Gst524 Ontario Form

What is the Gst524 Ontario?

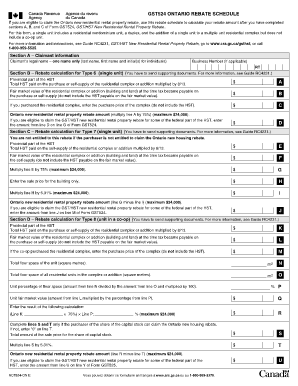

The Gst524 Ontario is a tax form used by residents in Ontario, Canada, primarily for claiming the Ontario Energy and Property Tax Credit. This form serves as a means for eligible individuals to receive financial relief related to energy costs and property taxes. Understanding the purpose of the Gst524 is crucial for ensuring that residents can access the benefits they are entitled to, especially in times of rising energy prices.

How to use the Gst524 Ontario

Using the Gst524 Ontario involves several straightforward steps. First, ensure you meet the eligibility criteria, which typically includes being a resident of Ontario and meeting specific income thresholds. Once eligibility is confirmed, you can obtain the form from the appropriate government website or through tax preparation software. After filling out the required information, including personal details and income, you can submit the form electronically or via traditional mail, depending on your preference.

Steps to complete the Gst524 Ontario

Completing the Gst524 Ontario requires careful attention to detail. Start by gathering all necessary documents, such as proof of income and property tax receipts. Next, follow these steps:

- Download the Gst524 form from the official website or access it through tax software.

- Fill in your personal information, including your name, address, and Social Insurance Number.

- Provide details about your income and any deductions you may qualify for.

- Review the form for accuracy before submission.

Finally, submit the completed form by the specified deadline to ensure you receive your credit in a timely manner.

Legal use of the Gst524 Ontario

The Gst524 Ontario is legally recognized as a valid document for claiming tax credits. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame. Compliance with the regulations set forth by the Canada Revenue Agency is essential for the form to be accepted. Utilizing a reliable eSignature solution can further enhance the legal validity of your submission by providing a secure and verifiable method of signing the document.

Eligibility Criteria

To qualify for the Gst524 Ontario, applicants must meet specific eligibility criteria. Generally, this includes being a resident of Ontario and having a household income below a certain threshold. Additional factors, such as age and family status, may also play a role in determining eligibility. It is important to review the latest guidelines from the Canada Revenue Agency to ensure compliance with all requirements.

Form Submission Methods

The Gst524 Ontario can be submitted through various methods to accommodate different preferences. Residents can choose to file the form online using the Canada Revenue Agency's secure portal, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own processing times, so it is advisable to choose one that aligns with your needs.

Quick guide on how to complete gst524 ontario

Complete Gst524 Ontario effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Gst524 Ontario on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and electronically sign Gst524 Ontario without hassle

- Locate Gst524 Ontario and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Gst524 Ontario and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst524 ontario

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst524 and how does it relate to airSlate SignNow?

The gst524 is a specific document or form that businesses often need to manage efficiently. With airSlate SignNow, you can easily create, send, and eSign gst524 forms, ensuring that your document workflow is streamlined and compliant with regulations.

-

How much does it cost to use airSlate SignNow for managing gst524 documents?

AirSlate SignNow offers various pricing plans designed to fit different business needs. Whether you are a small business or a large enterprise, you can find a plan that allows you to manage your gst524 documents at a cost-effective rate, making the solution accessible for everyone.

-

What are the key features of airSlate SignNow for gst524 document handling?

AirSlate SignNow provides a range of features to enhance the handling of gst524 documents, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your document process is efficient and transparent, saving you time and resources.

-

Can I integrate airSlate SignNow with other applications for managing gst524 document workflows?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Dropbox. Integrating these tools allows you to manage gst524 documents more effectively across your existing workflows, enhancing productivity.

-

What are the benefits of using airSlate SignNow for gst524 eSigning?

Using airSlate SignNow for gst524 eSigning provides numerous benefits, including increased efficiency and reduced paperwork. By digitizing your signing process, you can quickly send out gst524 forms and obtain signatures in a matter of minutes, streamlining your operations.

-

Is airSlate SignNow secure for handling sensitive gst524 documents?

Absolutely! AirSlate SignNow prioritizes security and compliance, utilizing encryption and secure storage to protect your gst524 documents. You can trust the platform to handle sensitive information safely, adhering to industry standards.

-

How can airSlate SignNow help with compliance for gst524 documents?

AirSlate SignNow aids in compliance by providing legally binding eSignatures and maintaining an audit trail for all transactions related to gst524 documents. This ensures that your business meets regulatory requirements and preserves accountability.

Get more for Gst524 Ontario

Find out other Gst524 Ontario

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple