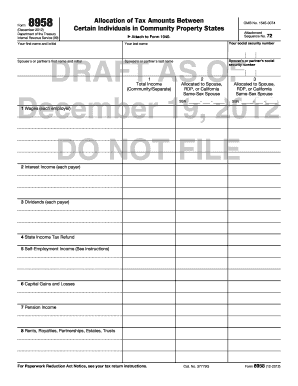

Example of Completed Form 8958

What is the example of completed form 8958

The form 8958, officially known as the "Allocation of Tax Amounts Between Certain Individuals in Community Property States," is primarily utilized by taxpayers in community property states. This form helps in determining how to allocate tax amounts between spouses or partners when filing jointly. A completed example of form 8958 illustrates how to accurately report income, deductions, and credits, ensuring that each individual's share is correctly calculated. This is particularly important for couples who have different income levels or tax liabilities.

Steps to complete the example of completed form 8958

Completing the form 8958 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, identify the community property income and deductions for both individuals. Fill out the form by entering the total income and deductions for each spouse, ensuring that the amounts are divided according to community property laws. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal use of the example of completed form 8958

The legal use of form 8958 is crucial for taxpayers in community property states to ensure compliance with IRS regulations. This form provides a clear method for reporting income and deductions, which can significantly affect tax liabilities. By accurately completing the form, couples can avoid potential penalties for misreporting income. It is essential to understand that the IRS requires this form to be filed when applicable, and failure to do so may lead to audits or disputes regarding tax obligations.

IRS Guidelines

The IRS provides specific guidelines for completing form 8958. These guidelines outline who is required to file the form, the information needed, and how to allocate income and deductions. Taxpayers should refer to the IRS instructions for form 8958 to ensure compliance with current tax laws. This includes understanding community property rules, which can vary by state, and how they impact the allocation of tax amounts between individuals.

Filing Deadlines / Important Dates

Filing deadlines for form 8958 align with the general tax filing deadlines for individuals. Typically, this means the form must be submitted by April 15 of the tax year, unless an extension is filed. It is important to keep track of any changes to deadlines that may occur due to special circumstances, such as natural disasters or changes in tax law. Meeting these deadlines is essential to avoid penalties and ensure timely processing of tax returns.

Penalties for Non-Compliance

Failure to file form 8958 when required can result in significant penalties. The IRS may impose fines for late filing, and incorrect allocations can lead to additional taxes owed. In severe cases, non-compliance may trigger an audit, resulting in further scrutiny of financial records. It is crucial for taxpayers to understand the importance of this form in the context of their overall tax obligations to avoid these consequences.

Quick guide on how to complete example of completed form 8958 16498100

Easily Prepare Example Of Completed Form 8958 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to locate the appropriate document and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents efficiently, without any delays. Manage Example Of Completed Form 8958 on any device using the airSlate SignNow apps for Android or iOS, and enhance your document-related processes today.

The Simplest Method to Edit and eSign Example Of Completed Form 8958 Effortlessly

- Locate Example Of Completed Form 8958 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and eSign Example Of Completed Form 8958 to ensure smooth communication throughout every phase of your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example of completed form 8958 16498100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an example of completed form 8958?

An example of completed form 8958 is a document that shows how multiple owners report their investment activities to the IRS. This form is essential for partners or shareholders and serves as a clear guide on how to fill it out correctly. You can find sample filled forms from various tax resources online.

-

How does airSlate SignNow help in completing form 8958?

AirSlate SignNow streamlines the process of completing form 8958 with its intuitive document editing features. Users can fill out the form digitally, add signatures, and ensure secure storage, making tax reporting more efficient. This eliminates the need for paper printing and manual submissions.

-

Is there a free trial available for airSlate SignNow when using form 8958?

Yes, airSlate SignNow offers a free trial that allows users to explore all features, including those for completing form 8958. This gives you the chance to test its signing capabilities, document editing tools, and storage before committing to a subscription. It's a perfect opportunity to see how it meets your needs.

-

What are the key features of airSlate SignNow for form 8958?

Key features of airSlate SignNow for completing form 8958 include customizable templates, eSignature capabilities, and document workflow automation. These features enable users to swiftly prepare and execute tax forms, ensuring compliance and accuracy. Plus, users can track document status in real-time.

-

Can I integrate airSlate SignNow with other tools I use for form 8958?

Absolutely! AirSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and various CRM systems. This integration facilitates easy importing and exporting of necessary documents such as form 8958. You can work with your favorite apps while leveraging SignNow's capabilities.

-

What are the pricing options for using airSlate SignNow for form 8958?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Whether you need a monthly or annual subscription, you can choose a plan that best fits your needs for preparing documents like form 8958. Check the website for current pricing details and any promotional offers.

-

How secure is airSlate SignNow when handling sensitive documents like form 8958?

AirSlate SignNow prioritizes security with advanced encryption and secure cloud storage. This ensures that your completed form 8958 and other sensitive documents are protected from unauthorized access. The platform complies with legal security standards to safeguard your information.

Get more for Example Of Completed Form 8958

Find out other Example Of Completed Form 8958

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors