Fmlareturntowork108 Tax Information for Small Construction Businesses

Understanding the TP 584 Form

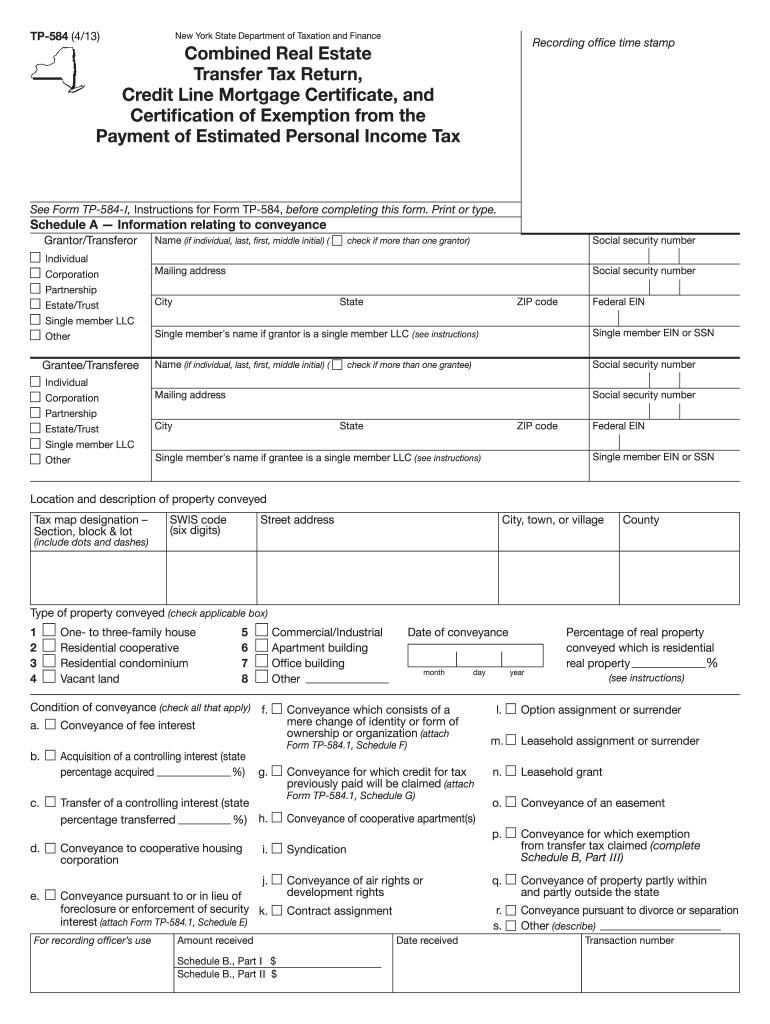

The TP 584 form, also known as the New York State Transfer Tax Form 584, is essential for reporting the transfer of real property in New York. This form is typically required by the New York State Department of Taxation and Finance during real estate transactions. It serves to document the transfer tax due on the sale of real property and is crucial for compliance with state tax regulations. Proper completion of the TP 584 form ensures that both the buyer and seller fulfill their legal obligations regarding property transfer taxes.

Steps to Complete the TP 584 Form

Completing the TP 584 form involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary information, including the property address, the names of the buyer and seller, and the sale price.

- Fill out the form accurately, ensuring all details match the property deed and sales contract.

- Calculate the transfer tax based on the sale price and applicable rates.

- Sign and date the form, as required by New York State regulations.

- Submit the completed form to the appropriate county clerk’s office along with any required payment.

Key Elements of the TP 584 Form

The TP 584 form includes several critical elements that must be accurately filled out. Key components include:

- Property Information: This section requires details about the property being transferred, including its location and type.

- Buyer and Seller Information: Names and addresses of both parties must be clearly stated.

- Sale Price: The total sale price of the property, which is used to calculate the transfer tax.

- Transfer Tax Calculation: A section for calculating the applicable transfer tax based on the sale price.

Legal Use of the TP 584 Form

The TP 584 form is legally binding when completed correctly. It serves as an official record of the property transfer and the associated tax obligations. Failure to submit the form may result in penalties or delays in the property transfer process. It is important to ensure that the form is filled out in accordance with New York State laws to avoid any legal complications.

Filing Deadlines for the TP 584 Form

Timely filing of the TP 584 form is crucial to avoid penalties. Generally, the form must be submitted at the time of the property transfer, often coinciding with the closing date of the real estate transaction. It is advisable to check with local county regulations for any specific deadlines or additional requirements that may apply.

Form Submission Methods

The TP 584 form can be submitted through various methods, depending on the county's regulations:

- In-Person: Many counties allow for in-person submissions at the county clerk's office.

- By Mail: The completed form can often be mailed to the appropriate county office, accompanied by any necessary payments.

- Online: Some counties may offer electronic submission options for the TP 584 form, streamlining the process.

Quick guide on how to complete fmlareturntowork108 tax information for small construction businesses

Effortlessly Prepare Fmlareturntowork108 Tax Information For Small Construction Businesses on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paper documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Fmlareturntowork108 Tax Information For Small Construction Businesses on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Fmlareturntowork108 Tax Information For Small Construction Businesses with Ease

- Obtain Fmlareturntowork108 Tax Information For Small Construction Businesses and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Fmlareturntowork108 Tax Information For Small Construction Businesses and guarantee clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fmlareturntowork108 tax information for small construction businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TP 584 forms, and why are they important?

TP 584 forms are used primarily in New York to transfer the ownership of real property. They play a crucial role in documenting property transfers for tax purposes. Understanding TP 584 forms is essential to ensure that all aspects of the transaction are handled correctly.

-

How can airSlate SignNow assist with filling out TP 584 forms?

With airSlate SignNow, users can easily fill out TP 584 forms online using our intuitive interface. The platform allows for seamless data entry and ensures that the forms are completed accurately. This minimizes errors and saves valuable time during the property transfer process.

-

Is there a cost associated with using airSlate SignNow for TP 584 forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our affordable solutions provide access to features specifically designed for managing TP 584 forms efficiently. Users can choose a plan that best fits their budget and usage requirements.

-

What features does airSlate SignNow offer for managing TP 584 forms?

airSlate SignNow provides features such as eSignature capabilities, document templates, and real-time collaboration tools for TP 584 forms. These features enhance the efficiency of the signing process and ensure that all necessary stakeholders can easily access and complete the forms. Additionally, our platform offers secure cloud storage for your documents.

-

Can I integrate airSlate SignNow with other applications for my TP 584 forms?

Yes, airSlate SignNow supports integration with numerous applications, allowing for a streamlined workflow when handling TP 584 forms. This includes CRM systems, cloud storage solutions, and others. By integrating these tools, you can enhance your document management processes and efficiency.

-

How does airSlate SignNow ensure the security of my TP 584 forms?

Security is a priority at airSlate SignNow, as we implement advanced encryption and authentication measures for your TP 584 forms. This ensures that your documents are safe from unauthorized access. Our platform complies with industry standards to provide peace of mind for all users.

-

Can multiple users collaborate on TP 584 forms using airSlate SignNow?

Absolutely! airSlate SignNow enables multiple users to collaborate on TP 584 forms in real-time. You can share documents with team members or stakeholders, allowing for efficient communication and quick revisions, ensuring a smoother document completion process.

Get more for Fmlareturntowork108 Tax Information For Small Construction Businesses

Find out other Fmlareturntowork108 Tax Information For Small Construction Businesses

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed