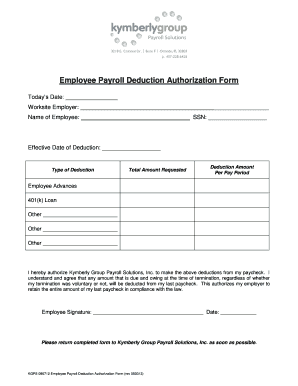

Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name of Employee SSN Effective Date of Deduction Typ

Understanding the Employee Payroll Deduction Authorization Form

The Employee Payroll Deduction Authorization Form is a crucial document that allows employees to authorize specific deductions from their paychecks. This form typically includes essential details such as the employee's name, Social Security Number (SSN), and the effective date of the deduction. It also specifies the type of deduction, whether for benefits like a 401(k) loan, employee advances, or other financial commitments. Understanding this form is vital for both employees and employers to ensure accurate payroll processing and compliance with financial regulations.

Steps to Complete the Employee Payroll Deduction Authorization Form

Completing the Employee Payroll Deduction Authorization Form requires careful attention to detail. Here are the steps to follow:

- Begin by entering today's date to indicate when the form is being completed.

- Provide the worksite and employer name to ensure the form is correctly associated with the right organization.

- Fill in the employee's name and Social Security Number (SSN) for identification purposes.

- Specify the effective date of the deduction to clarify when the deductions will begin.

- Indicate the type of deduction, such as a 401(k) loan or other specified deductions.

- State the total amount requested for the deduction and the deduction amount per pay period.

- Review all entries for accuracy before signing and submitting the form.

Legal Use of the Employee Payroll Deduction Authorization Form

The Employee Payroll Deduction Authorization Form holds legal significance as it serves as a binding agreement between the employee and employer regarding payroll deductions. For the form to be legally valid, it must be completed accurately and signed by the employee. Compliance with federal and state regulations, including the ESIGN Act and UETA, is essential to ensure that the electronic signatures are recognized as valid. Employers should maintain records of these forms to protect against disputes regarding payroll deductions.

Key Elements of the Employee Payroll Deduction Authorization Form

Several key elements must be included in the Employee Payroll Deduction Authorization Form to ensure its effectiveness and compliance:

- Employee Information: This includes the employee's name, SSN, and worksite details.

- Deduction Details: Clearly state the type of deduction, such as a 401(k) loan or other financial obligations.

- Effective Date: Specify when the deductions will start to take effect.

- Amount Information: Include both the total amount requested and the deduction amount per pay period.

- Employee Signature: The form must be signed by the employee to validate the authorization.

How to Obtain the Employee Payroll Deduction Authorization Form

The Employee Payroll Deduction Authorization Form can typically be obtained through the human resources department of your organization. Many companies provide these forms in digital format, allowing employees to fill them out electronically. Additionally, employers may have templates available on their internal portals or websites. If you are unable to find the form, consider reaching out directly to your HR representative for assistance.

Quick guide on how to complete employee payroll deduction authorization form todays date worksite employer name of employee ssn effective date of deduction

Effortlessly Prepare Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ on Any Device

The management of documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The Easiest Method to Edit and Electronically Sign Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ with Ease

- Obtain Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee payroll deduction authorization form todays date worksite employer name of employee ssn effective date of deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee Payroll Deduction Authorization Form?

The Employee Payroll Deduction Authorization Form is a document that allows employers to manage deductions from an employee's pay. It includes important details such as today's date, worksite, employer name, employee's SSN, effective date of deduction, type of deduction, total amount requested, and deduction amount per pay period for programs like 401k loans or other advances.

-

How can I fill out the Employee Payroll Deduction Authorization Form?

Filling out the Employee Payroll Deduction Authorization Form is simple with airSlate SignNow. You can input all required information, including today's date, employer name, and deduction details, directly in our user-friendly platform and send it for eSignature to streamline the process.

-

What types of deductions can I manage with this form?

The Employee Payroll Deduction Authorization Form allows you to manage various deductions such as 401k contributions, payroll advances, and other types of deductions you might need. You can specify the total amount requested and the deduction amount per pay period to ensure clarity for both employer and employee.

-

Is the Employee Payroll Deduction Authorization Form secure?

Yes, airSlate SignNow prioritizes security when transmitting documents like the Employee Payroll Deduction Authorization Form. We use encryption and secure sharing features to protect sensitive information such as the employee's SSN and financial details throughout the process.

-

Can I integrate the Employee Payroll Deduction Authorization Form with other software?

Absolutely! The Employee Payroll Deduction Authorization Form can be easily integrated with popular HR and payroll software tools. This integration helps automate the deduction process and ensures that all details including today's date and effective deduction dates are accurately maintained across systems.

-

What are the benefits of using airSlate SignNow for payroll deduction forms?

Using airSlate SignNow for your Employee Payroll Deduction Authorization Form ensures ease of use, cost-effectiveness, and compliance. Our platform simplifies the process by enabling eSigning, tracking, and secure storage, making it ideal for both employers and employees.

-

How do I correct mistakes on the Employee Payroll Deduction Authorization Form?

If you notice a mistake on the Employee Payroll Deduction Authorization Form, you can easily edit the digital document before sending it out for signature. airSlate SignNow allows for quick adjustments to information such as the type of deduction or amounts, ensuring accuracy and compliance.

Get more for Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ

Find out other Employee Payroll Deduction Authorization Form Todays Date Worksite Employer Name Of Employee SSN Effective Date Of Deduction Typ

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT