Paychex 401k Rollover Form

What is the Paychex 401k Rollover Form

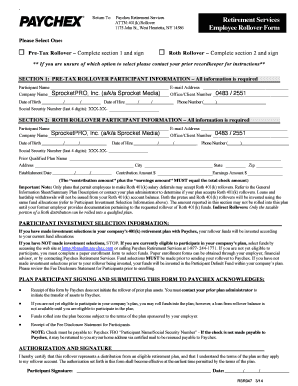

The Paychex 401k rollover form is a crucial document used by individuals who wish to transfer their retirement savings from one 401k plan to another. This process is often undertaken when changing jobs or seeking better investment options. The form facilitates the rollover of funds while ensuring compliance with IRS regulations, allowing for a seamless transition of retirement assets. Proper completion of this form is essential to avoid tax penalties and maintain the tax-deferred status of the retirement savings.

Steps to Complete the Paychex 401k Rollover Form

Completing the Paychex 401k rollover form involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather Necessary Information: Collect personal details, including your Social Security number, current employer information, and the details of the new retirement plan.

- Fill Out the Form: Accurately input all required information, ensuring that each section is complete to avoid delays.

- Review for Accuracy: Double-check all entries for correctness, including account numbers and amounts to be rolled over.

- Sign and Date: Provide your signature and the date to validate the form, confirming your intent to proceed with the rollover.

- Submit the Form: Follow the submission guidelines, whether online, by mail, or in person, as specified by Paychex.

Legal Use of the Paychex 401k Rollover Form

The legal use of the Paychex 401k rollover form is governed by federal regulations that dictate how retirement funds can be transferred. To be considered valid, the form must be completed with accurate information and submitted in accordance with IRS guidelines. Ensuring compliance with these regulations helps protect the tax-deferred status of the funds and avoids potential penalties. Additionally, using a secure platform for electronic signatures enhances the legal standing of the document.

Required Documents

To successfully complete the Paychex 401k rollover form, several documents may be required:

- Current 401k Plan Information: Details about your existing retirement plan, including account statements.

- New Plan Information: Documentation from the new 401k plan, including account numbers and contact information.

- Identification: A form of identification, such as a driver's license or Social Security card, to verify your identity.

Form Submission Methods

The Paychex 401k rollover form can be submitted through various methods, ensuring flexibility for users. The common submission methods include:

- Online Submission: Utilizing digital platforms for a quick and secure submission process.

- Mail: Sending a physical copy of the completed form to the designated Paychex address.

- In-Person: Delivering the form directly to a Paychex office or authorized representative.

Key Elements of the Paychex 401k Rollover Form

Understanding the key elements of the Paychex 401k rollover form is essential for proper completion. Important sections typically include:

- Personal Information: Your name, address, and Social Security number.

- Current Plan Details: Information about your existing 401k plan.

- New Plan Details: Information regarding the new retirement account where funds will be rolled over.

- Signature Section: A space for your signature, confirming the request for the rollover.

Quick guide on how to complete paychex 401k rollover form

Effortlessly Prepare Paychex 401k Rollover Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Paychex 401k Rollover Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Paychex 401k Rollover Form with Ease

- Locate Paychex 401k Rollover Form and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Mark crucial sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to deliver your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Paychex 401k Rollover Form to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the paychex 401k rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Paychex 401k withdrawal form?

The Paychex 401k withdrawal form is a document required for individuals to request a withdrawal from their Paychex 401k retirement account. This form ensures that the withdrawal process is handled correctly, following IRS regulations. Completing the Paychex 401k withdrawal form accurately can help avoid potential delays in processing your request.

-

How can I obtain the Paychex 401k withdrawal form?

You can obtain the Paychex 401k withdrawal form by visiting the Paychex website or contacting their customer service. Additionally, many employers who use Paychex provide access to these forms through their employee portals. Ensuring you have the correct Paychex 401k withdrawal form is crucial for a smooth withdrawal process.

-

What information do I need to complete the Paychex 401k withdrawal form?

When filling out the Paychex 401k withdrawal form, you'll need personal identification information, details about your account, and the amount you wish to withdraw. It's also important to indicate the reason for the withdrawal, as this can affect tax implications. Providing accurate information on the Paychex 401k withdrawal form can help expedite the process.

-

What fees are associated with withdrawing from my Paychex 401k?

Fees for withdrawing from your Paychex 401k may vary based on the plan specifics and the timing of your withdrawal. There might be penalties for early withdrawals if you're under the age of 59½, along with potential taxes. Reviewing the guidelines provided alongside the Paychex 401k withdrawal form can help you understand any costs involved.

-

How long does it take for the Paychex 401k withdrawal to be processed?

Typically, once you've submitted the Paychex 401k withdrawal form, the processing time can range from a few days to a couple of weeks. The exact timeframe may depend on several factors, including the completeness of your form and the payout options chosen. Staying informed about the timing can help you plan accordingly.

-

Can I withdraw funds from my Paychex 401k for any reason?

While you can withdraw funds from your Paychex 401k, eligible reasons often include financial hardship, purchasing a home, or retirement. Different circumstances may require specific documentation on the Paychex 401k withdrawal form. It's advisable to consult the rules governing your account before initiating a withdrawal.

-

Are there any tax implications when using the Paychex 401k withdrawal form?

Yes, there are tax implications associated with withdrawals from your Paychex 401k. Generally, withdrawn amounts are subject to income tax, and early withdrawals may incur additional penalties. It's essential to consult a tax advisor or review IRS guidelines to understand the impact of your Paychex 401k withdrawal.

Get more for Paychex 401k Rollover Form

Find out other Paychex 401k Rollover Form

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement