PAY RATIO SURTAX PRS SCHEDULE City of Portland Business Form

What is the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

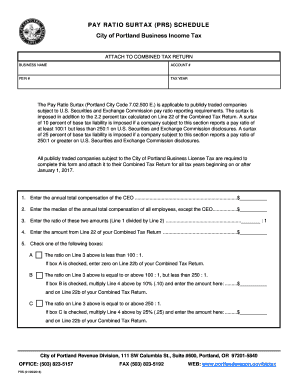

The PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business form is a specific document required for businesses operating in Portland, Oregon. It is designed to collect information related to the pay ratio surtax, which assesses the disparity between the compensation of top executives and the median compensation of all employees within the company. This form is part of the city's efforts to promote equity and transparency in compensation practices among local businesses.

Steps to complete the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

Completing the PAY RATIO SURTAX PRS SCHEDULE involves several key steps to ensure accuracy and compliance. First, gather necessary financial data, including total compensation for executives and median employee salaries. Next, fill out the form with this information, ensuring all figures are accurate and reflective of the current fiscal year. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online or by mail, adhering to any specified deadlines.

Legal use of the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

The PAY RATIO SURTAX PRS SCHEDULE is legally binding when completed correctly and submitted on time. It must comply with local regulations regarding pay equity and transparency. Businesses are required to provide truthful and accurate information, as any discrepancies can lead to penalties or legal repercussions. The form serves as an official record for the city and may be subject to audits, reinforcing the importance of careful completion.

Filing Deadlines / Important Dates

Filing deadlines for the PAY RATIO SURTAX PRS SCHEDULE are critical for compliance. Typically, businesses must submit the form annually, with specific dates set by the City of Portland. It is important to stay informed about these deadlines to avoid late fees or penalties. Mark your calendar for the due date, and consider submitting the form well in advance to ensure all information is accurate and complete.

Required Documents

To complete the PAY RATIO SURTAX PRS SCHEDULE, several documents are necessary. These include financial statements that detail executive compensation, employee salary data, and any relevant payroll records. Additionally, businesses may need to provide documentation that supports the calculations used to determine the median salary and the pay ratio. Having these documents organized and readily available can streamline the completion process.

Penalties for Non-Compliance

Failure to comply with the requirements of the PAY RATIO SURTAX PRS SCHEDULE can result in significant penalties. Businesses may face fines, increased scrutiny from regulatory bodies, and potential legal action if they do not submit the form accurately or on time. It is essential for businesses to understand these risks and prioritize compliance to avoid negative consequences.

Examples of using the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

Businesses can use the PAY RATIO SURTAX PRS SCHEDULE to assess their compensation practices and identify areas for improvement. For example, a company may discover through the form that their pay ratio is significantly higher than industry standards, prompting a review of their compensation strategy. Additionally, the data collected can be used to enhance transparency with employees and stakeholders, fostering a culture of equity within the organization.

Quick guide on how to complete pay ratio surtax prs schedule city of portland business

Complete PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business effortlessly on any device

Digital document management has become favored by enterprises and individuals alike. It offers an impeccable eco-friendly substitute to traditional printed and signed forms, as you can easily locate the necessary template and safely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to alter and eSign PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business with ease

- Obtain PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pay ratio surtax prs schedule city of portland business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

The PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business is a tax regulation that affects businesses based on their employee compensation ratios. It mandates that larger businesses contribute more to support local services. Understanding this schedule is vital for compliance and effective financial planning.

-

How can airSlate SignNow help with the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

AirSlate SignNow streamlines the document management process, making it easier for businesses to prepare and submit required documentation related to the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business. With its robust eSignature capabilities, you can efficiently collect necessary approvals and maintain compliance with local regulations.

-

What are the pricing options for airSlate SignNow related to the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

AirSlate SignNow offers competitive pricing plans suitable for all business sizes that need to address the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business requirements. Pricing is based on features and the number of users, providing flexibility for organizations looking for cost-effective solutions.

-

Are there any additional features in airSlate SignNow that assist with tax compliance like the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

Yes, airSlate SignNow includes features such as automated reminders, audit trails, and compliance alerts that can be particularly useful for adhering to the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business. These tools help ensure that your documents are submitted on time and in accordance with local regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business management software. This functionality allows businesses to easily manage financial documentation associated with the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business without disrupting existing workflows.

-

How does airSlate SignNow ensure secure document handling for addresses related to the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business?

Security is a priority at airSlate SignNow. We employ advanced encryption, secure cloud storage, and compliance with various regulatory standards to protect documents related to the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business, ensuring that your business information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business documentation?

Using airSlate SignNow for your PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business documentation offers numerous benefits, including increased efficiency, reduced errors, and improved collaboration among teams. It simplifies the signing process, thus freeing up time for your business to focus on growth and compliance.

Get more for PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

- Manimahesh yatra medical form

- Bivona custom trach form

- Cryolipolysis consent form 224969613

- Lawton police department online report form

- Sdq questionnaire word document form

- Apply for transnet learnership form

- English grammar in use pdf slideshare form

- Knights of columbus resolution of condolence form

Find out other PAY RATIO SURTAX PRS SCHEDULE City Of Portland Business

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors