L941 Form

What is the L941?

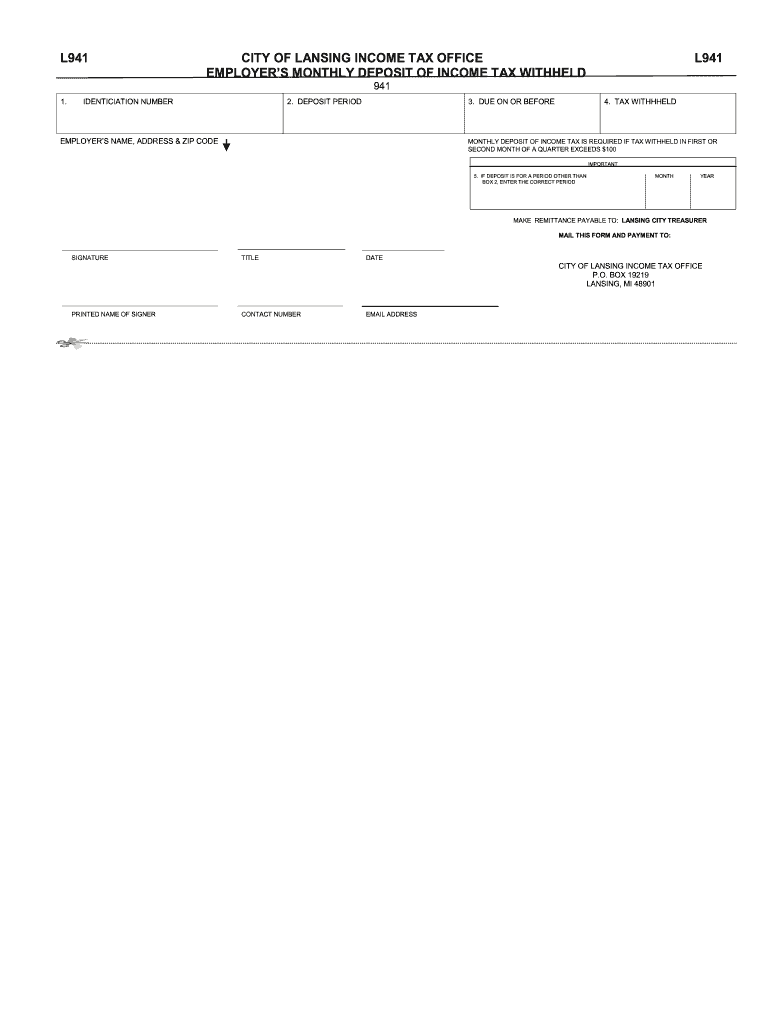

The L941 form, specifically for the City of Lansing, is a tax document used by businesses to report their income tax liabilities. It is essential for ensuring compliance with local tax regulations. This form requires accurate reporting of wages paid to employees and the corresponding tax withheld. The L941 is a critical component in the tax filing process for businesses operating within Lansing, as it helps the City of Lansing Income Tax Department assess the correct amount of tax owed.

Steps to complete the L941

Completing the L941 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect data on employee wages, tax withheld, and any relevant deductions.

- Fill out the form: Input the gathered information into the appropriate sections of the L941 form. Ensure that all figures are accurate and match your payroll records.

- Review for accuracy: Double-check all entries to prevent errors that could lead to penalties or delayed processing.

- Sign and date the form: An authorized individual must sign the form, confirming that the information provided is correct.

- Submit the form: Choose your submission method, whether online, by mail, or in-person, and ensure it is sent by the deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the L941 form to avoid penalties. Typically, the L941 must be filed quarterly, with specific deadlines for each quarter:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

Staying informed about these dates helps ensure timely compliance with local tax laws.

Legal use of the L941

The L941 form is legally binding when completed accurately and submitted according to the City of Lansing's regulations. It serves as an official record of income tax liabilities and payments made by businesses. Failure to file the L941 or submitting incorrect information can result in legal consequences, including fines and penalties. Understanding the legal implications of this form is essential for business owners to maintain compliance and avoid potential disputes with tax authorities.

Who Issues the Form

The L941 form is issued by the City of Lansing Income Tax Department. This department is responsible for overseeing the collection of income taxes within the city and ensuring that businesses comply with local tax laws. For any questions regarding the form or its requirements, businesses can contact the City of Lansing Income Tax Office for guidance and support.

Form Submission Methods

Businesses have several options for submitting the L941 form:

- Online: The preferred method, allowing for quick processing and confirmation of submission.

- By Mail: Businesses can print the completed form and send it to the designated address for tax submissions.

- In-Person: Submissions can also be made directly at the City of Lansing Income Tax Office, providing an opportunity for immediate assistance if needed.

Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete l941 city of lansing income tax office l941 employers lansingmi

Your assistance manual on how to prepare your L941

If you’re wondering how to create and file your L941, here are some concise guidelines on making tax submission easier.

To get started, you simply need to set up your airSlate SignNow account to transform your approach to handling documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to adjust answers as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your L941 in no time:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to access any IRS tax form; browse through variations and schedules.

- Press Get form to launch your L941 in our editor.

- Complete the essential fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to increased return errors and delayed refunds. Additionally, before e-filing your taxes, verify the IRS website for filing rules in your state.

Create this form in 5 minutes or less

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the l941 city of lansing income tax office l941 employers lansingmi

How to create an eSignature for your L941 City Of Lansing Income Tax Office L941 Employers Lansingmi in the online mode

How to make an electronic signature for the L941 City Of Lansing Income Tax Office L941 Employers Lansingmi in Google Chrome

How to create an electronic signature for putting it on the L941 City Of Lansing Income Tax Office L941 Employers Lansingmi in Gmail

How to generate an electronic signature for the L941 City Of Lansing Income Tax Office L941 Employers Lansingmi from your mobile device

How to generate an eSignature for the L941 City Of Lansing Income Tax Office L941 Employers Lansingmi on iOS

How to create an eSignature for the L941 City Of Lansing Income Tax Office L941 Employers Lansingmi on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to l941 city lansing?

airSlate SignNow is a powerful eSigning solution that enables businesses in l941 city lansing to manage document workflows seamlessly. With its easy-to-use interface, organizations can send, sign, and organize their documents efficiently. This solution is ideal for local businesses looking to optimize their operations in the l941 city lansing area.

-

How does pricing work for airSlate SignNow in l941 city lansing?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes in l941 city lansing. Customers can choose from various subscription options, including monthly and annual plans. This way, businesses in l941 city lansing can find a cost-effective solution that meets their specific needs.

-

What are the key features of airSlate SignNow for users in l941 city lansing?

Key features of airSlate SignNow for l941 city lansing users include customizable templates, document collaboration, and advanced security measures. These features enable businesses to streamline their eSigning processes while ensuring sensitive information remains protected. Users in l941 city lansing can benefit from integrated workflows that boost overall productivity.

-

What are the benefits of using airSlate SignNow for businesses in l941 city lansing?

Using airSlate SignNow provides numerous benefits for businesses in l941 city lansing, including increased efficiency and reduced turnaround times for document signing. The platform's intuitive design allows users to navigate easily, saving time and resources. Additionally, it enhances customer experiences through quick and reliable document management.

-

Are there integration options available for airSlate SignNow in l941 city lansing?

Yes, airSlate SignNow offers a variety of integration options that cater to businesses in l941 city lansing. Users can connect the platform with popular tools such as Google Drive, Salesforce, and more. This ability to integrate with existing systems ensures a smooth flow of information and enhances overall operational efficiency.

-

Can airSlate SignNow help with legal compliance in l941 city lansing?

Absolutely! airSlate SignNow is designed to meet legal compliance standards, making it a reliable choice for businesses in l941 city lansing. The platform complies with eSignature laws, ensuring that all signed documents are legally binding. This commitment to compliance gives businesses peace of mind in managing their digital documentation.

-

How can I get started with airSlate SignNow in l941 city lansing?

Getting started with airSlate SignNow in l941 city lansing is simple. Potential users can visit the SignNow website to sign up for a free trial or choose a subscription plan. Once registered, businesses can quickly start uploading documents and sending them for eSignature, streamlining their processes from day one.

Get more for L941

- Apy form

- Annexure g performance quarterly perforamce assessment

- Tr1 form completed example

- Affidavit of affixture utah form

- Women39s health intake form iowa department of public health idph state ia

- Cfs 374 transition funding application and disbursement plan form

- Emancipation application form

- Dasa contractual policy manual illinois department of form

Find out other L941

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template