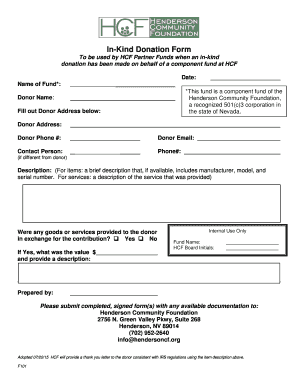

In Kind Donation Form

What is the in kind donation form?

The in kind donation form is a document used to record non-cash contributions made to a charitable organization. These contributions can include goods, services, or other forms of support that do not involve monetary exchange. This form is essential for both the donor and the recipient organization, as it provides a clear record of the donation for accounting and tax purposes. It typically includes details such as the donor's information, a description of the donated items or services, and their estimated value.

How to use the in kind donation form

Using the in kind donation form involves several straightforward steps. First, the donor should fill out the form with accurate information about themselves and the donation. This includes the donor's name, contact information, and a detailed description of the items or services being donated. Next, the estimated value of the donation should be provided, which is crucial for tax reporting purposes. Once completed, both the donor and the recipient organization should sign the form to acknowledge the transaction. This signed document serves as proof of the donation for both parties.

Key elements of the in kind donation form

Several key elements must be included in the in kind donation form to ensure its validity. These elements typically consist of:

- Donor Information: Name, address, and contact details of the donor.

- Description of Donation: A detailed account of the items or services being donated.

- Estimated Value: A fair market value of the donated items, which is important for tax deductions.

- Recipient Information: Name and address of the charitable organization receiving the donation.

- Signatures: Signatures of both the donor and an authorized representative of the organization.

Steps to complete the in kind donation form

Completing the in kind donation form involves the following steps:

- Gather necessary information about the donation, including the type of items or services provided.

- Fill in the donor's personal information accurately.

- Provide a detailed description of the donation, ensuring clarity and completeness.

- Estimate the fair market value of the donated items or services.

- Obtain the signature of the donor and a representative from the recipient organization.

- Keep a copy of the completed form for personal records and tax purposes.

Legal use of the in kind donation form

The legal use of the in kind donation form is crucial for ensuring compliance with tax regulations. In the United States, the IRS requires documentation for non-cash charitable contributions to qualify for tax deductions. The completed form serves as proof of the donation, which may be necessary if the donor is audited. Additionally, the form should be filled out accurately and retained for at least three years following the tax year in which the donation was made, as this period aligns with IRS audit timelines.

IRS guidelines for in kind donations

The IRS provides specific guidelines regarding in kind donations, emphasizing the importance of proper documentation. Donors must ensure that the value of the donated items is substantiated, especially for items valued over five hundred dollars. For donations exceeding five thousand dollars, a qualified appraisal may be required. The in kind donation form should reflect these values and details to comply with IRS regulations, making it a vital document for both tax deductions and legal compliance.

Quick guide on how to complete in kind donation form 390741039

Easily manage In Kind Donation Form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle In Kind Donation Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and electronically sign In Kind Donation Form effortlessly

- Find In Kind Donation Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the entered information and click the Done button to save your updates.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign In Kind Donation Form to ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in kind donation form 390741039

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in kind donation receipt?

An in kind donation receipt is a document that provides acknowledgment of a non-cash contribution made to a nonprofit organization. This receipt outlines the value of the donated goods or services, which is essential for tax purposes. Properly issued, an in kind donation receipt ensures that both the donor and the receiving organization maintain accurate records.

-

How can airSlate SignNow assist in creating in kind donation receipts?

airSlate SignNow simplifies the creation of in kind donation receipts by allowing you to customize templates to suit your organization's needs. You can easily fill in donor information and the specifics of the donation, ensuring all necessary details are captured. Once completed, these receipts can be sent electronically for quick signatures, streamlining your donation processing.

-

What features does airSlate SignNow offer for managing in kind donation receipts?

With airSlate SignNow, you can easily create, send, and track in kind donation receipts using a user-friendly interface. Key features include customizable templates, electronic signatures, and real-time tracking of document status. Additionally, you can automate reminders for signing to ensure timely acknowledgment of donations.

-

Is there a cost associated with generating in kind donation receipts using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to different organizational needs, allowing you to generate in kind donation receipts without incurring high costs. Pricing is based on the number of users and features required. You can start with a trial to evaluate how efficiently it meets your in kind donation receipt requirements before committing to a plan.

-

Can I integrate airSlate SignNow with other software for processing in kind donation receipts?

Yes, airSlate SignNow seamlessly integrates with various software applications such as CRM systems, accounting software, and donor management tools. This integration allows for a more streamlined process when managing in kind donation receipts, ensuring that all relevant data is shared efficiently. By connecting your tools, you can enhance productivity while maintaining accurate donation records.

-

What are the benefits of using airSlate SignNow for in kind donation receipts?

Using airSlate SignNow for in kind donation receipts brings numerous benefits, such as increased efficiency and reduced paperwork. The electronic signing process speeds up the acknowledgment of donations, helping you build strong relationships with donors. Moreover, cloud storage ensures all receipts are easily accessible whenever needed, aiding in compliance and record-keeping.

-

How secure is the information on in kind donation receipts created with airSlate SignNow?

Security is a top priority for airSlate SignNow, with robust encryption protocols in place to protect all documents, including in kind donation receipts. Compliance with industry standards ensures that donor information is kept confidential at all times. With secure storage and controlled access, you can trust that your sensitive data remains protected.

Get more for In Kind Donation Form

Find out other In Kind Donation Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement