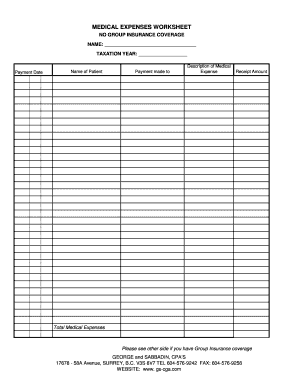

Medical Expenses Worksheet Form

What is the Medical Expenses Worksheet

The medical expenses worksheet is a crucial document used by individuals in the United States to track and report medical expenses for tax purposes. This worksheet helps taxpayers itemize their medical costs, which may be deductible on their federal income tax return. It includes various categories of expenses such as hospital bills, prescription medications, and other healthcare-related costs. By organizing these expenses, taxpayers can better understand their financial health and maximize potential deductions.

How to Use the Medical Expenses Worksheet

Using the medical expenses worksheet involves several straightforward steps. First, gather all relevant receipts and documentation related to medical expenses incurred during the tax year. Next, categorize these expenses according to the sections provided in the worksheet, such as medical care, dental care, and vision care. Ensure that you include only eligible expenses, as defined by IRS guidelines. Finally, total your expenses and transfer the appropriate amounts to your tax return, ensuring accuracy to avoid issues with the IRS.

Steps to Complete the Medical Expenses Worksheet

Completing the medical expenses worksheet requires careful attention to detail. Start by listing all qualifying medical expenses incurred throughout the year. Be sure to include:

- Payments for medical services, such as doctor visits and hospital stays

- Costs for prescription drugs and necessary medical supplies

- Expenses related to long-term care and health insurance premiums

After compiling your expenses, sum them up and compare the total against the income threshold set by the IRS for deductibility. This will help determine if your expenses qualify for deduction on your tax return.

Legal Use of the Medical Expenses Worksheet

The medical expenses worksheet is legally recognized as a valid tool for reporting medical expenses to the IRS. To ensure compliance, it is essential to adhere to IRS guidelines regarding what constitutes deductible medical expenses. Additionally, maintaining accurate records and receipts is vital, as the IRS may request documentation to support your claims. Using a reliable platform like signNow can help you securely manage and eSign your medical expenses worksheet, ensuring that your documentation meets legal standards.

IRS Guidelines

The IRS provides specific guidelines on what qualifies as a deductible medical expense. According to IRS Publication 502, eligible expenses include a wide range of medical services and products. Taxpayers should familiarize themselves with these guidelines to ensure they accurately report their medical expenses. Key points include understanding the difference between qualified medical expenses and those that are not deductible, as well as knowing the limits and thresholds for deductions based on adjusted gross income.

Filing Deadlines / Important Dates

Filing deadlines for tax returns, including those that involve the medical expenses worksheet, are typically set by the IRS. For most taxpayers, the deadline to file your federal income tax return is April 15. However, if you require additional time, you can file for an extension, which typically allows for an additional six months. It is important to be aware of these deadlines to avoid penalties and ensure that you submit your medical expenses worksheet in a timely manner.

Required Documents

To accurately complete the medical expenses worksheet, several documents are necessary. Collect the following:

- Receipts for all medical expenses incurred

- Insurance statements and Explanation of Benefits (EOB) documents

- Records of any reimbursements received from insurance or health savings accounts

Having these documents organized will facilitate the completion of the worksheet and help ensure that all eligible expenses are accounted for.

Quick guide on how to complete medical expenses worksheet

Easily Prepare Medical Expenses Worksheet on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Medical Expenses Worksheet on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Medical Expenses Worksheet Effortlessly

- Find Medical Expenses Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Medical Expenses Worksheet and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the medical expenses worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a medical expenses worksheet?

A medical expenses worksheet is a tool that helps individuals and businesses track and calculate their medical expenses for tax purposes. Using airSlate SignNow, you can easily create and manage your medical expenses worksheet with eSigning capabilities to ensure that all parties sign and complete necessary documentation efficiently.

-

How can airSlate SignNow help me with managing my medical expenses worksheet?

airSlate SignNow provides a comprehensive platform to digitally create, send, and eSign your medical expenses worksheet. Our user-friendly interface ensures you can track expenses seamlessly, and the eSignature feature streamlines the approval process, making it easier to manage and document your medical expenses.

-

Is airSlate SignNow cost-effective for creating a medical expenses worksheet?

Yes, airSlate SignNow is a cost-effective solution for creating and managing your medical expenses worksheet. With flexible pricing plans, you can choose an option that fits your budget while gaining access to powerful features that simplify document management and eSigning.

-

What features does airSlate SignNow offer for medical expenses worksheet management?

airSlate SignNow offers a variety of features for managing your medical expenses worksheet, including customizable templates, secure cloud storage, and advanced eSignature capabilities. These tools enhance your productivity and streamline the process of tracking and signing medical expense documents.

-

Can I integrate airSlate SignNow with other applications for better management of my medical expenses worksheet?

Absolutely! airSlate SignNow allows for seamless integration with various applications such as CRM and accounting software, enhancing the management of your medical expenses worksheet. This integration helps you keep all related documentation and data in one centralized place, improving workflow efficiency.

-

How secure is airSlate SignNow when handling my medical expenses worksheet?

Security is a top priority at airSlate SignNow. When creating your medical expenses worksheet, we implement industry-standard encryption and secure authentication processes to protect your sensitive information. You can trust that your data remains safe while you manage and sign documents online.

-

Can I share my medical expenses worksheet with others using airSlate SignNow?

Yes, with airSlate SignNow, you can easily share your medical expenses worksheet with colleagues, accountants, or family members for review and eSigning. This functionality allows for collaborative work, ensuring that all necessary parties can access and finalize the document efficiently.

Get more for Medical Expenses Worksheet

Find out other Medical Expenses Worksheet

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe