginia Department of Taxation's website, if available.

- Mail the completed form to the appropriate address provided by the tax authority.

- Deliver the form in person to a local tax office for immediate processing.

Each submission method may have different processing times, so it is advisable to consider which option best suits your needs.

Quick guide on how to complete virginia form r 7 authority tax services

Conveniently manage Virginia Form R 7 Authority Tax Services on any gadget

Digital document handling has gained traction among companies and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, adjust, and electronically sign your documents swiftly and without complications. Manage Virginia Form R 7 Authority Tax Services on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign Virginia Form R 7 Authority Tax Services with ease

- Obtain Virginia Form R 7 Authority Tax Services and click on Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Virginia Form R 7 Authority Tax Services and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia form r 7 authority tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Virginia Form R 7 Authority Tax Services?

Virginia Form R 7 Authority Tax Services is a specific form used for managing tax-related authority issues in Virginia. This service helps businesses comply with state tax regulations efficiently. airSlate SignNow streamlines this process by allowing users to fill out, sign, and send these documents electronically.

-

How can airSlate SignNow help with Virginia Form R 7 Authority Tax Services?

airSlate SignNow provides a user-friendly platform for preparing, signing, and managing Virginia Form R 7 Authority Tax Services. Its intuitive interface reduces the time spent on paperwork, enabling faster processing and compliance. Moreover, you can easily track and manage document flows in one place.

-

What features does airSlate SignNow offer for handling tax documents?

With airSlate SignNow, users can access features like electronic signatures, customizable templates, and secure document storage specifically for Virginia Form R 7 Authority Tax Services. These tools enhance productivity by minimizing manual work and ensuring that all documents are accurately completed and stored securely.

-

Is there a cost associated with using airSlate SignNow for Virginia Form R 7 Authority Tax Services?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost-effective solution includes features specifically designed for handling Virginia Form R 7 Authority Tax Services, making it affordable for businesses of all sizes. You can choose a plan that suits your budgeting requirements while still accessing all essential features.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your workflow for Virginia Form R 7 Authority Tax Services. This integration ensures that all your tax documents are easily accessible and managed alongside your financial data, saving you time and reducing errors.

-

How secure is airSlate SignNow for managing Virginia Form R 7 Authority Tax Services?

Security is a top priority for airSlate SignNow. Our platform employs state-of-the-art encryption protocols to protect your documents, including Virginia Form R 7 Authority Tax Services. Additionally, access controls and audit trails ensure that only authorized users can view or modify sensitive information.

-

What benefits does airSlate SignNow provide for businesses dealing with Virginia Form R 7 Authority Tax Services?

Using airSlate SignNow for Virginia Form R 7 Authority Tax Services offers several benefits, including improved efficiency in document handling and reduced turnaround times on tax-related tasks. Companies can also enhance compliance with state requirements, fostering a more reliable and organized tax management process.

Get more for Virginia Form R 7 Authority Tax Services

- Domicile determination form eligibility for in state

- Hilton new application form

- Admissionsmsuedudocsaffidavitofsupportinternational applicants only affidavit of support for form

- Personal data form

- Tnccedusitesdefaultconsortium agreement section 1 student acknowledgement form

- 1 forms divided by the department to which they should be

- Utmb medical records form

- New york job letter form

Find out other Virginia Form R 7 Authority Tax Services

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form