Print Tax Forms 1040

What is the Print Tax Forms 1040

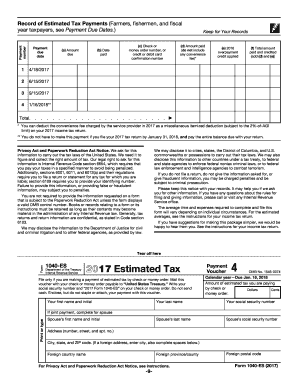

The print tax forms 1040 is the standard federal income tax form used by individuals in the United States to report their annual income. This form is essential for calculating the amount of tax owed or the refund due to the taxpayer. The 1040 form allows taxpayers to detail their income, claim deductions, and report credits, which can significantly affect their tax liability. The 2017 version includes specific lines and schedules that cater to various income types and deductions, ensuring that taxpayers can accurately report their financial situation.

How to Use the Print Tax Forms 1040

Using the print tax forms 1040 involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary documents, including W-2s, 1099s, and receipts for deductible expenses. Next, carefully fill out the form, ensuring that all income sources are reported and deductions are claimed correctly. It is crucial to follow the instructions provided with the form, as they guide taxpayers on how to complete each section. Once completed, the form can be submitted either by mail or electronically, depending on the taxpayer's preference.

Steps to Complete the Print Tax Forms 1040

Completing the print tax forms 1040 involves a systematic approach:

- Gather all income documents, including W-2s and 1099s.

- Determine your filing status (single, married filing jointly, etc.).

- Fill out personal information, including your name, address, and Social Security number.

- Report all income on the appropriate lines, including wages, interest, and dividends.

- Claim deductions and credits, ensuring you have documentation to support your claims.

- Calculate your total tax liability using the tax tables provided.

- Review the form for accuracy before submission.

Legal Use of the Print Tax Forms 1040

The print tax forms 1040 is legally recognized by the IRS as the official document for reporting income and tax liabilities. To ensure its legal validity, it must be completed accurately and submitted by the designated deadlines. Additionally, eSignatures can be used for electronic submissions, provided they comply with the relevant eSignature laws. It is important to retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the print tax forms 1040 are crucial for compliance. For the 2017 tax year, the deadline to file was April 17, 2018. Taxpayers who needed additional time could file for an extension, allowing them until October 15, 2018, to submit their forms. However, it is important to note that an extension to file does not extend the deadline to pay any taxes owed. Taxpayers should be aware of these dates to avoid penalties and interest on late payments.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the print tax forms 1040. The most common methods include:

- Online Submission: Taxpayers can e-file their forms using IRS-approved software, which often provides a streamlined process and faster refunds.

- Mail: The completed form can be mailed to the appropriate IRS address based on the taxpayer's location and whether a payment is included.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, although this method is less common.

Quick guide on how to complete print tax forms 1040

Effortlessly Prepare Print Tax Forms 1040 on Any Device

Online document management has become increasingly prevalent among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without any holdups. Manage Print Tax Forms 1040 on any device using airSlate SignNow's Android or iOS applications and elevate any document-centric operation today.

The Most Convenient Way to Alter and eSign Print Tax Forms 1040 with Ease

- Find Print Tax Forms 1040 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—by email, SMS, or invite link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Print Tax Forms 1040 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the print tax forms 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I print tax forms 1040 2017 using airSlate SignNow?

To print tax forms 1040 2017 with airSlate SignNow, simply upload your completed tax document to our platform, make any necessary adjustments, and click on the print option. Our user-friendly interface ensures that printing your forms is straightforward and efficient. Once printed, you can submit your forms to the IRS with confidence.

-

What features does airSlate SignNow offer for printing tax forms?

airSlate SignNow offers features like easy document uploads, customizable templates, and direct printing options specifically designed for documents like tax forms 1040 2017. With our platform, you can also eSign your forms seamlessly before printing. This combination ensures that you're fully prepared for tax season.

-

Are there any costs associated with printing tax forms 1040 2017 on airSlate SignNow?

Using airSlate SignNow to print tax forms 1040 2017 comes at a minimal cost that delivers high value. Our subscription plans offer affordable pricing with no hidden fees, allowing you to efficiently manage your documents without breaking the bank. You can even start with a free trial to assess our services.

-

Can I integrate airSlate SignNow with other tools to manage my tax documents?

Yes, airSlate SignNow supports seamless integrations with various accounting and tax software, allowing you to print tax forms 1040 2017 alongside managing your finances efficiently. Our API and pre-built integrations make it easy to connect with tools like QuickBooks and Xero, improving your document workflow.

-

Is it safe to print tax forms 1040 2017 using airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security of your documents. When you use our platform to print tax forms 1040 2017, your data is protected with advanced encryption and safety protocols. You can trust us to keep your information secure while providing you with the essential printing services.

-

What are the benefits of using airSlate SignNow to print tax forms 1040 2017?

The major benefits of using airSlate SignNow include efficiency, ease of use, and affordability when printing tax forms 1040 2017. Our platform eliminates traditional hassles associated with printing by providing a streamlined process. Plus, you can eSign your forms directly, saving time and increasing productivity.

-

Can I download my completed tax forms before printing them?

Yes, airSlate SignNow allows you to download your completed tax forms 1040 2017 in multiple formats before printing. This feature ensures that you have a backup of your documents. Simply download the file in your preferred format and print it or store it for your records.

Get more for Print Tax Forms 1040

- Psychiatrist medical certificate form

- The one page business plan for the creative entrepreneur pdf form

- Employee personal details form nz

- Balancing chemical equations worksheet grade 10 answer key form

- Provisional pension form 33 in hindi

- Affidavit of dependent parents form

- Vtr 62 a application for standard texas exempt license plates form

- D2l2jhoszs7d12 cloudfront net state texasapplication for standard texas exempt license plates form

Find out other Print Tax Forms 1040

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History