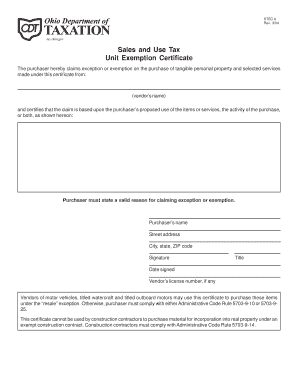

Tax Ohio Gov Sales and Use Tax Unit Exemption Certificate 2004-2026

Understanding the Ohio Unit Exemption Certificate

The Ohio unit exemption certificate is a crucial document that allows eligible purchasers to buy specific goods or services without paying sales tax. This exemption is primarily aimed at governmental entities, non-profit organizations, and certain educational institutions. The certificate serves as proof that the purchaser qualifies for tax exemption under Ohio law, helping to streamline the purchasing process and reduce costs associated with sales tax.

How to Use the Ohio Unit Exemption Certificate

To effectively use the Ohio unit exemption certificate, the purchaser must present it to the vendor at the time of purchase. This document should be completed with accurate information, including the purchaser's name, address, and the type of exemption being claimed. Vendors are required to keep a copy of the certificate on file to validate the tax-exempt status of the transaction. It is essential that the certificate is used only for eligible purchases as specified by Ohio tax regulations.

Steps to Complete the Ohio Unit Exemption Certificate

Completing the Ohio unit exemption certificate involves several key steps:

- Obtain the certificate form from the Ohio Department of Taxation or a trusted source.

- Fill in the required fields, including the purchaser's name, address, and the nature of the exemption.

- Ensure that the certificate is signed and dated by an authorized representative of the purchasing entity.

- Provide the completed certificate to the vendor at the time of purchase.

Following these steps ensures that the certificate is valid and compliant with Ohio tax laws.

Legal Use of the Ohio Unit Exemption Certificate

The legal use of the Ohio unit exemption certificate is governed by state tax laws. It is important for users to understand that misuse of the certificate can lead to penalties. The certificate should only be used for purchases that qualify for exemption under Ohio law. Vendors are also responsible for verifying the legitimacy of the certificate before processing tax-exempt transactions.

Eligibility Criteria for the Ohio Unit Exemption Certificate

Eligibility for the Ohio unit exemption certificate is typically limited to specific entities, including:

- Government agencies

- Non-profit organizations recognized under IRS regulations

- Educational institutions that meet certain criteria

Each entity must provide documentation that supports their eligibility for tax exemption, ensuring compliance with Ohio's sales tax regulations.

Required Documents for the Ohio Unit Exemption Certificate

To obtain and utilize the Ohio unit exemption certificate, certain documents may be required. These typically include:

- Proof of the entity's tax-exempt status (e.g., IRS determination letter for non-profits)

- Identification of the authorized representative who will sign the certificate

- Any additional documentation that supports the claim for exemption

Having these documents ready can facilitate a smoother process when applying for and using the exemption certificate.

Quick guide on how to complete tax ohio gov sales and use tax unit exemption certificate

Complete Tax ohio gov Sales And Use Tax Unit Exemption Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools essential for creating, editing, and eSigning your documents swiftly without delays. Manage Tax ohio gov Sales And Use Tax Unit Exemption Certificate on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Tax ohio gov Sales And Use Tax Unit Exemption Certificate with ease

- Locate Tax ohio gov Sales And Use Tax Unit Exemption Certificate and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize necessary sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax ohio gov Sales And Use Tax Unit Exemption Certificate while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax ohio gov sales and use tax unit exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio STEC U form?

The Ohio STEC U form is a document used for various business and compliance purposes in Ohio. It is essential for ensuring that your organization's documents meet state requirements. Understanding how to effectively use this form is crucial for compliance and operational efficiency.

-

How can airSlate SignNow help with the Ohio STEC U form?

airSlate SignNow provides a user-friendly platform that streamlines the signing and sending process for the Ohio STEC U form. With its robust digital signature capabilities, you can ensure your documents are signed securely and efficiently. This helps in reducing turnaround time and enhances collaboration.

-

What are the pricing options for using airSlate SignNow with the Ohio STEC U form?

airSlate SignNow offers competitive pricing plans that cater to different business needs when working with the Ohio STEC U form. Subscription plans vary based on features, allowing you to choose one that fits your budget and requirements. Free trials and discounts may also be available for new users.

-

Are there any integrations available for using the Ohio STEC U form with airSlate SignNow?

Yes, airSlate SignNow supports various integrations that enhance the functionality of the Ohio STEC U form. You can integrate with popular platforms like Google Workspace, Salesforce, and more, making it easier to manage documents within your existing workflows. This versatility helps in boosting productivity.

-

What features does airSlate SignNow offer for managing the Ohio STEC U form?

airSlate SignNow includes features such as document templates, in-app notifications, and secure cloud storage for the Ohio STEC U form. These tools simplify the document management process and ensure that all parties are kept informed throughout the signing process. Enhanced tracking also allows you to monitor document status.

-

Is the Ohio STEC U form legally compliant when signed electronically?

Yes, the Ohio STEC U form can be legally signed using airSlate SignNow's electronic signature feature. All signatures comply with federal and state e-signature laws, ensuring that your electronically signed documents hold the same legal weight as traditional signatures. This compliance helps mitigate legal risks.

-

Can I customize the Ohio STEC U form in airSlate SignNow?

Absolutely! You can customize the Ohio STEC U form using airSlate SignNow's intuitive document editor. This allows you to add company logos, adjust layouts, and include specific fields that your organization may require. Customization ensures that your documents are professional and tailored to your brand.

Get more for Tax ohio gov Sales And Use Tax Unit Exemption Certificate

- Form 1099 s rev january 2022 proceeds from real estate transactions

- Missouri form mo 1041 missouri fiduciary income returninstructions for form 1041 and schedules a b g j and kmissouri form mo

- Missouri form mo crp certification of rent paid 2020missouri form mo crp certification of rent paid 2020missouri form mo ptc

- Form mo 1040v 2022 individual income tax payment voucher

- Form 2210 2022 underpayment of estimated tax by individuals

- 1120 reit us income tax return for real estateabout form 1120 reit us income tax return for real estate investm1120 reit us

- 4923 non highway use motor fuel refund claim form

- Form ft 943 quarterly inventory report by retail service stations and fixed base operators revised 522

Find out other Tax ohio gov Sales And Use Tax Unit Exemption Certificate

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure