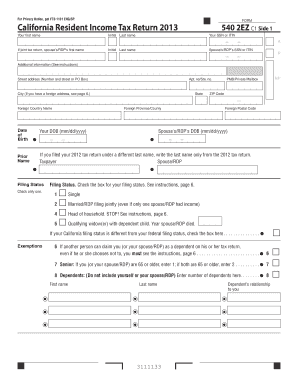

Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save

What is the Form 540 2EZ California Resident Income Tax Return?

The Form 540 2EZ is a simplified version of the California Resident Income Tax Return designed for eligible taxpayers. This form allows individuals to report their income, claim deductions, and calculate their tax liability in a straightforward manner. It is specifically tailored for those who meet certain criteria, including filing status, income limits, and types of income received. By using this form, residents can efficiently manage their tax obligations while benefiting from a user-friendly format.

Steps to Complete the Form 540 2EZ California Resident Income Tax Return

Completing the Form 540 2EZ involves several key steps to ensure accurate reporting. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which could be single, married filing jointly, or head of household.

- Report your total income from all sources, ensuring you include all applicable earnings.

- Claim any eligible deductions, such as the standard deduction for your filing status.

- Calculate your tax liability based on the provided tax tables.

- Review your form for accuracy before submitting it.

Legal Use of the Form 540 2EZ California Resident Income Tax Return

The Form 540 2EZ is legally recognized for filing state income taxes in California. It must be completed accurately to comply with state tax laws. When submitted, the form becomes a binding document, subject to review by the California Franchise Tax Board. To ensure legal validity, it is essential to follow all instructions and include accurate information. Any discrepancies may lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Timely filing of the Form 540 2EZ is crucial to avoid penalties. The standard deadline for filing individual income tax returns in California is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which can provide additional time to file, though taxes owed must still be paid by the original deadline to avoid interest and penalties.

Eligibility Criteria for Using the Form 540 2EZ California Resident Income Tax Return

To qualify for the Form 540 2EZ, taxpayers must meet specific eligibility criteria. These include:

- Filing status must be single, married filing jointly, or head of household.

- Adjusted gross income should not exceed a certain threshold, which is updated annually.

- Taxpayers must not claim dependents or certain credits that require more complex forms.

- Income must be derived from wages, salaries, or other straightforward sources.

How to Obtain the Form 540 2EZ California Resident Income Tax Return

The Form 540 2EZ can be obtained through various channels. Taxpayers can access the form online via the California Franchise Tax Board's website, where it is available for download in PDF format. Additionally, physical copies may be found at local libraries, post offices, or tax preparation offices. It is advisable to ensure that the most current version of the form is used to comply with the latest tax regulations.

Quick guide on how to complete form 540 2ez california resident income tax return california resident income tax return fill in ampampampamp save

Effortlessly Prepare Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save with Ease

- Obtain Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal weight as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 2ez california resident income tax return california resident income tax return fill in ampampampamp save

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540 2EZ and how does it relate to California Resident Income Tax Return?

Form 540 2EZ is a simplified California Resident Income Tax Return form that allows eligible taxpayers to file their state tax return easily. It helps streamline the filing process by providing step-by-step instructions for filling in essential tax information. By using airSlate SignNow, you can efficiently fill in and save your Form 540 2EZ California Resident Income Tax Return.

-

What features does airSlate SignNow offer for filling out Form 540 2EZ?

airSlate SignNow provides a user-friendly interface for completing the Form 540 2EZ California Resident Income Tax Return. You can easily fill in required fields, save your progress, and securely share the completed document with tax professionals or family members. Additionally, the platform ensures compliance with California tax regulations.

-

What are the benefits of using airSlate SignNow for my California Resident Income Tax Return?

Using airSlate SignNow for your California Resident Income Tax Return offers multiple benefits, including cost-effectiveness and convenience. It allows you to complete your Form 540 2EZ online, reducing paperwork and time spent on filing. You can also benefit from eSign capabilities, ensuring your documents are legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for Form 540 2EZ?

Yes, airSlate SignNow offers various pricing plans to suit different needs when filling out Form 540 2EZ California Resident Income Tax Return. The pricing is affordable, especially considering the convenience and efficiency it provides. It's best to check our website for current pricing and any promotional offers available.

-

Can airSlate SignNow integrate with other tax preparation software?

Yes, airSlate SignNow can integrate with various tax preparation software platforms, making it easier to manage your Form 540 2EZ California Resident Income Tax Return. Integration allows for seamless sharing of data and documents, streamlining your workflow and reducing the likelihood of errors. Check our integrations section for more details.

-

How does airSlate SignNow ensure security when filling out tax documents?

airSlate SignNow prioritizes your security by implementing robust encryption and data protection measures. When filling out your Form 540 2EZ California Resident Income Tax Return, your information remains confidential and secure from unauthorized access. Trust in our platform to keep your sensitive tax documents safe.

-

Can I save my progress when filling out the Form 540 2EZ on airSlate SignNow?

Yes, one of the key features of airSlate SignNow is the ability to save your progress while filling out your Form 540 2EZ California Resident Income Tax Return. This allows you to revisit your document at any time without losing previously entered information, making the filing process more flexible and user-friendly.

Get more for Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save

- Macquarie withdrawal form bank with macquariemacquarie

- My sanford chart adultteen proxy form sacred heart mercy

- This wyoming commercial lease agreement agreement made on form

- Free bill of sale forms pdf template form downloadfree texas bill of sale forms pdf word eformsfree bill of sale forms word pdf

- Tennessee residential rental application form

- Make typemodel form

- Buyers name quotbuyerquot with a mailing address of form

- South carolina general personal property bill of sale form

Find out other Form 540 2EZ California Resident Income Tax Return California Resident Income Tax Return Fill in & Save

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter