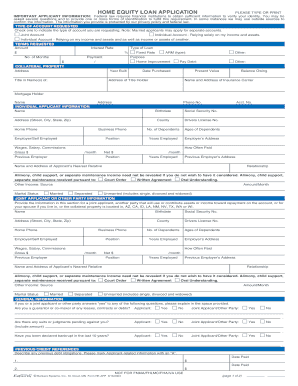

HOME EQUITY LOAN APPLICATION Form

What is the home equity loan application?

The home equity loan application is a formal document that individuals use to request a loan secured by the equity in their home. This type of loan allows homeowners to borrow against the value of their property, which can be beneficial for various financial needs, such as home improvements, debt consolidation, or major purchases. The application typically requires personal information, financial details, and information about the property being used as collateral.

Steps to complete the home equity loan application

Completing the home equity loan application involves several key steps:

- Gather necessary documents, including proof of income, tax returns, and details about your property.

- Fill out the application form with accurate personal and financial information.

- Provide information about your current mortgage, including balance and lender details.

- Review the application for accuracy and completeness before submission.

- Submit the application electronically or via traditional mail, depending on the lender's requirements.

Required documents for the home equity loan application

To successfully complete the home equity loan application, certain documents are essential:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or proof of income.

- Tax returns for the past two years.

- Current mortgage statement, detailing the balance and lender.

- Homeowners insurance policy information.

Legal use of the home equity loan application

The legal use of the home equity loan application is governed by various regulations that ensure the protection of both the borrower and lender. The application must comply with federal and state laws, including the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). These laws require lenders to provide clear information about loan terms, fees, and the borrower's rights, ensuring transparency throughout the application process.

Application process and approval time

The application process for a home equity loan typically involves several stages:

- Submission of the completed application along with required documents.

- Review by the lender, which may include a credit check and verification of financial information.

- Appraisal of the property to determine its current market value.

- Final approval or denial of the loan based on the lender's assessment.

The approval time can vary, but it generally takes anywhere from a few days to several weeks, depending on the lender's workload and the complexity of the application.

Eligibility criteria for the home equity loan application

Eligibility for a home equity loan typically includes several factors:

- Homeownership: You must own the home you are borrowing against.

- Equity: Sufficient equity in the home is required, usually at least twenty percent.

- Credit score: A good credit score is often necessary to qualify for favorable loan terms.

- Debt-to-income ratio: Lenders assess your income relative to your existing debts to ensure you can manage additional payments.

Quick guide on how to complete home equity loan application

Effortlessly Prepare HOME EQUITY LOAN APPLICATION on Any Device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage HOME EQUITY LOAN APPLICATION on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign HOME EQUITY LOAN APPLICATION

- Locate HOME EQUITY LOAN APPLICATION and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors necessitating the printing of new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign HOME EQUITY LOAN APPLICATION to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home equity loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a HOME EQUITY LOAN APPLICATION?

A HOME EQUITY LOAN APPLICATION is a process where homeowners can borrow against the equity in their home. This type of loan allows you to access cash for various needs, such as home renovations or debt consolidation. Understanding the application process is essential to ensure you get the best rates and terms.

-

What documents are needed for a HOME EQUITY LOAN APPLICATION?

To complete a HOME EQUITY LOAN APPLICATION, you'll typically need documents that verify your income, credit history, and home ownership. These may include tax returns, pay stubs, and property deeds. Ensuring you have all the necessary paperwork will streamline your application process.

-

How long does a HOME EQUITY LOAN APPLICATION take?

The timeline for a HOME EQUITY LOAN APPLICATION can vary, but it generally takes a few weeks from application to closing. Factors influencing this timeline include the lender's processing speed and your preparedness with required documentation. Being organized can help expedite the process.

-

Are there any fees associated with a HOME EQUITY LOAN APPLICATION?

Yes, there are often fees associated with a HOME EQUITY LOAN APPLICATION, such as appraisal fees, origination fees, and closing costs. These costs can vary signNowly between lenders, so it's advisable to compare multiple offers. Understanding these fees upfront can help you budget accordingly.

-

What are the benefits of applying for a HOME EQUITY LOAN?

Applying for a HOME EQUITY LOAN can offer several benefits, including lower interest rates compared to unsecured loans and potential tax deductions on interest payments. Moreover, it provides access to signNow funds for major expenses. It's an effective way to leverage the value of your home.

-

Can I apply for a HOME EQUITY LOAN online?

Yes, many lenders now offer the ability to submit a HOME EQUITY LOAN APPLICATION online for convenience. This can save you time and allow you to compare various options easily. Make sure to choose a reputable lender with a secure online application process.

-

What are the typical interest rates for a HOME EQUITY LOAN?

Interest rates for a HOME EQUITY LOAN can vary based on market conditions, lender offerings, and your credit profile. Generally, they are lower than personal loans due to the collateral involved. It's wise to shop around to find competitive rates that suit your financial situation.

Get more for HOME EQUITY LOAN APPLICATION

Find out other HOME EQUITY LOAN APPLICATION

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple