Tax Computation Format Malaysia

What is the tax computation format Malaysia?

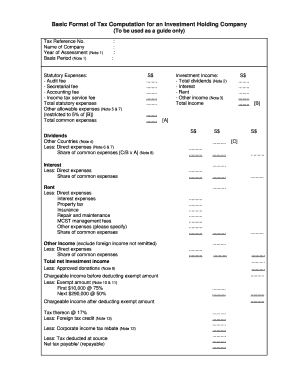

The tax computation format Malaysia is a structured document used to calculate the tax liabilities of individuals or businesses in Malaysia. This format includes various sections that detail income, deductions, and applicable tax rates, ensuring that taxpayers adhere to local regulations. It serves as a critical tool for both personal and corporate tax filings, providing clarity and organization to the tax calculation process.

Key elements of the tax computation format Malaysia

Understanding the key elements of the tax computation format Malaysia is essential for accurate tax reporting. The primary components include:

- Income Section: This section outlines all sources of income, including salaries, business profits, and investment earnings.

- Deductions: Taxpayers can list allowable deductions, such as business expenses, charitable contributions, and personal allowances.

- Tax Rates: The applicable tax rates for different income brackets are specified, guiding taxpayers in calculating their total tax liability.

- Final Tax Calculation: This section summarizes the calculated tax due, taking into account any credits or prepayments.

Steps to complete the tax computation format Malaysia

Completing the tax computation format Malaysia involves several straightforward steps:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Fill out the income section by listing all sources of income accurately.

- Detail your deductions in the appropriate section, ensuring compliance with tax regulations.

- Apply the correct tax rates to your taxable income to determine your tax liability.

- Review the completed form for accuracy and completeness before submission.

Legal use of the tax computation format Malaysia

The legal use of the tax computation format Malaysia is governed by the Income Tax Act and related regulations. To ensure compliance, taxpayers must:

- Adhere to the prescribed format and guidelines set by the Malaysian tax authorities.

- Maintain accurate records that support the information reported on the form.

- Submit the completed form within the stipulated deadlines to avoid penalties.

Examples of using the tax computation format Malaysia

Examples of using the tax computation format Malaysia can help clarify its practical application. For instance:

- A sole proprietorship may use the format to report business income and expenses, ensuring they claim all eligible deductions.

- An individual taxpayer can utilize the format to calculate their annual income tax, factoring in personal allowances and tax credits.

Filing deadlines / Important dates

Filing deadlines for the tax computation format Malaysia are crucial for compliance. Typically, individual taxpayers must submit their forms by April 30 of the following year, while corporate entities have until the end of the seventh month after their financial year-end. Staying informed about these deadlines helps prevent late fees and penalties.

Quick guide on how to complete tax computation format malaysia

Effortlessly Prepare Tax Computation Format Malaysia on Any Device

The management of documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without any delays. Manage Tax Computation Format Malaysia on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and eSign Tax Computation Format Malaysia with Ease

- Locate Tax Computation Format Malaysia and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Thoroughly review all information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Tax Computation Format Malaysia and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax computation format malaysia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the company tax computation format Malaysia Excel?

The company tax computation format Malaysia Excel is a standardized template used for calculating corporate tax liabilities in Malaysia. It simplifies the tax computation process, allowing businesses to efficiently prepare their tax returns while ensuring compliance with Malaysian tax regulations.

-

How can airSlate SignNow help me with the company tax computation format Malaysia Excel?

airSlate SignNow provides seamless integration with your preferred Excel files, enabling you to electronically sign your company tax computation format Malaysia Excel documents. This enhances workflow efficiency and ensures that all parties can review and approve tax documents quickly.

-

Is the company tax computation format Malaysia Excel compliant with Malaysian tax laws?

Yes, the company tax computation format Malaysia Excel is designed to comply with the latest Malaysian tax regulations. Using this format helps businesses accurately calculate their tax obligations, thus minimizing risks associated with incorrect filings.

-

What are the key features of the company tax computation format Malaysia Excel?

Key features of the company tax computation format Malaysia Excel include automated calculations, easy data entry fields, and clear categorization of income and expenses. These features make the tax computation process more efficient, saving time and reducing errors.

-

Can I customize the company tax computation format Malaysia Excel for my business needs?

Absolutely! The company tax computation format Malaysia Excel can be customized to reflect your specific business requirements. This allows you to add custom calculations, additional income sources, or adjust expense categories to better suit your company's financial structure.

-

What benefits do I gain from using the company tax computation format Malaysia Excel?

Using the company tax computation format Malaysia Excel streamlines the tax calculation process, enhances accuracy, and facilitates timely submissions. With the right tools, businesses can focus more on growth rather than spending excessive time on tax preparation.

-

Is airSlate SignNow a cost-effective solution for managing my tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing all your tax documents, including the company tax computation format Malaysia Excel. The platform provides flexible pricing plans that cater to businesses of all sizes, ensuring you get great value.

Get more for Tax Computation Format Malaysia

- Opwdd training requirements guide form

- Non refundable deposit agreement pdf form

- Prize claim form template

- Broward schools seperation of employment iform

- Beta club service hours form

- Ergonomic assessment checklist form

- Seating chart form 6 by 5 blank seating chart 6 by 5 with form field for teachers to type in the names of the students

- Form 656 b offer in compromise instructions

Find out other Tax Computation Format Malaysia

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now