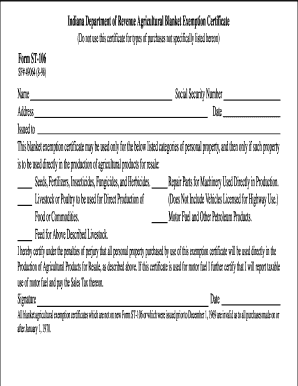

Sf 49064 Form

What is the Indiana Form 106?

The Indiana Form 106, also known as the Indiana personal property tax form 106, is a tax document used by businesses and individuals to report personal property for taxation purposes. This form is essential for accurately assessing the value of personal property owned as of January first of the tax year. It includes information about various types of personal property, such as machinery, equipment, and furniture. Completing this form correctly ensures compliance with Indiana tax laws and helps in determining the appropriate tax obligations.

Steps to Complete the Indiana Form 106

Filling out the Indiana Form 106 requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary information about all personal property owned as of January first.

- List each type of property, including its location and estimated value.

- Complete the required sections of the form, ensuring all information is accurate.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county assessor by the specified deadline.

Legal Use of the Indiana Form 106

The Indiana Form 106 is legally binding once submitted. It is crucial to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be filed annually, and failure to do so may result in additional fines or legal consequences. Understanding the legal implications of this form helps taxpayers maintain compliance with state tax regulations.

Filing Deadlines / Important Dates

Timely filing of the Indiana Form 106 is essential to avoid penalties. The form must be submitted by May 15 of each year. If May 15 falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these deadlines helps ensure that personal property is reported accurately and on time, preventing any unnecessary penalties.

Form Submission Methods

The Indiana Form 106 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the county assessor's website.

- Mailing a printed copy of the completed form to the appropriate county office.

- In-person submission at the local county assessor's office.

Choosing the right method for submission can streamline the process and ensure that the form is received on time.

Key Elements of the Indiana Form 106

Understanding the key elements of the Indiana Form 106 is vital for accurate completion. The form typically includes:

- Identification information for the taxpayer, including name and address.

- A detailed list of personal property, categorized by type.

- Estimated values for each item of personal property.

- Signature of the taxpayer or authorized representative, certifying the accuracy of the information provided.

Each of these elements plays a critical role in the assessment process and ensures compliance with Indiana tax laws.

Quick guide on how to complete sf 49064

Complete Sf 49064 seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Sf 49064 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Sf 49064 effortlessly

- Obtain Sf 49064 and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow covers all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Sf 49064 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sf 49064

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Form 106 and who needs to file it?

The Indiana Form 106 is used by partnerships and limited liability companies (LLCs) to report income and calculate taxes owed to the state. Businesses with income derived from Indiana sources must file this form annually. Making sure that you have the correct Indiana Form 106 filled out is crucial for compliance with state tax requirements.

-

How can airSlate SignNow help me with the Indiana Form 106?

airSlate SignNow simplifies the process of signing and sending the Indiana Form 106. With its user-friendly interface, you can quickly prepare the form, collect necessary signatures, and ensure secure document handling. This streamlines your tax filing process and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the Indiana Form 106?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for submitting the Indiana Form 106. These plans are competitively priced and provide access to essential features for efficient document management. Investing in an airSlate SignNow subscription can save you time and effort while preparing and filing your forms.

-

What integrations does airSlate SignNow offer for processing the Indiana Form 106?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. This means you can easily access and manage all your documents, including the Indiana Form 106, from one platform. These integrations enhance your productivity and make document collaboration easier.

-

What are the benefits of eSigning the Indiana Form 106 with airSlate SignNow?

eSigning the Indiana Form 106 with airSlate SignNow provides a secure and legally binding method to sign documents. It eliminates the need for paper printing, scanning, or mailing, speeding up your filing process. Additionally, it allows for remote signing, making it convenient for all parties involved.

-

Can I save templates for frequently used Indiana forms in airSlate SignNow?

Yes, airSlate SignNow allows you to create and save templates for frequently used documents, including the Indiana Form 106. This feature saves time by letting you quickly access and fill out the form without starting from scratch. Easily customize templates for different scenarios or business needs.

-

Is airSlate SignNow compliant with legal standards for signing the Indiana Form 106?

Absolutely, airSlate SignNow complies with eSignature laws, ensuring that your signed Indiana Form 106 is legally valid. The platform adheres to regulations set forth by the ESIGN Act and UETA, giving you confidence in the legal standing of your documents. Your eSigned forms are protected and can be used with certainty in legal and tax matters.

Get more for Sf 49064

Find out other Sf 49064

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney