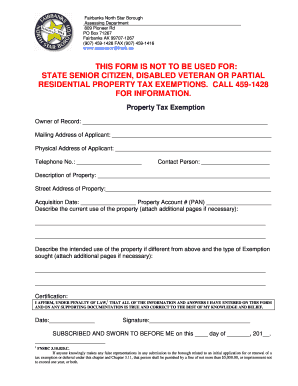

Fnsb Property Tax Form

What is the Fairbanks North Star Borough Property Tax?

The Fairbanks North Star Borough (FNSB) property tax is a local tax levied on real estate within the borough. This tax is calculated based on the assessed value of the property, which is determined by the borough's assessment office. Property taxes are essential for funding local services such as education, public safety, and infrastructure. Understanding how this tax works is crucial for property owners in the borough.

Eligibility Criteria for the FNSB Property Tax Exemption

To qualify for a property tax exemption in the Fairbanks North Star Borough, applicants must meet specific eligibility criteria. Generally, exemptions may be available for seniors, disabled individuals, and veterans. Additionally, properties used for certain purposes, such as non-profit organizations, may also qualify. It is important for applicants to review the requirements thoroughly to ensure they meet the necessary conditions for exemption.

Steps to Complete the FNSB Property Tax Exemption Application

Completing the FNSB property tax exemption application involves several key steps:

- Gather required documentation, including proof of age, disability, or veteran status.

- Obtain the exemption application form from the Fairbanks North Star Borough website or local assessment office.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application form along with supporting documents to the borough's assessment office by the specified deadline.

Following these steps carefully can help ensure a smooth application process.

Required Documents for the FNSB Property Tax Exemption

When applying for the FNSB property tax exemption, specific documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation verifying age, disability, or veteran status.

- Property ownership documents, including a deed or title.

Having these documents ready can expedite the application process and increase the chances of approval.

Form Submission Methods for the FNSB Property Tax Exemption

Applicants can submit the FNSB property tax exemption application through various methods. These include:

- Online submission via the Fairbanks North Star Borough website.

- Mailing the completed application to the borough's assessment office.

- In-person submission at the assessment office during business hours.

Choosing the most convenient method can help ensure timely processing of the application.

Legal Use of the FNSB Property Tax Exemption

The legal framework governing the FNSB property tax exemption is defined by local and state laws. It is essential for applicants to understand the legal implications of the exemption. Properly completing the application and adhering to the guidelines ensures that the exemption is recognized by the borough and protects the applicant from potential legal issues related to property taxes.

Quick guide on how to complete fnsb property tax

Complete Fnsb Property Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Manage Fnsb Property Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Fnsb Property Tax without stress

- Find Fnsb Property Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to record your modifications.

- Select how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Alter and eSign Fnsb Property Tax and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fnsb property tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fairbanks North Star Borough property tax exemption?

The Fairbanks North Star Borough property tax exemption provides financial relief to eligible property owners by reducing their taxable property value. This exemption can signNowly lower annual property tax bills, making it an essential benefit for residents in the borough. Understanding the details of this exemption can help property owners save money.

-

Who qualifies for the Fairbanks North Star Borough property tax exemption?

Eligibility for the Fairbanks North Star Borough property tax exemption typically includes senior citizens, veterans, and individuals with disabilities. Specific criteria may vary, so it's important to review the qualifications set by the borough. By checking eligibility, residents can take advantage of this helpful financial benefit.

-

How do I apply for the Fairbanks North Star Borough property tax exemption?

To apply for the Fairbanks North Star Borough property tax exemption, property owners need to complete an application form available on the borough's website. Along with the completed application, necessary documentation must be submitted by the specified deadline. This process ensures that eligible residents can receive their rightful property tax benefits.

-

What documents are required for the Fairbanks North Star Borough property tax exemption application?

When applying for the Fairbanks North Star Borough property tax exemption, applicants usually need to provide proof of age, military service, or disability, depending on eligibility criteria. Additionally, documentation related to property ownership may be required. Ensuring all necessary papers are provided can streamline the application process.

-

What are the benefits of the Fairbanks North Star Borough property tax exemption?

The Fairbanks North Star Borough property tax exemption offers various benefits, including reduced tax liability, increased financial security, and peace of mind for eligible homeowners. This exemption can make a substantial difference in your annual budget, allowing residents to allocate funds to other essential needs. Understanding this exemption can empower property owners with signNow savings.

-

How will the Fairbanks North Star Borough property tax exemption affect my property value?

The Fairbanks North Star Borough property tax exemption directly impacts the assessed value of your property, which in turn lowers your taxable amount. By decreasing the taxable value, this exemption can lead to lower property tax bills each year. Homeowners should consider this exemption as a way to enhance their financial well-being.

-

Is there a deadline for applying for the Fairbanks North Star Borough property tax exemption?

Yes, there is usually a deadline for applying for the Fairbanks North Star Borough property tax exemption that varies each year. It's essential to check the borough's website for the current application period to ensure you meet all necessary timelines. Submitting your application on time is crucial to receiving the tax benefits.

Get more for Fnsb Property Tax

- Christmas printable gift tags form

- Citu membership form

- Christmas iou certificate 300x232 christmas iou printable certificate form

- Charles schwab charitable gift transfer form

- Gown rental dress rental agreement template form

- Gym equipment rental agreement template form

- Gym rental agreement template 787742966 form

- 30 day rental agreement template form

Find out other Fnsb Property Tax

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document