St 100 Fillable Form

What is the St 100 Fillable Form

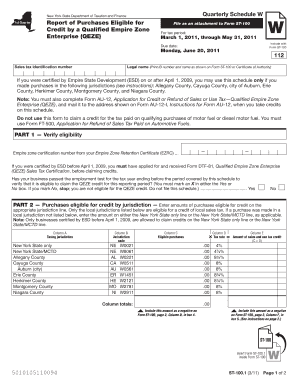

The St 100 fillable form is a specific document used for various tax and legal purposes within the United States. This form is designed to facilitate the collection of essential information required by state authorities, ensuring compliance with local regulations. It is often utilized by individuals and businesses alike to report income, claim deductions, or fulfill other statutory obligations. The fillable format allows users to complete the form digitally, making it more accessible and efficient.

How to Use the St 100 Fillable Form

Using the St 100 fillable form involves several straightforward steps. First, download the form from a reliable source, ensuring it is the most current version. Next, open the form in a compatible PDF reader or form-filling software. Carefully fill in the required fields, providing accurate information to avoid potential issues. Once completed, review the form for any errors before saving it. Finally, submit the form according to the specified method, whether online, by mail, or in person, depending on the requirements.

Steps to Complete the St 100 Fillable Form

Completing the St 100 fillable form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Access the form from an official source.

- Open the form in a PDF reader or editor.

- Fill in personal or business information as required.

- Provide any necessary financial data, ensuring it is accurate and up-to-date.

- Review the completed form for any mistakes or missing information.

- Save the form securely on your device.

- Submit the form according to the guidelines provided, ensuring it reaches the appropriate agency.

Legal Use of the St 100 Fillable Form

The legal use of the St 100 fillable form hinges on its compliance with state and federal regulations. When filled out correctly, this form serves as a legally binding document that can be used in various legal and financial contexts. It is crucial to adhere to all instructions and guidelines associated with the form to ensure its validity. Additionally, using a reliable electronic signature solution can enhance the legal standing of the document, providing an added layer of security and authenticity.

Who Issues the Form

The St 100 fillable form is typically issued by state tax authorities or relevant government agencies. These entities are responsible for providing the necessary documentation for individuals and businesses to fulfill their tax obligations. It is important to check with the specific state agency to obtain the correct version of the form and to understand any unique requirements associated with its use.

Filing Deadlines / Important Dates

Filing deadlines for the St 100 fillable form can vary based on the specific purpose of the form and the jurisdiction in which it is used. Generally, it is essential to submit the form by the designated due date to avoid penalties or interest. Users should consult the guidelines provided by the issuing agency to determine the exact deadlines applicable to their situation. Keeping track of these dates is crucial for maintaining compliance and ensuring timely submissions.

Quick guide on how to complete st 100 fillable form

Prepare St 100 Fillable Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the right form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without interruptions. Manage St 100 Fillable Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and electronically sign St 100 Fillable Form without any hassle

- Locate St 100 Fillable Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or the need to print new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign St 100 Fillable Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 100 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ST 100 fillable form?

The ST 100 fillable form is a tax form used in certain jurisdictions for reporting sales tax. It can be easily filled out, signed, and submitted electronically. Using the airSlate SignNow platform allows for streamlined completion and submission of the ST 100 fillable form.

-

How can I easily create an ST 100 fillable form with airSlate SignNow?

Creating an ST 100 fillable form with airSlate SignNow is simple and intuitive. Users can start with a blank form or upload an existing document and convert it into a fillable format. The platform’s editing tools enable you to customize the form to meet your specific needs.

-

Is there a cost associated with using the ST 100 fillable form on airSlate SignNow?

Yes, there are pricing plans available for using airSlate SignNow, which include features for managing the ST 100 fillable form. Plans vary based on the number of users and features required, but airSlate SignNow offers cost-effective options to fit different budgets.

-

What features does airSlate SignNow offer for the ST 100 fillable form?

AirSlate SignNow provides various features for the ST 100 fillable form, including eSignature capabilities, document sharing, and secure storage. Additionally, users can track the status of their forms and receive notifications when documents are completed.

-

Can I integrate airSlate SignNow with other software for my ST 100 fillable form?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing the functionality of your ST 100 fillable form. Popular integrations include CRM systems and document management tools, allowing for easier workflow and data management.

-

What are the benefits of using airSlate SignNow for the ST 100 fillable form?

Using airSlate SignNow for your ST 100 fillable form simplifies the process of document completion and signing, saving time and reducing errors. The platform is user-friendly and creates a more efficient workflow, allowing for faster submission of important tax forms.

-

Is it secure to use airSlate SignNow for my ST 100 fillable form?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with global standards. Your ST 100 fillable form and personal data are protected at every stage of the signing process, ensuring confidentiality and safety.

Get more for St 100 Fillable Form

Find out other St 100 Fillable Form

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast