Illinois Department of Revenue Fiduciary Income and Replacement Tax Return Form IL 1041 *363601110* Due on or Before the 15th Da

What is the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*?

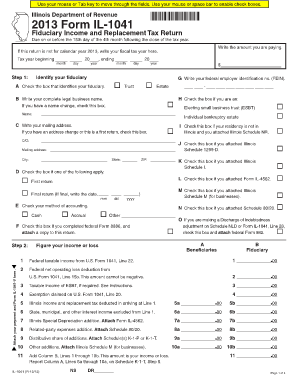

The Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* is a tax form specifically designed for fiduciaries managing estates or trusts in Illinois. This form is essential for reporting the income generated by these entities and calculating the associated tax obligations. It must be filed annually, and the due date is on or before the fifteenth day of the fourth month following the close of the tax year. Understanding this form is crucial for fiduciaries to ensure compliance with state tax laws and avoid potential penalties.

Steps to Complete the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*

Completing the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* involves several key steps:

- Gather all necessary financial information related to the estate or trust, including income, deductions, and credits.

- Obtain the form from the Illinois Department of Revenue website or through authorized channels.

- Fill out the form accurately, ensuring that all sections are completed according to the instructions provided.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the due date, either electronically or by mail, depending on your preference.

Legal Use of the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*

The legal use of the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* is paramount for fiduciaries. This form serves as an official declaration of income and tax liability, making it a critical document for compliance with Illinois tax regulations. Properly completing and filing this form ensures that fiduciaries fulfill their legal obligations to report income and pay taxes on behalf of the estate or trust. Failure to file or inaccuracies in the form can lead to penalties and legal repercussions.

Filing Deadlines / Important Dates

For the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*, it is crucial to adhere to specific deadlines:

- The form is due on or before the fifteenth day of the fourth month following the close of the tax year.

- For estates or trusts operating on a calendar year, the deadline typically falls on April 15.

- Extensions may be available, but they must be requested prior to the original due date.

Form Submission Methods

Fiduciaries have several options for submitting the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*:

- Online submission through the Illinois Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Key Elements of the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*

Understanding the key elements of the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* is essential for accurate completion:

- Identification information for the estate or trust, including name and tax identification number.

- Details of income earned by the estate or trust during the tax year.

- Deductions and credits applicable to the estate or trust.

- Calculation of the total tax liability based on reported income.

How to Obtain the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*

Obtaining the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* is straightforward:

- Visit the official Illinois Department of Revenue website to download the form.

- Request a physical copy from local tax offices or authorized distribution centers.

- Consult with tax professionals who may provide the form as part of their services.

Quick guide on how to complete illinois department of revenue fiduciary income and replacement tax return form il 1041 363601110 due on or before the 15th day

Accomplish Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools you require to create, adjust, and electronically sign your documents rapidly without interruptions. Handle Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da with ease

- Obtain Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize key sections of the documents or conceal sensitive information using tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da and ensure outstanding communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue fiduciary income and replacement tax return form il 1041 363601110 due on or before the 15th day

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*?

The Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* is a tax return form used by fiduciaries in Illinois to report income for trusts and estates. It is crucial for fulfilling tax obligations and ensuring compliance with Illinois state tax laws.

-

When is the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* due?

This form is due on or before the 15th day of the 4th month following the close of the tax year. Meeting this deadline is essential to avoid penalties and ensure timely processing of your fiduciary tax return.

-

How can airSlate SignNow assist in filing the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*?

airSlate SignNow provides an easy-to-use platform for sending and electronically signing the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*. This streamlines the submission process, making it cost-effective and efficient.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a variety of features, including document templates, electronic signatures, and secure cloud storage. These features simplify the management of the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* and other tax-related documents.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. The pricing is competitive and includes various features to help you manage your Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* efficiently.

-

Can airSlate SignNow integrate with other accounting or tax software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This integration allows you to streamline your workflow, especially when dealing with forms like the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*.

-

What benefits come from using airSlate SignNow for fiduciary tax returns?

Using airSlate SignNow for fiduciary tax returns provides numerous benefits, including convenience, efficiency, and reduced paperwork. This is especially useful for completing the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110*, as it helps ensure a hassle-free filing experience.

Get more for Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da

- 4669 form

- Form 2290 rev july 2022 heavy highway vehicle use tax return

- Dormogovformsmo atc2020form mo atc adoption tax credit claim

- 2022 i 111 form 1 instructions wisconsin income tax form 1 instructions

- Instructions for form 8959 2020internal revenue serviceinstructions for form 8959 2020internal revenue serviceinstructions for

- Information about your notice penalty and interest irs tax forms

- Connecticut form ct 1040nr py nonresidentpart year

- Portalctgovdsshuman resourcesdepartment of revenue services state of connecticut form ct

Find out other Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Form IL 1041 *363601110* Due On Or Before The 15th Da

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors